| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

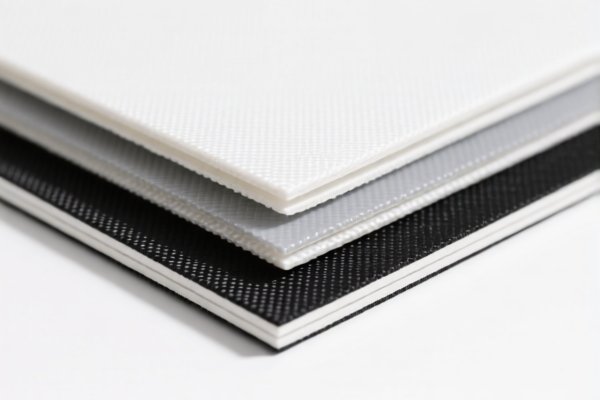

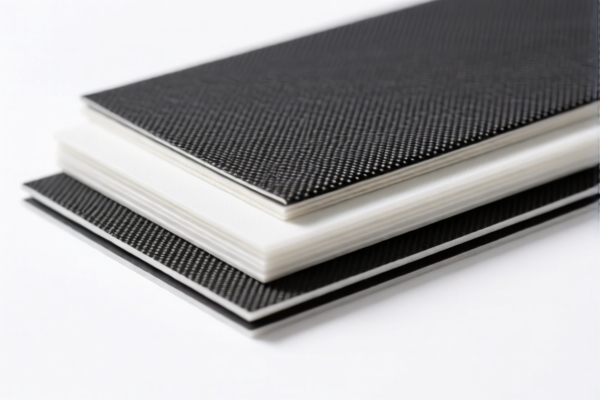

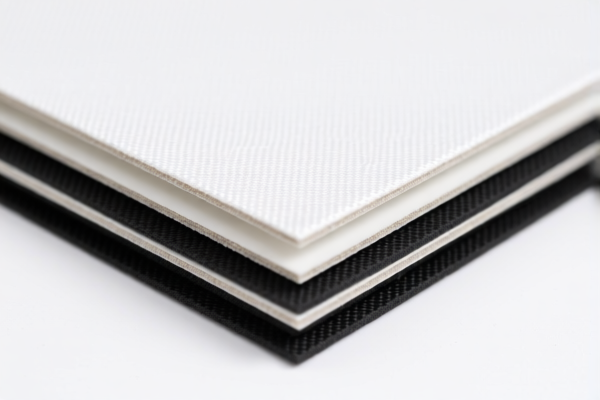

Product Classification: PVC Textile Composite Sheets

HS CODE:

- 3921121950

- 3921121910

- 3921902900

🔍 Classification Summary

These HS codes classify PVC textile composite sheets, which are plastic sheets, plates, films, foils, or strips made of polyvinyl chloride (PVC) and combined with textile materials. The classification depends on the specific composition and weight of the product:

- 3921121950: PVC textile composite foam boards, other than those with plant fiber textiles.

- 3921121910: PVC plastic composite boards with plant fiber textile materials.

- 3921902900: Textile composite plastic sheets, combined with other materials, with a weight exceeding 1.492 kg/m².

📊 Tariff Overview (as of now)

✅ Base Tariff Rate

- 3921121950: 5.3%

- 3921121910: 5.3%

- 3921902900: 4.4%

🚫 Additional Tariffs (Currently in Effect)

- 25.0% added to the base rate for all three codes.

⏳ Special Tariff After April 11, 2025

- 30.0% additional tariff will be imposed after April 11, 2025.

⚠️ Anti-dumping Duties

- Not applicable for these HS codes (no specific anti-dumping duties on PVC textile composites are currently in place).

📌 Total Tax Rate Summary

- 3921121950 & 3921121910: 60.3% (5.3% + 25.0% + 30.0% after April 11, 2025)

- 3921902900: 59.4% (4.4% + 25.0% + 30.0% after April 11, 2025)

🛑 Important Notes & Recommendations

- Verify the exact composition of the product (e.g., whether it contains plant fiber textiles or other materials).

- Check the weight of the product to determine if it falls under 3921902900 (weight > 1.492 kg/m²).

- Confirm the unit price and material specifications to ensure correct classification.

- Review required certifications (e.g., RoHS, REACH, or other import compliance documents).

- Monitor the April 11, 2025 deadline for the special tariff increase to avoid unexpected costs.

📞 Proactive Action Steps

- Consult with customs brokers or classification experts for confirmation.

- Maintain detailed product documentation for customs inspections.

- Track any updates on tariff policies, especially after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation for these products.

Product Classification: PVC Textile Composite Sheets

HS CODE:

- 3921121950

- 3921121910

- 3921902900

🔍 Classification Summary

These HS codes classify PVC textile composite sheets, which are plastic sheets, plates, films, foils, or strips made of polyvinyl chloride (PVC) and combined with textile materials. The classification depends on the specific composition and weight of the product:

- 3921121950: PVC textile composite foam boards, other than those with plant fiber textiles.

- 3921121910: PVC plastic composite boards with plant fiber textile materials.

- 3921902900: Textile composite plastic sheets, combined with other materials, with a weight exceeding 1.492 kg/m².

📊 Tariff Overview (as of now)

✅ Base Tariff Rate

- 3921121950: 5.3%

- 3921121910: 5.3%

- 3921902900: 4.4%

🚫 Additional Tariffs (Currently in Effect)

- 25.0% added to the base rate for all three codes.

⏳ Special Tariff After April 11, 2025

- 30.0% additional tariff will be imposed after April 11, 2025.

⚠️ Anti-dumping Duties

- Not applicable for these HS codes (no specific anti-dumping duties on PVC textile composites are currently in place).

📌 Total Tax Rate Summary

- 3921121950 & 3921121910: 60.3% (5.3% + 25.0% + 30.0% after April 11, 2025)

- 3921902900: 59.4% (4.4% + 25.0% + 30.0% after April 11, 2025)

🛑 Important Notes & Recommendations

- Verify the exact composition of the product (e.g., whether it contains plant fiber textiles or other materials).

- Check the weight of the product to determine if it falls under 3921902900 (weight > 1.492 kg/m²).

- Confirm the unit price and material specifications to ensure correct classification.

- Review required certifications (e.g., RoHS, REACH, or other import compliance documents).

- Monitor the April 11, 2025 deadline for the special tariff increase to avoid unexpected costs.

📞 Proactive Action Steps

- Consult with customs brokers or classification experts for confirmation.

- Maintain detailed product documentation for customs inspections.

- Track any updates on tariff policies, especially after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.