Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

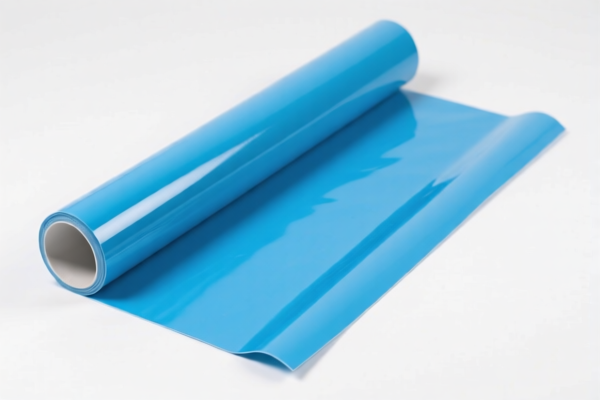

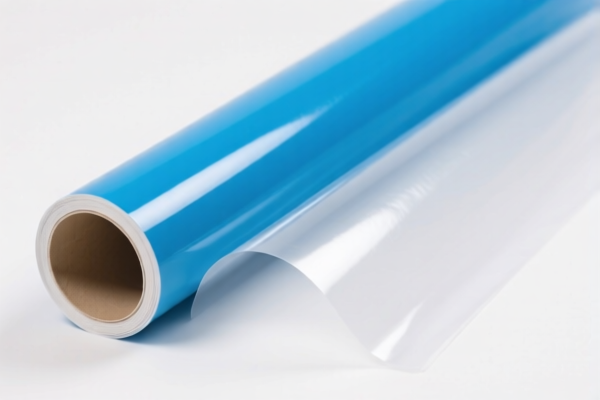

Product Classification: PVC Wall Covering Film (Synthetic Fiber Backing, Other)

HS CODE: 3918.10.31.50 (10-digit code)

🔍 Classification Summary

- Product Type: PVC wall covering film with synthetic fiber backing (e.g., textile or synthetic fibers, with more than 70% plastic content).

- HS Code: 3918.10.31.50 (common code for PVC wall coverings with synthetic fiber backing).

- Alternative HS Code: 3918.10.32.50 (for similar products, but with slight differences in description or composition).

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.2% (for 3918.10.31.50) or 6.5% (for 3918.10.32.50)

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate:

- 3918.10.31.50: 59.2%

- 3918.10.32.50: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed on this product category.

- This is a special tariff and not related to anti-dumping duties on iron or aluminum.

- Ensure your customs clearance is completed before this date to avoid higher costs.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product contains more than 70% plastic and has a synthetic fiber backing (e.g., textile or synthetic fibers).

- Check Unit Price and Classification: The HS code may vary slightly based on the exact description (e.g., "wall covering film" vs. "wall protection film").

- Certifications Required: Some countries may require product safety certifications (e.g., flame resistance, VOC compliance) for wall coverings.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product description is ambiguous.

📌 Key Takeaway

- Use HS Code 3918.10.31.50 for PVC wall covering films with synthetic fiber backing and >70% plastic.

- Total tax rate is 59.2%, but will increase to 89.2% after April 11, 2025.

- Act now to avoid the higher tariff by ensuring timely customs clearance.

Product Classification: PVC Wall Covering Film (Synthetic Fiber Backing, Other)

HS CODE: 3918.10.31.50 (10-digit code)

🔍 Classification Summary

- Product Type: PVC wall covering film with synthetic fiber backing (e.g., textile or synthetic fibers, with more than 70% plastic content).

- HS Code: 3918.10.31.50 (common code for PVC wall coverings with synthetic fiber backing).

- Alternative HS Code: 3918.10.32.50 (for similar products, but with slight differences in description or composition).

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.2% (for 3918.10.31.50) or 6.5% (for 3918.10.32.50)

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate:

- 3918.10.31.50: 59.2%

- 3918.10.32.50: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed on this product category.

- This is a special tariff and not related to anti-dumping duties on iron or aluminum.

- Ensure your customs clearance is completed before this date to avoid higher costs.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product contains more than 70% plastic and has a synthetic fiber backing (e.g., textile or synthetic fibers).

- Check Unit Price and Classification: The HS code may vary slightly based on the exact description (e.g., "wall covering film" vs. "wall protection film").

- Certifications Required: Some countries may require product safety certifications (e.g., flame resistance, VOC compliance) for wall coverings.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product description is ambiguous.

📌 Key Takeaway

- Use HS Code 3918.10.31.50 for PVC wall covering films with synthetic fiber backing and >70% plastic.

- Total tax rate is 59.2%, but will increase to 89.2% after April 11, 2025.

- Act now to avoid the higher tariff by ensuring timely customs clearance.

Customer Reviews

No reviews yet.