| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

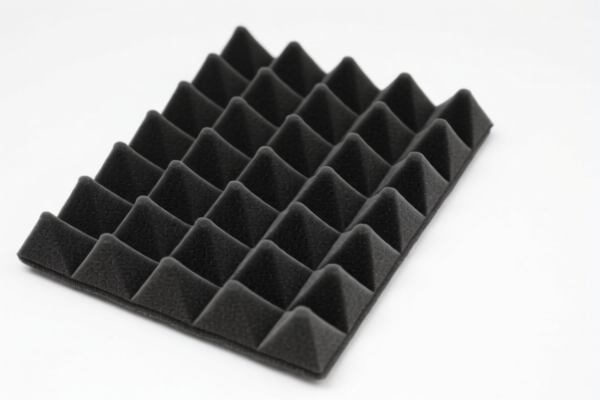

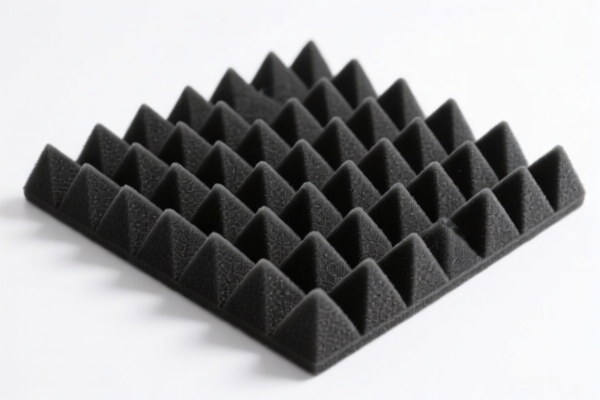

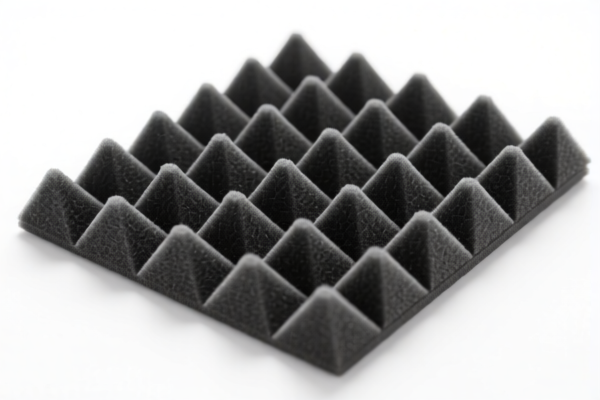

Product Classification and Customs Tariff Analysis for PVC Textile Composite Soundproofing Panel

Based on the product description and the provided HS codes, the following classification and tariff details are outlined:

✅ HS CODE: 3921121500

Product Description: PVC textile composite soundproofing panel

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is the most accurate classification for PVC textile composite soundproofing panels.

🟡 HS CODE: 3920435000

Product Description: PVC soundproofing panel (other unspecified types)

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for PVC soundproofing panels not specifically classified under 3921.

🟡 HS CODE: 3921902900

Product Description: Textile-plastic composite soundproofing panel (composite with other materials, weight >1.492kg/m²)

Total Tax Rate: 59.4%

Breakdown of Tariffs:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to composite materials with specific weight criteria.

🟡 HS CODE: 3921131500

Product Description: Polyurethane textile composite soundproofing panel

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a suitable classification for polyurethane-based textile composites.

🟡 HS CODE: 3921131100

Product Description: Polyurethane textile composite soundproofing panel

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code may apply to similar products with slight variations in composition or structure.

⚠️ Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition (e.g., PVC, polyurethane, textile content, weight per square meter) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, soundproofing performance) are required for import compliance.

- Unit Price: Verify the unit price and total value for accurate customs valuation and duty calculation.

✅ Recommended Action:

- Confirm the exact material composition and weight of the product to ensure the most accurate HS code.

- Review the latest customs regulations and consult with a customs broker or expert for final classification and duty calculation. Product Classification and Customs Tariff Analysis for PVC Textile Composite Soundproofing Panel

Based on the product description and the provided HS codes, the following classification and tariff details are outlined:

✅ HS CODE: 3921121500

Product Description: PVC textile composite soundproofing panel

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is the most accurate classification for PVC textile composite soundproofing panels.

🟡 HS CODE: 3920435000

Product Description: PVC soundproofing panel (other unspecified types)

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for PVC soundproofing panels not specifically classified under 3921.

🟡 HS CODE: 3921902900

Product Description: Textile-plastic composite soundproofing panel (composite with other materials, weight >1.492kg/m²)

Total Tax Rate: 59.4%

Breakdown of Tariffs:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to composite materials with specific weight criteria.

🟡 HS CODE: 3921131500

Product Description: Polyurethane textile composite soundproofing panel

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a suitable classification for polyurethane-based textile composites.

🟡 HS CODE: 3921131100

Product Description: Polyurethane textile composite soundproofing panel

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code may apply to similar products with slight variations in composition or structure.

⚠️ Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition (e.g., PVC, polyurethane, textile content, weight per square meter) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., fire resistance, soundproofing performance) are required for import compliance.

- Unit Price: Verify the unit price and total value for accurate customs valuation and duty calculation.

✅ Recommended Action:

- Confirm the exact material composition and weight of the product to ensure the most accurate HS code.

- Review the latest customs regulations and consult with a customs broker or expert for final classification and duty calculation.

Customer Reviews

No reviews yet.