| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

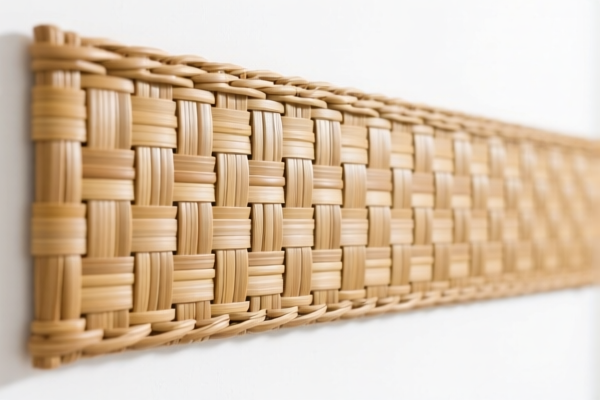

Product Classification: PVC Wall Coverings with Man-Made Fiber Backing

HS CODE: 3918.10.32.50 (10-digit code)

🔍 Classification Summary

- Product Type: PVC wall coverings with man-made fiber (synthetic fiber) backing.

- HS Code: 3918.10.32.50 (classified under "Plastics and articles thereof" – specifically for wall coverings with synthetic fiber backing).

- Tariff Summary: 61.5% total tax rate.

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Note: This is a time-sensitive policy. If your goods are imported after April 2, 2025, the additional tariff will increase to 30.0%.

⚠️ Important Policy Alerts

-

April 2, 2025 Tariff Adjustment:

A 30.0% additional tariff will be applied to this product after April 2, 2025. Ensure your import timeline is planned accordingly to avoid unexpected costs. -

Anti-dumping duties:

No specific anti-dumping duties are listed for this product category at this time. However, always verify with customs or a compliance expert for the latest updates.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed PVC with a synthetic fiber backing. Any deviation in material may lead to misclassification.

- Check Unit Price and Quantity: Tariff rates may vary based on the value or quantity of the goods, especially if falling under different tariff headings or preferential trade agreements.

- Certifications Required: Ensure that the product meets any required certifications (e.g., fire safety, environmental standards) for import into the destination country.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and tariff calculation.

📚 Example Use Case

If you are importing 1000 square meters of PVC wall coverings with synthetic fiber backing, and the FOB price is $10 per square meter, the total tax would be calculated as follows:

- Total Value: $10,000

- Total Tax (61.5%): $6,150

- Breakdown:

- Base: $650

- Additional: $2,500

- Special (after April 2, 2025): $3,000

Let me know if you need help with a specific import scenario or want to compare with other HS codes.

Product Classification: PVC Wall Coverings with Man-Made Fiber Backing

HS CODE: 3918.10.32.50 (10-digit code)

🔍 Classification Summary

- Product Type: PVC wall coverings with man-made fiber (synthetic fiber) backing.

- HS Code: 3918.10.32.50 (classified under "Plastics and articles thereof" – specifically for wall coverings with synthetic fiber backing).

- Tariff Summary: 61.5% total tax rate.

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Note: This is a time-sensitive policy. If your goods are imported after April 2, 2025, the additional tariff will increase to 30.0%.

⚠️ Important Policy Alerts

-

April 2, 2025 Tariff Adjustment:

A 30.0% additional tariff will be applied to this product after April 2, 2025. Ensure your import timeline is planned accordingly to avoid unexpected costs. -

Anti-dumping duties:

No specific anti-dumping duties are listed for this product category at this time. However, always verify with customs or a compliance expert for the latest updates.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed PVC with a synthetic fiber backing. Any deviation in material may lead to misclassification.

- Check Unit Price and Quantity: Tariff rates may vary based on the value or quantity of the goods, especially if falling under different tariff headings or preferential trade agreements.

- Certifications Required: Ensure that the product meets any required certifications (e.g., fire safety, environmental standards) for import into the destination country.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and tariff calculation.

📚 Example Use Case

If you are importing 1000 square meters of PVC wall coverings with synthetic fiber backing, and the FOB price is $10 per square meter, the total tax would be calculated as follows:

- Total Value: $10,000

- Total Tax (61.5%): $6,150

- Breakdown:

- Base: $650

- Additional: $2,500

- Special (after April 2, 2025): $3,000

Let me know if you need help with a specific import scenario or want to compare with other HS codes.

Customer Reviews

No reviews yet.