| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

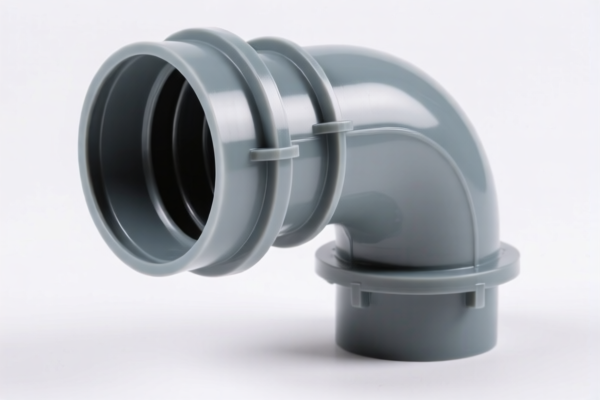

Product Classification: PVC Vent Elbow Fittings

HS CODE: 3917400060 (Other plastic pipe fittings made of polyvinyl chloride (PVC))

🔍 Classification Summary

- Product: PVC Vent Elbow Fittings

- HS Code: 3917400060

- Description: Other plastic pipe fittings made of polyvinyl chloride (PVC)

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- April 11 Special Tariff:

- A 30.0% additional tariff will be applied after April 11, 2025.

- This may significantly increase the total import cost.

-

Action Required: Confirm the exact import date and consider adjusting pricing or sourcing strategies accordingly.

-

Anti-dumping Duties:

- No specific anti-dumping duties are listed for PVC fittings in this classification.

- However, always verify if any anti-dumping or countervailing duties apply based on the country of origin.

📌 Proactive Advice

- Verify Material and Unit Price:

-

Ensure the product is indeed made of PVC and not a composite or mixed material, which may fall under a different HS code.

-

Check Required Certifications:

-

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Review HS Code Accuracy:

-

Cross-check with customs authorities or a qualified customs broker to ensure the correct HS code is used for your specific product.

-

Monitor Tariff Updates:

- Stay informed about any changes in tariff rates or trade policies, especially after April 11, 2025.

📋 Alternative HS Codes for Reference

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3917230000 | Plastic fittings, rigid PVC made | 58.1% |

| 3904220000 | Primary forms of PVC | 61.5% |

| 3904400000 | PVC products (not primary forms) | 60.3% |

| 3917400020 | PVC DWV (Drain, Waste, Vent) fittings | 60.3% |

If you are importing this product, it is highly recommended to consult with a customs expert or use an HS code lookup tool to confirm the most accurate classification and tax implications.

Product Classification: PVC Vent Elbow Fittings

HS CODE: 3917400060 (Other plastic pipe fittings made of polyvinyl chloride (PVC))

🔍 Classification Summary

- Product: PVC Vent Elbow Fittings

- HS Code: 3917400060

- Description: Other plastic pipe fittings made of polyvinyl chloride (PVC)

- Tariff Summary: 60.3% total tax rate

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- April 11 Special Tariff:

- A 30.0% additional tariff will be applied after April 11, 2025.

- This may significantly increase the total import cost.

-

Action Required: Confirm the exact import date and consider adjusting pricing or sourcing strategies accordingly.

-

Anti-dumping Duties:

- No specific anti-dumping duties are listed for PVC fittings in this classification.

- However, always verify if any anti-dumping or countervailing duties apply based on the country of origin.

📌 Proactive Advice

- Verify Material and Unit Price:

-

Ensure the product is indeed made of PVC and not a composite or mixed material, which may fall under a different HS code.

-

Check Required Certifications:

-

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Review HS Code Accuracy:

-

Cross-check with customs authorities or a qualified customs broker to ensure the correct HS code is used for your specific product.

-

Monitor Tariff Updates:

- Stay informed about any changes in tariff rates or trade policies, especially after April 11, 2025.

📋 Alternative HS Codes for Reference

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3917230000 | Plastic fittings, rigid PVC made | 58.1% |

| 3904220000 | Primary forms of PVC | 61.5% |

| 3904400000 | PVC products (not primary forms) | 60.3% |

| 3917400020 | PVC DWV (Drain, Waste, Vent) fittings | 60.3% |

If you are importing this product, it is highly recommended to consult with a customs expert or use an HS code lookup tool to confirm the most accurate classification and tax implications.

Customer Reviews

No reviews yet.