| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

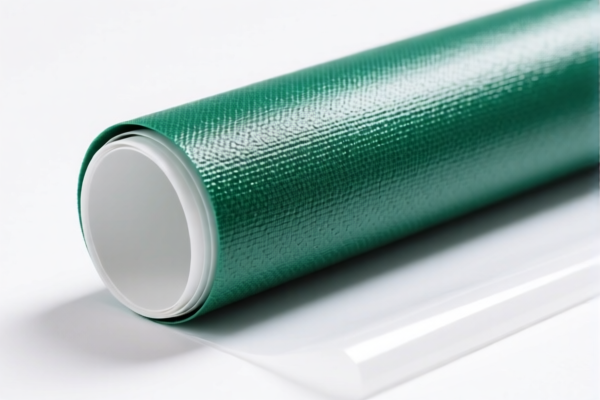

Product Classification: PVC Textile Composite Film

HS CODE: 3921121950 and 3921121100

🔍 Classification Overview

- HS CODE 3921121950:

- Description: Other plastic sheets, plates, films, foils, and strips, cellular, made of polyvinyl chloride (PVC) polymers, combined with textile materials, other, other products.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3921121100:

- Description: Plastic sheets, plates, films, foils, and strips made of vinyl polymers (PVC), combined with textile materials, where the textile component contains synthetic fibers in greater weight than any other single textile fiber, and the plastic weight exceeds 70%.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes

- April 11, 2025 Special Tariff:

- Both HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product category (PVC textile composites).

📌 Proactive Advice for Importers

- Verify Material Composition:

- Ensure the product meets the 70% plastic weight requirement for HS CODE 3921121100.

-

Confirm the type of textile fibers used (e.g., synthetic vs. natural) to determine the correct classification.

-

Check Unit Price and Certification:

- Review the unit price to ensure it aligns with the declared HS code.

-

Confirm if certifications (e.g., REACH, RoHS, or textile-related standards) are required for import.

-

Plan for Tariff Increases:

- If importing after April 11, 2025, budget for the 30.0% additional tariff.

- Consider alternative sourcing or tariff mitigation strategies if applicable.

✅ Summary

- HS CODE 3921121950: General PVC textile composite film, 60.3% total tax.

- HS CODE 3921121100: PVC textile composite with 70%+ plastic weight, 59.2% total tax.

- Important: April 11, 2025 tariff increase applies to both.

- Action Required: Verify product composition and prepare for higher tariffs post-2025.

Product Classification: PVC Textile Composite Film

HS CODE: 3921121950 and 3921121100

🔍 Classification Overview

- HS CODE 3921121950:

- Description: Other plastic sheets, plates, films, foils, and strips, cellular, made of polyvinyl chloride (PVC) polymers, combined with textile materials, other, other products.

-

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3921121100:

- Description: Plastic sheets, plates, films, foils, and strips made of vinyl polymers (PVC), combined with textile materials, where the textile component contains synthetic fibers in greater weight than any other single textile fiber, and the plastic weight exceeds 70%.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes

- April 11, 2025 Special Tariff:

- Both HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product category (PVC textile composites).

📌 Proactive Advice for Importers

- Verify Material Composition:

- Ensure the product meets the 70% plastic weight requirement for HS CODE 3921121100.

-

Confirm the type of textile fibers used (e.g., synthetic vs. natural) to determine the correct classification.

-

Check Unit Price and Certification:

- Review the unit price to ensure it aligns with the declared HS code.

-

Confirm if certifications (e.g., REACH, RoHS, or textile-related standards) are required for import.

-

Plan for Tariff Increases:

- If importing after April 11, 2025, budget for the 30.0% additional tariff.

- Consider alternative sourcing or tariff mitigation strategies if applicable.

✅ Summary

- HS CODE 3921121950: General PVC textile composite film, 60.3% total tax.

- HS CODE 3921121100: PVC textile composite with 70%+ plastic weight, 59.2% total tax.

- Important: April 11, 2025 tariff increase applies to both.

- Action Required: Verify product composition and prepare for higher tariffs post-2025.

Customer Reviews

No reviews yet.