Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

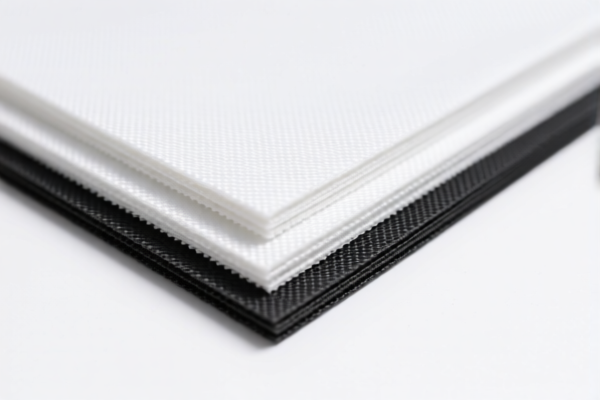

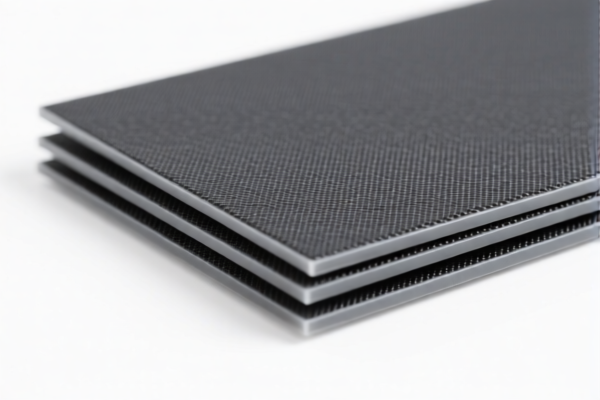

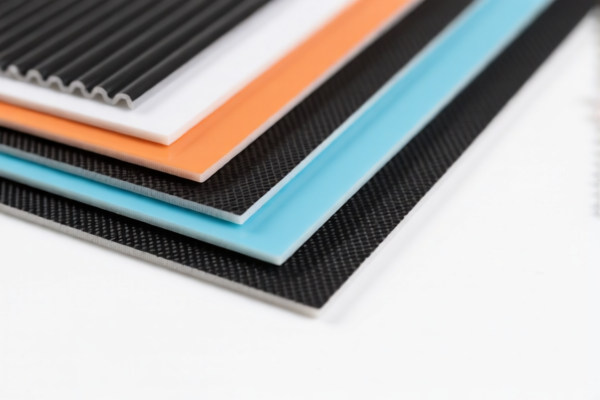

Product Classification: PVC Textile Composite Sheets (Vegetable Fiber Predominant)

HS CODE: 3921121910 (10-digit code)

🔍 Classification Summary

- The product "PVC Textile Composite Sheets (Vegetable Fiber Predominant)" is classified under HS CODE 3921121910.

- This code includes items described as "combined with textile materials" and "other", which aligns with the composite nature of your product.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 60.3%

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date to note for customs clearance planning.

🛑 Anti-Dumping Duties (if applicable)

- Not applicable for this product category (PVC textile composites with vegetable fiber). Anti-dumping duties typically apply to specific metals like iron and aluminum, not to textile composites.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed vegetable fiber predominant and not primarily synthetic.

- Check Unit Price: Tariff calculations may depend on the declared value, so ensure accurate pricing.

- Certifications Required: Confirm if any import permits, environmental certifications, or textile-related compliance documents are needed for customs clearance.

- Monitor Tariff Updates: Keep an eye on any new policy changes or tariff adjustments after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: PVC Textile Composite Sheets (Vegetable Fiber Predominant)

HS CODE: 3921121910 (10-digit code)

🔍 Classification Summary

- The product "PVC Textile Composite Sheets (Vegetable Fiber Predominant)" is classified under HS CODE 3921121910.

- This code includes items described as "combined with textile materials" and "other", which aligns with the composite nature of your product.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 60.3%

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date to note for customs clearance planning.

🛑 Anti-Dumping Duties (if applicable)

- Not applicable for this product category (PVC textile composites with vegetable fiber). Anti-dumping duties typically apply to specific metals like iron and aluminum, not to textile composites.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed vegetable fiber predominant and not primarily synthetic.

- Check Unit Price: Tariff calculations may depend on the declared value, so ensure accurate pricing.

- Certifications Required: Confirm if any import permits, environmental certifications, or textile-related compliance documents are needed for customs clearance.

- Monitor Tariff Updates: Keep an eye on any new policy changes or tariff adjustments after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.