| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918104010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

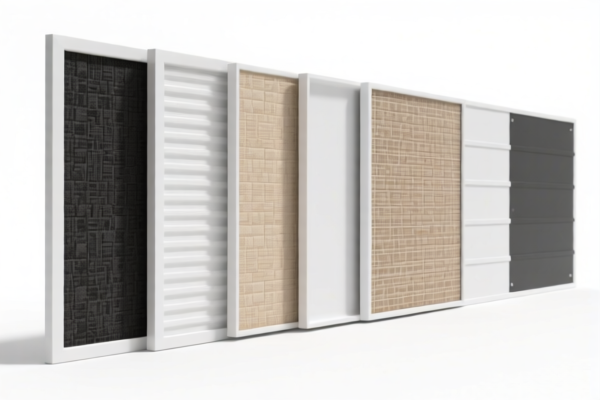

Product Classification: PVC Textile Composite Exterior Panels

HS CODEs and Tax Details:

- HS CODE: 3921121950

- Description: Other plastic sheets, plates, films, foils, and strips, cellular, made of polyvinyl chloride polymers, combined with textile materials, other, other products.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104010

- Description: Wall coverings with textile fiber backing made of polyvinyl chloride (PVC).

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: Plastic sheets, plates, films, foils, and strips made of vinyl polymers (PVC), combined with textile materials, where the textile component contains man-made fibers weighing more than any other single textile fiber, and the plastic weight exceeds 70%.

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910 (repeated in the input)

- Description 1: PVC (polyvinyl chloride polymer) combined with textile materials, wall coverings, under the category of "other plastic sheets, plates, films, foils, and strips."

- Description 2: PVC plastic composite panels with plant fiber textile materials.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any ongoing investigations or duties related to PVC or textile composites. -

Material Composition and Certification:

- Ensure the exact composition of the product (e.g., percentage of PVC vs. textile, type of textile fiber) is clearly documented.

- Confirm whether the textile component contains man-made fibers (e.g., polyester, nylon) or natural fibers (e.g., cotton, hemp), as this affects the applicable HS code.

-

Verify if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification:

-

The HS code may vary based on the unit price and product description. Ensure the product is classified correctly to avoid delays or penalties at customs.

-

Consultation:

For precise classification, it is recommended to consult a customs broker or HS code expert, especially if the product has multiple components or is used in specialized applications. Product Classification: PVC Textile Composite Exterior Panels

HS CODEs and Tax Details: -

HS CODE: 3921121950

- Description: Other plastic sheets, plates, films, foils, and strips, cellular, made of polyvinyl chloride polymers, combined with textile materials, other, other products.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104010

- Description: Wall coverings with textile fiber backing made of polyvinyl chloride (PVC).

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: Plastic sheets, plates, films, foils, and strips made of vinyl polymers (PVC), combined with textile materials, where the textile component contains man-made fibers weighing more than any other single textile fiber, and the plastic weight exceeds 70%.

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910 (repeated in the input)

- Description 1: PVC (polyvinyl chloride polymer) combined with textile materials, wall coverings, under the category of "other plastic sheets, plates, films, foils, and strips."

- Description 2: PVC plastic composite panels with plant fiber textile materials.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any ongoing investigations or duties related to PVC or textile composites. -

Material Composition and Certification:

- Ensure the exact composition of the product (e.g., percentage of PVC vs. textile, type of textile fiber) is clearly documented.

- Confirm whether the textile component contains man-made fibers (e.g., polyester, nylon) or natural fibers (e.g., cotton, hemp), as this affects the applicable HS code.

-

Verify if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification:

-

The HS code may vary based on the unit price and product description. Ensure the product is classified correctly to avoid delays or penalties at customs.

-

Consultation:

For precise classification, it is recommended to consult a customs broker or HS code expert, especially if the product has multiple components or is used in specialized applications.

Customer Reviews

No reviews yet.