| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

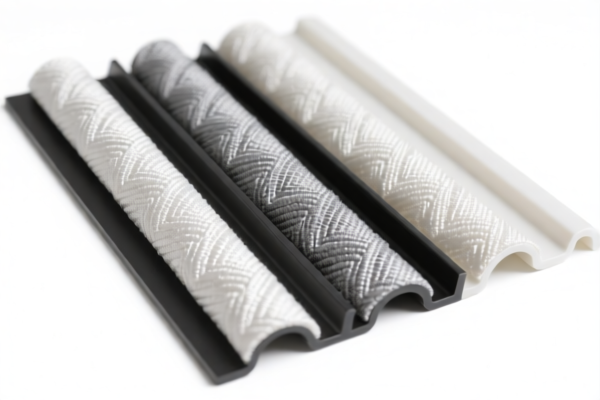

Here is the structured classification and tariff information for the PVC Textile Composite Decorative Panel based on the provided HS codes and tax details:

✅ HS CODE: 3921121950

Product Description:

PVC textile composite foam plastic board, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymers, combined with textile materials, other, other products.

Tariff Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.3%

✅ HS CODE: 3921902900

Product Description:

Textile plastic composite decorative panel, other plastic sheets, films, foils, and strips, combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Breakdown: - Base Tariff Rate: 4.4% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.4%

✅ HS CODE: 3904220000

Product Description:

PVC decorative panel, halogenated olefins polymer, primary form.

Tariff Breakdown: - Base Tariff Rate: 6.5% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

✅ HS CODE: 3904400000

Product Description:

PVC decorative panel, polymer of polyvinyl chloride or other halogenated olefins, primary form.

Tariff Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.3%

✅ HS CODE: 3921125000

Product Description:

PVC decorative panel, other plastic sheets, films, foils, and strips based on polyvinyl chloride polymers.

Tariff Breakdown: - Base Tariff Rate: 6.5% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification Requirements: Confirm the exact composition of the product (e.g., PVC content, textile material type) and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

📌 Proactive Advice:

- Verify the exact product composition (e.g., whether it is a foam board, decorative panel, or composite with textile).

- Check the unit price and weight to ensure the correct HS code is applied (e.g., weight over 1.492 kg/m² may affect classification).

- Consult with customs or a classification expert if the product is borderline between categories.

- Keep updated on policy changes, especially regarding the April 11, 2025 tariff adjustment.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for the PVC Textile Composite Decorative Panel based on the provided HS codes and tax details:

✅ HS CODE: 3921121950

Product Description:

PVC textile composite foam plastic board, other plastic sheets, films, foils, and strips, honeycomb structure, made of polyvinyl chloride polymers, combined with textile materials, other, other products.

Tariff Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.3%

✅ HS CODE: 3921902900

Product Description:

Textile plastic composite decorative panel, other plastic sheets, films, foils, and strips, combined with other materials, with a weight exceeding 1.492 kg/m².

Tariff Breakdown: - Base Tariff Rate: 4.4% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 59.4%

✅ HS CODE: 3904220000

Product Description:

PVC decorative panel, halogenated olefins polymer, primary form.

Tariff Breakdown: - Base Tariff Rate: 6.5% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

✅ HS CODE: 3904400000

Product Description:

PVC decorative panel, polymer of polyvinyl chloride or other halogenated olefins, primary form.

Tariff Breakdown: - Base Tariff Rate: 5.3% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.3%

✅ HS CODE: 3921125000

Product Description:

PVC decorative panel, other plastic sheets, films, foils, and strips based on polyvinyl chloride polymers.

Tariff Breakdown: - Base Tariff Rate: 6.5% - Additional Tariff: 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification Requirements: Confirm the exact composition of the product (e.g., PVC content, textile material type) and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

📌 Proactive Advice:

- Verify the exact product composition (e.g., whether it is a foam board, decorative panel, or composite with textile).

- Check the unit price and weight to ensure the correct HS code is applied (e.g., weight over 1.492 kg/m² may affect classification).

- Consult with customs or a classification expert if the product is borderline between categories.

- Keep updated on policy changes, especially regarding the April 11, 2025 tariff adjustment.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.