| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918104010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

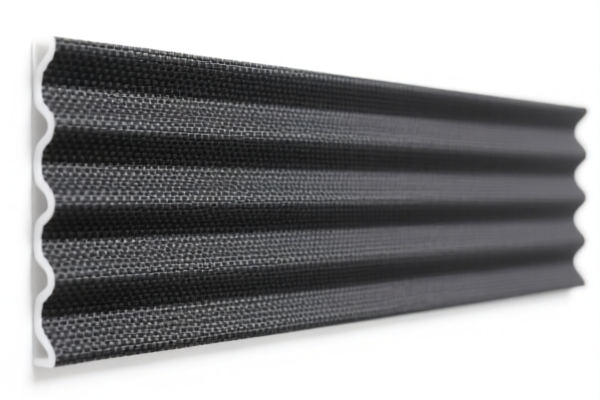

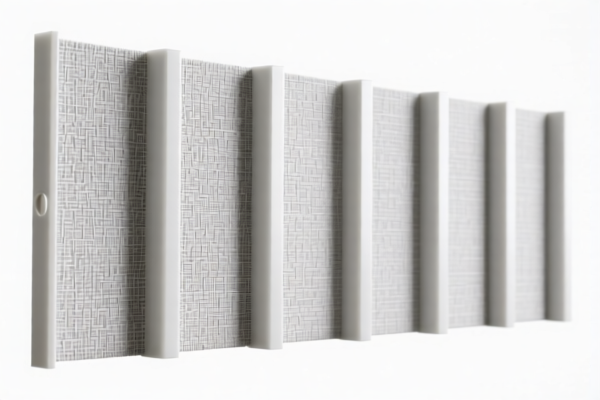

Product Name: PVC Textile Composite Wall Panel

Classification HS Codes and Tax Information:

- HS CODE: 3918104010

- Description: PVC textile composite wall panel, which fits the definition under HS code 3918 — plastic products with textile backing.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for products with a textile backing made of PVC.

-

HS CODE: 3921121100

- Description: PVC textile composite wall panel, where the textile component contains more synthetic fibers than any other single fiber type, and the plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to products with a high plastic content and specific textile composition.

-

HS CODE: 3921121910

- Description: PVC textile composite wall panel, categorized under "other plastic sheets, plates, films, foils, and strips" with textile integration.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC-based products with textile integration that do not fall under more specific categories.

-

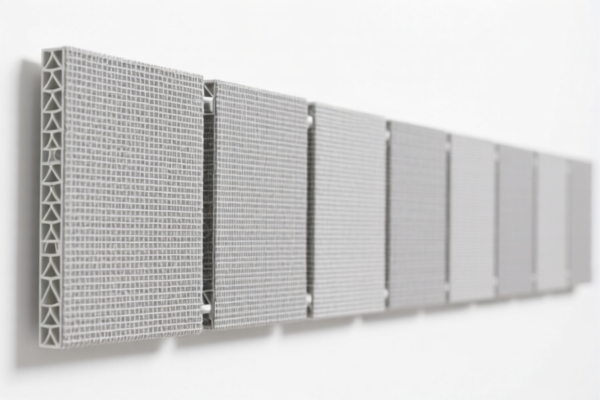

HS CODE: 3921902900

- Description: Textile-plastic composite wall panel, with a weight exceeding 1.492 kg/m² and combined with other materials.

- Total Tax Rate: 59.4%

- Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for heavier composite panels with a textile-plastic combination.

-

HS CODE: 3921131100

- Description: Polyurethane textile composite wall panel, with a textile component containing more synthetic fibers than any other single fiber type, and plastic content over 70%.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane-based products with textile integration.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition of the product (e.g., PVC, polyurethane, textile content, weight per square meter) to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., textile content verification).

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost planning.

-

Consult Customs Authority: For complex or borderline cases, it is recommended to consult local customs or a customs broker for confirmation. Product Name: PVC Textile Composite Wall Panel

Classification HS Codes and Tax Information: -

HS CODE: 3918104010

- Description: PVC textile composite wall panel, which fits the definition under HS code 3918 — plastic products with textile backing.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for products with a textile backing made of PVC.

-

HS CODE: 3921121100

- Description: PVC textile composite wall panel, where the textile component contains more synthetic fibers than any other single fiber type, and the plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to products with a high plastic content and specific textile composition.

-

HS CODE: 3921121910

- Description: PVC textile composite wall panel, categorized under "other plastic sheets, plates, films, foils, and strips" with textile integration.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC-based products with textile integration that do not fall under more specific categories.

-

HS CODE: 3921902900

- Description: Textile-plastic composite wall panel, with a weight exceeding 1.492 kg/m² and combined with other materials.

- Total Tax Rate: 59.4%

- Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for heavier composite panels with a textile-plastic combination.

-

HS CODE: 3921131100

- Description: Polyurethane textile composite wall panel, with a textile component containing more synthetic fibers than any other single fiber type, and plastic content over 70%.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane-based products with textile integration.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition of the product (e.g., PVC, polyurethane, textile content, weight per square meter) to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., textile content verification).

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost planning.

- Consult Customs Authority: For complex or borderline cases, it is recommended to consult local customs or a customs broker for confirmation.

Customer Reviews

No reviews yet.