| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

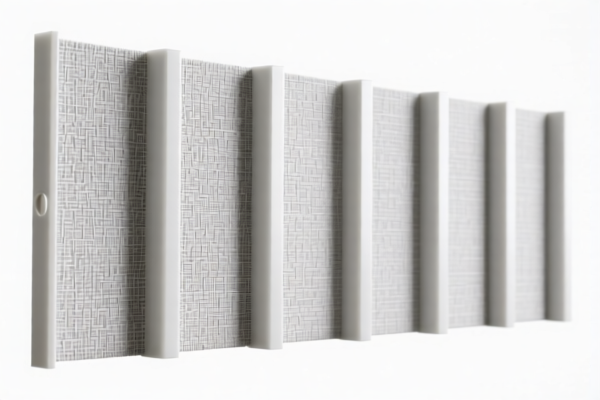

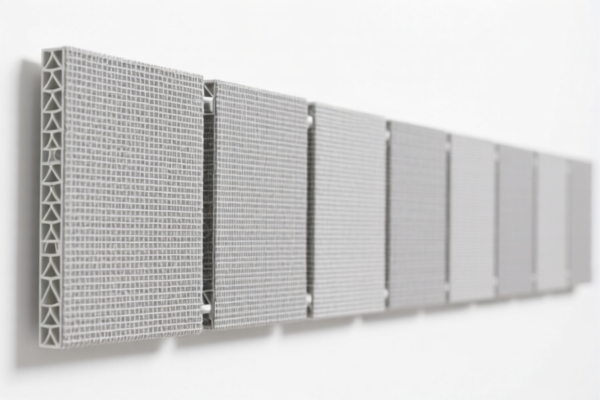

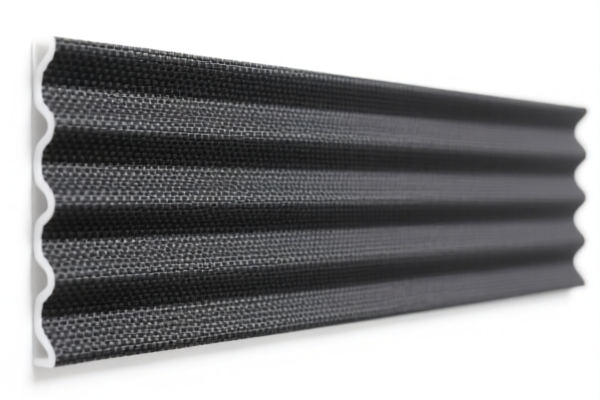

Here is the structured analysis and customs compliance guidance for the PVC Textile Composite Ceiling Panel based on the provided HS codes and tax details:

✅ HS CODE: 3921121950

Product Description: PVC纺织复合泡沫塑料板 (PVC textile composite foam board)

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3921902900

Product Description: 纺织塑料复合天花板 (Textile plastic composite ceiling)

Total Tax Rate: 59.4%

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3918105000

Product Description: PVC天花板板 (PVC ceiling board)

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3918102000

Product Description: PVC天花板板 (PVC ceiling board)

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3918103250

Product Description: PVC纺织底天花板装饰 (PVC textile base ceiling decoration)

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a foam board, textile composite, or decorative panel) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Unit Price: Verify the unit price and total value of the goods, as this may affect the applicability of anti-dumping or other duties.

- Customs Declaration: Provide detailed product descriptions and technical specifications to avoid misclassification and potential penalties.

If you need further assistance with HS code selection or customs documentation, feel free to provide more product details. Here is the structured analysis and customs compliance guidance for the PVC Textile Composite Ceiling Panel based on the provided HS codes and tax details:

✅ HS CODE: 3921121950

Product Description: PVC纺织复合泡沫塑料板 (PVC textile composite foam board)

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3921902900

Product Description: 纺织塑料复合天花板 (Textile plastic composite ceiling)

Total Tax Rate: 59.4%

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3918105000

Product Description: PVC天花板板 (PVC ceiling board)

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3918102000

Product Description: PVC天花板板 (PVC ceiling board)

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

✅ HS CODE: 3918103250

Product Description: PVC纺织底天花板装饰 (PVC textile base ceiling decoration)

Total Tax Rate: 61.5%

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron/aluminum: Not applicable

- April 11 Special Tariff: Applies (30.0%)

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a foam board, textile composite, or decorative panel) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Unit Price: Verify the unit price and total value of the goods, as this may affect the applicability of anti-dumping or other duties.

- Customs Declaration: Provide detailed product descriptions and technical specifications to avoid misclassification and potential penalties.

If you need further assistance with HS code selection or customs documentation, feel free to provide more product details.

Customer Reviews

No reviews yet.