| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

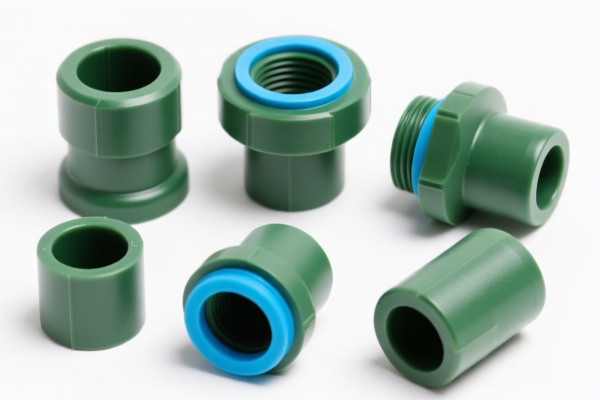

Here is the structured analysis and customs compliance guidance for PVC Vent Fittings based on the provided HS codes and tax details:

🔍 Product Classification Overview: PVC Vent Fittings

These products are classified under various HS codes depending on their specific type and application. Below is a breakdown of the relevant HS codes and their associated tariffs:

📦 HS Code 3917320010

Product Description: PVC Vent Fittings, made of polyvinyl chloride (PVC) plastic pipes and fittings.

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is suitable for general-purpose PVC vent fittings.

- Ensure the product is not classified under a more specific code (e.g., 3917400020 for DWV fittings).

📦 HS Code 3917400020

Product Description: Non-pressure grade PVC (DWV) drainage, waste, and vent (DWV) pipe fittings.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This code is for non-pressure PVC fittings used in drainage systems.

- Higher base tariff compared to general-purpose fittings.

📦 HS Code 3917390020

Product Description: Plastic pipes made of PVC (polyvinyl chloride).

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This code is for PVC pipes, not fittings.

- No additional tariff currently applies, but the 30% special tariff will be added after April 11, 2025.

📦 HS Code 3917230000

Product Description: Rigid plastic pipes made of PVC (polyvinyl chloride).

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This code is for rigid PVC pipes, not fittings.

- Similar to 3917320010 but for rigid pipes.

📦 HS Code 3917400060

Product Description: Other plastic fittings made of PVC.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This is a catch-all code for PVC fittings not covered by more specific classifications.

- Higher base tariff compared to general-purpose fittings.

⚠️ Important Alerts and Recommendations:

- April 11, 2025 Special Tariff: All listed codes will be subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact material (e.g., rigid vs. flexible PVC) and whether the product is a pipe or fitting, as this affects classification.

- Certifications: Check if any certifications (e.g., ISO, CE, or local safety standards) are required for import.

- Unit Price: Be aware that higher tax rates may affect the final cost. Consider this in pricing and compliance planning.

✅ Proactive Advice:

- Double-check the product description to ensure the correct HS code is used.

- Consult with a customs broker or local customs authority for the most up-to-date classification and tariff information.

- Keep records of product specifications and documentation to support your classification.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured analysis and customs compliance guidance for PVC Vent Fittings based on the provided HS codes and tax details:

🔍 Product Classification Overview: PVC Vent Fittings

These products are classified under various HS codes depending on their specific type and application. Below is a breakdown of the relevant HS codes and their associated tariffs:

📦 HS Code 3917320010

Product Description: PVC Vent Fittings, made of polyvinyl chloride (PVC) plastic pipes and fittings.

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Key Notes:

- This code is suitable for general-purpose PVC vent fittings.

- Ensure the product is not classified under a more specific code (e.g., 3917400020 for DWV fittings).

📦 HS Code 3917400020

Product Description: Non-pressure grade PVC (DWV) drainage, waste, and vent (DWV) pipe fittings.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This code is for non-pressure PVC fittings used in drainage systems.

- Higher base tariff compared to general-purpose fittings.

📦 HS Code 3917390020

Product Description: Plastic pipes made of PVC (polyvinyl chloride).

Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This code is for PVC pipes, not fittings.

- No additional tariff currently applies, but the 30% special tariff will be added after April 11, 2025.

📦 HS Code 3917230000

Product Description: Rigid plastic pipes made of PVC (polyvinyl chloride).

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This code is for rigid PVC pipes, not fittings.

- Similar to 3917320010 but for rigid pipes.

📦 HS Code 3917400060

Product Description: Other plastic fittings made of PVC.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Key Notes:

- This is a catch-all code for PVC fittings not covered by more specific classifications.

- Higher base tariff compared to general-purpose fittings.

⚠️ Important Alerts and Recommendations:

- April 11, 2025 Special Tariff: All listed codes will be subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact material (e.g., rigid vs. flexible PVC) and whether the product is a pipe or fitting, as this affects classification.

- Certifications: Check if any certifications (e.g., ISO, CE, or local safety standards) are required for import.

- Unit Price: Be aware that higher tax rates may affect the final cost. Consider this in pricing and compliance planning.

✅ Proactive Advice:

- Double-check the product description to ensure the correct HS code is used.

- Consult with a customs broker or local customs authority for the most up-to-date classification and tariff information.

- Keep records of product specifications and documentation to support your classification.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.