| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

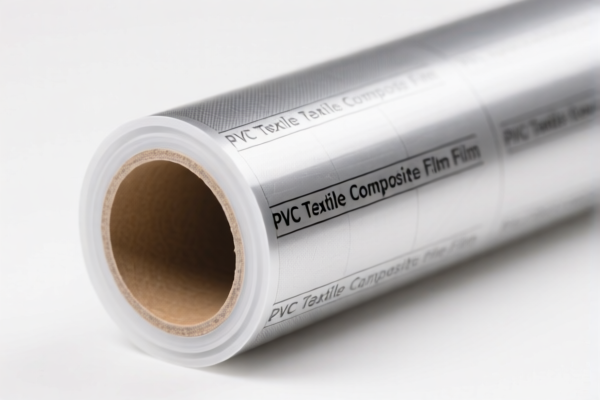

Product Classification: PVC Textile Composite Waterproof Membrane

HS CODE: 3921121910, 3921121500, 3921901100, 3921121950 (multiple options based on specific product details)

🔍 Classification Overview

The product "PVC Textile Composite Waterproof Membrane" falls under Chapter 39 of the HS Code, which covers Plastics and articles thereof. Specifically, it is classified under Heading 3921, which includes Plastics and articles thereof, of plastics, in the form of sheets, plates, films, foils, etc..

Depending on the exact composition and structure of the product, the following HS codes may apply:

- 3921121910 – PVC textile composite waterproof fabric

- 3921121500 – PVC textile composite waterproof sheet

- 3921901100 – Plastic textile composite waterproof film

- 3921121950 – PVC-coated waterproof textile product or PVC textile composite foam plastic film

📊 Tariff Summary (as of now)

All listed HS codes share the following tariff structure:

- Base Tariff Rate: 4.2% to 6.5% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2% to 61.5% (varies by HS code)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. If your product is imported after this date, this rate will be applied.

📌 Key Considerations for Customs Compliance

- Material Composition: Confirm the exact composition of the product (e.g., PVC content, textile type, and whether it contains foam or is a fabric). This will determine the correct HS code.

- Unit Price: Verify the unit price and whether it falls under any preferential tariff agreements (e.g., RCEP, China-EU, etc.).

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Product Description: Ensure the product description on the invoice and customs documents matches the HS code classification.

📢 Proactive Advice

- Verify HS Code: Confirm the exact HS code with customs or a classification expert based on the product's detailed specifications.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline for the special tariff increase.

- Consult a Customs Broker: For large or complex shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📋 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921121910 | PVC textile composite waterproof fabric | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921121500 | PVC textile composite waterproof sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901100 | Plastic textile composite waterproof film | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921121950 | PVC-coated waterproof textile product | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921121950 | PVC textile composite foam plastic film | 5.3% | 25.0% | 30.0% | 60.3% |

If you provide more details about the product (e.g., thickness, composition, end use), I can help you further narrow down the correct HS code and tax implications.

Product Classification: PVC Textile Composite Waterproof Membrane

HS CODE: 3921121910, 3921121500, 3921901100, 3921121950 (multiple options based on specific product details)

🔍 Classification Overview

The product "PVC Textile Composite Waterproof Membrane" falls under Chapter 39 of the HS Code, which covers Plastics and articles thereof. Specifically, it is classified under Heading 3921, which includes Plastics and articles thereof, of plastics, in the form of sheets, plates, films, foils, etc..

Depending on the exact composition and structure of the product, the following HS codes may apply:

- 3921121910 – PVC textile composite waterproof fabric

- 3921121500 – PVC textile composite waterproof sheet

- 3921901100 – Plastic textile composite waterproof film

- 3921121950 – PVC-coated waterproof textile product or PVC textile composite foam plastic film

📊 Tariff Summary (as of now)

All listed HS codes share the following tariff structure:

- Base Tariff Rate: 4.2% to 6.5% (varies by HS code)

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2% to 61.5% (varies by HS code)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. If your product is imported after this date, this rate will be applied.

📌 Key Considerations for Customs Compliance

- Material Composition: Confirm the exact composition of the product (e.g., PVC content, textile type, and whether it contains foam or is a fabric). This will determine the correct HS code.

- Unit Price: Verify the unit price and whether it falls under any preferential tariff agreements (e.g., RCEP, China-EU, etc.).

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Product Description: Ensure the product description on the invoice and customs documents matches the HS code classification.

📢 Proactive Advice

- Verify HS Code: Confirm the exact HS code with customs or a classification expert based on the product's detailed specifications.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline for the special tariff increase.

- Consult a Customs Broker: For large or complex shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📋 Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921121910 | PVC textile composite waterproof fabric | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921121500 | PVC textile composite waterproof sheet | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901100 | Plastic textile composite waterproof film | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921121950 | PVC-coated waterproof textile product | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921121950 | PVC textile composite foam plastic film | 5.3% | 25.0% | 30.0% | 60.3% |

If you provide more details about the product (e.g., thickness, composition, end use), I can help you further narrow down the correct HS code and tax implications.

Customer Reviews

No reviews yet.