| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

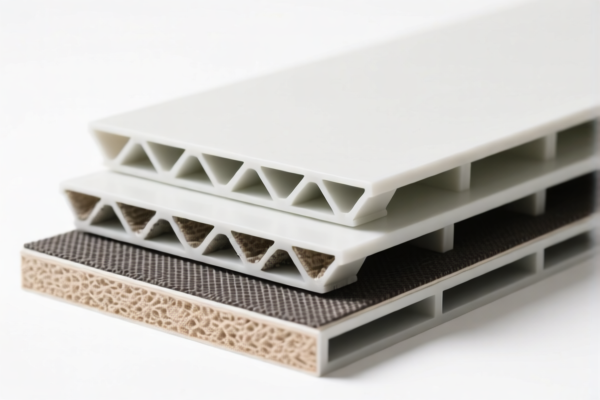

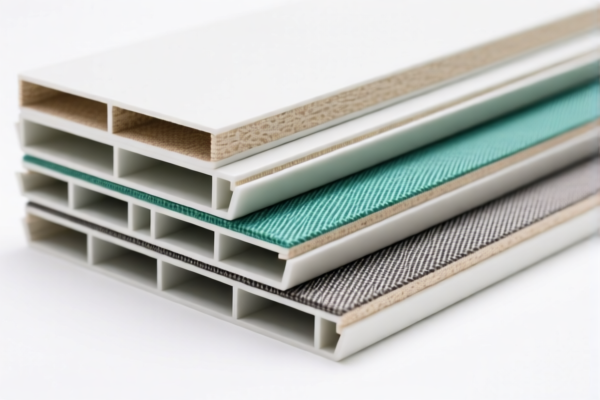

Product Classification: PVC Textile Composite Furniture Boards

HS CODE: 3921121950 (Primary Code)

Description: PVC textile composite boards, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 Key Notes on Tax Rates:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 60.3% (from 5.3% base + 25.0% general + 30.0% special). -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are currently applicable for this product category.

📦 Customs Compliance Considerations:

-

Material Verification: Confirm that the product is indeed made of PVC polymer combined with textile materials and not misclassified as a different composite (e.g., polyurethane-based).

-

Unit Price and Certification:

Ensure that the unit price is correctly declared and that any certifications (e.g., textile content, PVC composition) are available for customs inspection. -

Product Description:

Use precise and detailed product descriptions to avoid misclassification. For example, specify whether the board is honeycomb structured or flat, and the type of textile material used (e.g., cotton, polyester).

🛠️ Proactive Advice:

- Check for Updates: Monitor any changes in tariff policies or classification rules after April 11, 2025.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

- Document Everything: Maintain records of material composition, manufacturing process, and certifications to support your classification and tariff claims.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: PVC Textile Composite Furniture Boards

HS CODE: 3921121950 (Primary Code)

Description: PVC textile composite boards, honeycomb structure, made of polyvinyl chloride polymer combined with textile materials, other, other products.

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📌 Key Notes on Tax Rates:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 60.3% (from 5.3% base + 25.0% general + 30.0% special). -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are currently applicable for this product category.

📦 Customs Compliance Considerations:

-

Material Verification: Confirm that the product is indeed made of PVC polymer combined with textile materials and not misclassified as a different composite (e.g., polyurethane-based).

-

Unit Price and Certification:

Ensure that the unit price is correctly declared and that any certifications (e.g., textile content, PVC composition) are available for customs inspection. -

Product Description:

Use precise and detailed product descriptions to avoid misclassification. For example, specify whether the board is honeycomb structured or flat, and the type of textile material used (e.g., cotton, polyester).

🛠️ Proactive Advice:

- Check for Updates: Monitor any changes in tariff policies or classification rules after April 11, 2025.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

- Document Everything: Maintain records of material composition, manufacturing process, and certifications to support your classification and tariff claims.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.