| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

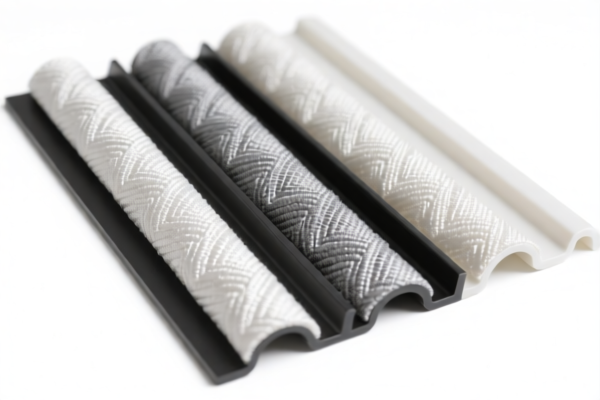

Product Classification: PVC Textile Composite Decorative Panels

HS CODEs and Tax Details:

- HS CODE: 3921121950

- Description: PVC textile composite foam panels, made of polyvinyl chloride polymer combined with textile materials, other than those specifically mentioned.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for foam-based composite panels with textile integration.

-

HS CODE: 3921125000

- Description: PVC decorative panels, falling under the broader category of other plastic sheets, films, etc., made of polyvinyl chloride polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a general category for non-foam PVC decorative panels.

-

HS CODE: 3904220000

- Description: PVC decorative panels, classified under the primary form of polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to primary form PVC decorative panels, not composite or foam-based.

-

HS CODE: 3904400000

- Description: PVC decorative panels, classified under the category of polyvinyl chloride or other halogenated ethylene polymers in primary form.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for primary form PVC decorative panels, not composite or foam-based.

-

HS CODE: 3921121100

- Description: PVC textile composite decorative panels, made of polyvinyl chloride (PVC) combined with textile materials.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for decorative panels with textile integration, not foam-based.

Key Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-dumping duties: Not applicable for this product category (PVC textile composite decorative panels).

- Material Verification: Confirm the exact composition (e.g., foam, textile integration, primary form) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Unit Price: Verify the unit price and product specifications to ensure compliance with customs valuation rules.

If you have more details about the product (e.g., thickness, textile content, foam structure), I can help further refine the classification.

Product Classification: PVC Textile Composite Decorative Panels

HS CODEs and Tax Details:

- HS CODE: 3921121950

- Description: PVC textile composite foam panels, made of polyvinyl chloride polymer combined with textile materials, other than those specifically mentioned.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for foam-based composite panels with textile integration.

-

HS CODE: 3921125000

- Description: PVC decorative panels, falling under the broader category of other plastic sheets, films, etc., made of polyvinyl chloride polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is a general category for non-foam PVC decorative panels.

-

HS CODE: 3904220000

- Description: PVC decorative panels, classified under the primary form of polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to primary form PVC decorative panels, not composite or foam-based.

-

HS CODE: 3904400000

- Description: PVC decorative panels, classified under the category of polyvinyl chloride or other halogenated ethylene polymers in primary form.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for primary form PVC decorative panels, not composite or foam-based.

-

HS CODE: 3921121100

- Description: PVC textile composite decorative panels, made of polyvinyl chloride (PVC) combined with textile materials.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for decorative panels with textile integration, not foam-based.

Key Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-dumping duties: Not applicable for this product category (PVC textile composite decorative panels).

- Material Verification: Confirm the exact composition (e.g., foam, textile integration, primary form) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Unit Price: Verify the unit price and product specifications to ensure compliance with customs valuation rules.

If you have more details about the product (e.g., thickness, textile content, foam structure), I can help further refine the classification.

Customer Reviews

No reviews yet.