| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 5903102090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103110 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tax information for the PVC Wall Cloth (Man-made Fiber Base) product, based on the provided HS codes and tariff details:

🔍 Product Classification Overview

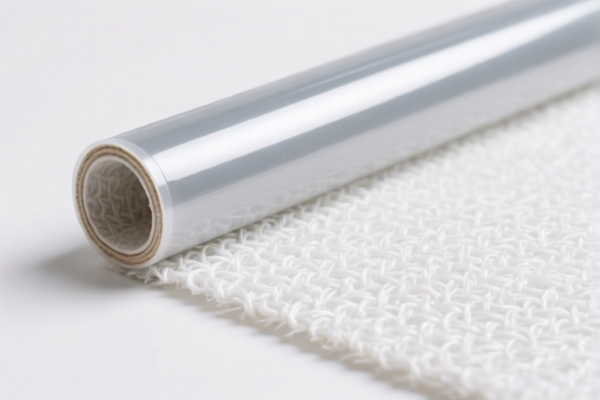

- Product Name: PVC Wall Cloth (Man-made Fiber Base)

- Material: PVC-coated or PVC-backed man-made fiber fabric

- Usage: Wall covering or decorative wall fabric

📦 HS Code Classification & Tax Details

1. HS Code: 5903101800

- Description: PVC-coated man-made fiber wall cloth

- Total Tax Rate: 69.1%

- Base Tariff: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the listed options.

2. HS Code: 5903102090

- Description: PVC-laminated man-made fiber wall cloth

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but still subject to the same additional and special tariffs.

3. HS Code: 3918103250

- Description: PVC man-made fiber base wall paper

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower than 5903101800 but still high.

4. HS Code: 3918103210

- Description: PVC man-made fiber backer wall paper

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as 3918103250, but for a different type of wall paper.

5. HS Code: 3918103110

- Description: Man-made fiber base with PVC surface wall covering

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower than the others, but still subject to the same additional and special tariffs.

⚠️ Important Notes & Alerts

-

April 11, 2025 Special Tariff:

All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it's advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin. -

Certifications Required:

Ensure the product meets customs compliance standards, including material composition, unit price, and certifications (e.g., fire resistance, environmental standards, etc.) if applicable.

✅ Proactive Advice for Importers

- Verify the exact product description to match the correct HS code.

- Check the material composition (e.g., PVC content, fiber type) to ensure proper classification.

- Confirm the country of origin to determine if any additional duties apply.

- Review the April 11, 2025 tariff change and factor it into your import cost estimation.

- Consult with customs brokers or legal advisors for compliance and documentation requirements.

Let me know if you need help selecting the most appropriate HS code for your specific product variant. Here is the structured classification and tax information for the PVC Wall Cloth (Man-made Fiber Base) product, based on the provided HS codes and tariff details:

🔍 Product Classification Overview

- Product Name: PVC Wall Cloth (Man-made Fiber Base)

- Material: PVC-coated or PVC-backed man-made fiber fabric

- Usage: Wall covering or decorative wall fabric

📦 HS Code Classification & Tax Details

1. HS Code: 5903101800

- Description: PVC-coated man-made fiber wall cloth

- Total Tax Rate: 69.1%

- Base Tariff: 14.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the listed options.

2. HS Code: 5903102090

- Description: PVC-laminated man-made fiber wall cloth

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but still subject to the same additional and special tariffs.

3. HS Code: 3918103250

- Description: PVC man-made fiber base wall paper

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower than 5903101800 but still high.

4. HS Code: 3918103210

- Description: PVC man-made fiber backer wall paper

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as 3918103250, but for a different type of wall paper.

5. HS Code: 3918103110

- Description: Man-made fiber base with PVC surface wall covering

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower than the others, but still subject to the same additional and special tariffs.

⚠️ Important Notes & Alerts

-

April 11, 2025 Special Tariff:

All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it's advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin. -

Certifications Required:

Ensure the product meets customs compliance standards, including material composition, unit price, and certifications (e.g., fire resistance, environmental standards, etc.) if applicable.

✅ Proactive Advice for Importers

- Verify the exact product description to match the correct HS code.

- Check the material composition (e.g., PVC content, fiber type) to ensure proper classification.

- Confirm the country of origin to determine if any additional duties apply.

- Review the April 11, 2025 tariff change and factor it into your import cost estimation.

- Consult with customs brokers or legal advisors for compliance and documentation requirements.

Let me know if you need help selecting the most appropriate HS code for your specific product variant.

Customer Reviews

No reviews yet.