| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

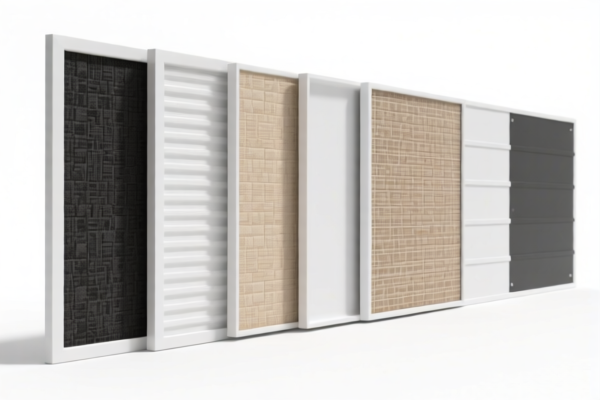

Product Name: PVC Textile Composite Interior Panels

Classification: Based on HS Code (Harmonized System Code) and tariff details provided.

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC textile composite interior panels:

🔢 HS CODE: 3921121910

Description: PVC textile composite automotive interior fabric, matching the description of HS code 3921121910.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to textile composites with PVC as the primary material.

🔢 HS CODE: 3921121100

Description: PVC textile composite automotive interior panel, matching HS code 3921.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to thinner or simpler composite structures.

🔢 HS CODE: 3921131100

Description: Polyurethane textile composite interior panel, matching HS code 3921131100.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane-based composites, not PVC.

🔢 HS CODE: 3921121950 (Duplicate Entry)

Description: PVC textile composite foam board, matching HS code 3921121950.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to foam-based PVC textile composites.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification: Confirm the exact composition (e.g., PVC vs. polyurethane) and whether the product requires specific certifications (e.g., fire resistance, environmental compliance) for import.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (PVC, polyurethane, etc.).

- Check Unit Price and Tax Impact: The 30.0% special tariff after April 11, 2025, could significantly increase the total cost. Consider this in pricing and contract negotiations.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to the boundary of multiple HS codes.

- Document Compliance: Maintain records of product specifications, certifications, and origin to support customs declarations.

Let me know if you need help determining the most appropriate HS code for your specific product.

Product Name: PVC Textile Composite Interior Panels

Classification: Based on HS Code (Harmonized System Code) and tariff details provided.

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC textile composite interior panels:

🔢 HS CODE: 3921121910

Description: PVC textile composite automotive interior fabric, matching the description of HS code 3921121910.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to textile composites with PVC as the primary material.

🔢 HS CODE: 3921121100

Description: PVC textile composite automotive interior panel, matching HS code 3921.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to thinner or simpler composite structures.

🔢 HS CODE: 3921131100

Description: Polyurethane textile composite interior panel, matching HS code 3921131100.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane-based composites, not PVC.

🔢 HS CODE: 3921121950 (Duplicate Entry)

Description: PVC textile composite foam board, matching HS code 3921121950.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to foam-based PVC textile composites.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all listed HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification: Confirm the exact composition (e.g., PVC vs. polyurethane) and whether the product requires specific certifications (e.g., fire resistance, environmental compliance) for import.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (PVC, polyurethane, etc.).

- Check Unit Price and Tax Impact: The 30.0% special tariff after April 11, 2025, could significantly increase the total cost. Consider this in pricing and contract negotiations.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to the boundary of multiple HS codes.

- Document Compliance: Maintain records of product specifications, certifications, and origin to support customs declarations.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.