| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918104010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

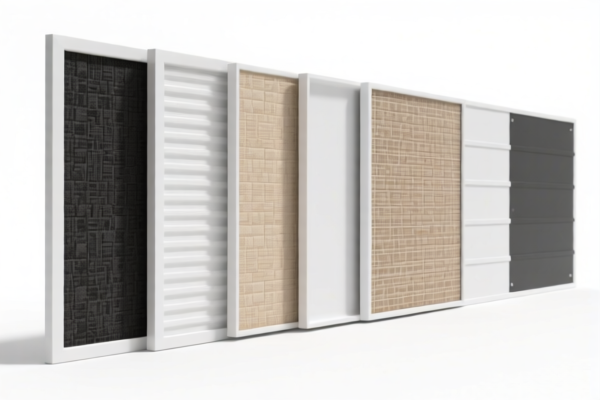

Product Name: PVC Textile Composite Wall Panels

Classification HS Codes and Tax Information:

- HS CODE: 3918104010

- Description: PVC textile composite wall panels, made of polyvinyl chloride (PVC) with a textile fiber backing, matching the definition under HS code 3918.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC textile composite wall panels made of vinyl polymers (PVC), combined with textile materials, where the textile component contains synthetic fibers in greater weight than any other single fiber, and the plastic content exceeds 70%.

- Total Tax Rate: 59.2%

-

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC textile composite wall panels, categorized under "other plastic sheets, plates, films, foils, and strips" made of PVC combined with textile materials.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902900

- Description: Textile-plastic composite wall panels, categorized under "other plastic sheets, plates, films, foils, and strips" combined with other materials and with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

-

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131100

- Description: Polyurethane textile composite wall panels, made of polyurethane plastic combined with textile materials, where synthetic fibers in the textile component exceed any other single fiber, and the plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is imposed on all the above HS codes after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specifically mentioned for this product, but it is advisable to check for any ongoing anti-dumping investigations or duties applicable to PVC or textile composite products.

- Certifications: Ensure that the product meets all required certifications (e.g., fire resistance, environmental standards) for import into the destination country.

- Material Verification: Confirm the exact composition of the product (e.g., percentage of PVC, textile content, and weight per square meter) to ensure correct HS code classification.

- Unit Price: Verify the unit price and total weight for accurate customs valuation and duty calculation.

Proactive Advice:

Before shipping, double-check the product specifications and consult with a customs broker or classification expert to ensure compliance with the latest HS code and tariff regulations.

Product Name: PVC Textile Composite Wall Panels

Classification HS Codes and Tax Information:

- HS CODE: 3918104010

- Description: PVC textile composite wall panels, made of polyvinyl chloride (PVC) with a textile fiber backing, matching the definition under HS code 3918.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121100

- Description: PVC textile composite wall panels made of vinyl polymers (PVC), combined with textile materials, where the textile component contains synthetic fibers in greater weight than any other single fiber, and the plastic content exceeds 70%.

- Total Tax Rate: 59.2%

-

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121910

- Description: PVC textile composite wall panels, categorized under "other plastic sheets, plates, films, foils, and strips" made of PVC combined with textile materials.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921902900

- Description: Textile-plastic composite wall panels, categorized under "other plastic sheets, plates, films, foils, and strips" combined with other materials and with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 59.4%

-

Tax Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131100

- Description: Polyurethane textile composite wall panels, made of polyurethane plastic combined with textile materials, where synthetic fibers in the textile component exceed any other single fiber, and the plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff is imposed on all the above HS codes after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specifically mentioned for this product, but it is advisable to check for any ongoing anti-dumping investigations or duties applicable to PVC or textile composite products.

- Certifications: Ensure that the product meets all required certifications (e.g., fire resistance, environmental standards) for import into the destination country.

- Material Verification: Confirm the exact composition of the product (e.g., percentage of PVC, textile content, and weight per square meter) to ensure correct HS code classification.

- Unit Price: Verify the unit price and total weight for accurate customs valuation and duty calculation.

Proactive Advice:

Before shipping, double-check the product specifications and consult with a customs broker or classification expert to ensure compliance with the latest HS code and tariff regulations.

Customer Reviews

No reviews yet.