Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

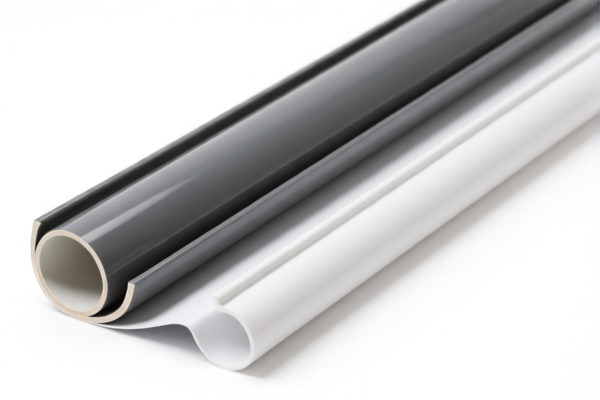

- Product Name: PVC Wall Covering Material

- Classification: Multiple HS codes may apply depending on the specific product type (e.g., panels, sheets, profiles). Below are the relevant HS codes and their associated tax details:

🔍 HS Code: 3918901000

- Description: PVC Wall Panels

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC wall panels not covered by more specific classifications.

🔍 HS Code: 3921125000

- Description: PVC Wall Panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC wall panels with specific technical features or compositions.

🔍 HS Code: 3918102000

- Description: PVC Wall Panels

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be for PVC wall panels with specific dimensions or manufacturing processes.

🔍 HS Code: 3920490000

- Description: PVC Wall Sheet Material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC sheets used for wall covering.

🔍 HS Code: 3916200020

- Description: PVC Wall Profile Material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC profiles used in wall coverings, such as molding or trim.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not currently applicable for PVC wall covering materials, but always verify with the latest customs updates.

- Certifications: Ensure your product meets any required certifications (e.g., fire resistance, environmental standards) depending on the destination market.

- Material and Unit Price: Verify the exact composition and unit price of the product to ensure correct classification and tax calculation.

✅ Proactive Advice:

- Confirm the exact product type (panel, sheet, profile) and material composition to select the correct HS code.

- Check with customs or a compliance expert if the product contains additives or is part of a composite material.

- Keep updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

- Product Name: PVC Wall Covering Material

- Classification: Multiple HS codes may apply depending on the specific product type (e.g., panels, sheets, profiles). Below are the relevant HS codes and their associated tax details:

🔍 HS Code: 3918901000

- Description: PVC Wall Panels

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC wall panels not covered by more specific classifications.

🔍 HS Code: 3921125000

- Description: PVC Wall Panels

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC wall panels with specific technical features or compositions.

🔍 HS Code: 3918102000

- Description: PVC Wall Panels

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be for PVC wall panels with specific dimensions or manufacturing processes.

🔍 HS Code: 3920490000

- Description: PVC Wall Sheet Material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC sheets used for wall covering.

🔍 HS Code: 3916200020

- Description: PVC Wall Profile Material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC profiles used in wall coverings, such as molding or trim.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not currently applicable for PVC wall covering materials, but always verify with the latest customs updates.

- Certifications: Ensure your product meets any required certifications (e.g., fire resistance, environmental standards) depending on the destination market.

- Material and Unit Price: Verify the exact composition and unit price of the product to ensure correct classification and tax calculation.

✅ Proactive Advice:

- Confirm the exact product type (panel, sheet, profile) and material composition to select the correct HS code.

- Check with customs or a compliance expert if the product contains additives or is part of a composite material.

- Keep updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

Customer Reviews

No reviews yet.