| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918104010 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103110 | Doc | 59.2% | CN | US | 2025-05-12 |

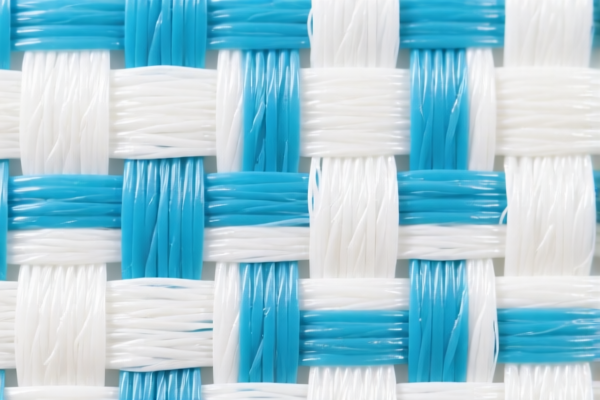

Here is the structured analysis and customs compliance guidance for the PVC Wall Coverings with Man-Made Fiber Backing (including medical use) based on the provided HS codes and tax details:

✅ HS CODE: 3918104010

Product Description: PVC Textile Backed Wall Fabric – for Medical Institutions

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for medical use, which may require certifications (e.g., medical device or hospital-grade approvals).

✅ HS CODE: 3918103210

Product Description: PVC with Man-Made Fiber Backed Wall Paper

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for general use wall coverings with synthetic fiber backing.

✅ HS CODE: 3918103250

Product Description: PVC Wall Decals with Synthetic Fiber Backing

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for decorative wall stickers with synthetic fiber backing.

✅ HS CODE: 3918103150

Product Description: PVC Wall Decals (Textile Fiber Backing, Synthetic Fiber, >70% Plastic)

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC wall coverings with mixed fiber backing (textile + synthetic), and plastic content >70%.

✅ HS CODE: 3918103110

Product Description: Man-Made Fiber Backed PVC Wall Fabric

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for general use wall coverings with man-made fiber backing.

📌 Key Observations and Recommendations:

- All codes are subject to a 30.0% additional tariff after April 11, 2025.

-

This is a time-sensitive policy. Ensure your import timeline aligns with this date to avoid unexpected costs.

-

Base Tariff Varies by Product Type:

-

Medical-grade products (e.g., 3918104010) may have higher base tariffs due to specialized use.

-

Material Composition Matters:

-

Ensure the percentage of plastic and type of backing (textile vs. synthetic) are clearly documented to avoid misclassification.

-

Certifications Required:

-

For medical use, check if medical certification or safety compliance (e.g., FDA, CE) is required for customs clearance.

-

Unit Price and Material Verification:

- Confirm the material composition and unit price to ensure correct HS code selection and tax calculation.

🛑 Proactive Advice:

- Verify the exact product description (e.g., medical use, decorative, wall decal, etc.) to match the correct HS code.

- Check for any additional duties (e.g., anti-dumping duties) if the product is from a country under such measures.

- Consult a customs broker or HS code expert if the product is borderline between categories (e.g., wall decal vs. wall fabric).

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured analysis and customs compliance guidance for the PVC Wall Coverings with Man-Made Fiber Backing (including medical use) based on the provided HS codes and tax details:

✅ HS CODE: 3918104010

Product Description: PVC Textile Backed Wall Fabric – for Medical Institutions

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for medical use, which may require certifications (e.g., medical device or hospital-grade approvals).

✅ HS CODE: 3918103210

Product Description: PVC with Man-Made Fiber Backed Wall Paper

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for general use wall coverings with synthetic fiber backing.

✅ HS CODE: 3918103250

Product Description: PVC Wall Decals with Synthetic Fiber Backing

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for decorative wall stickers with synthetic fiber backing.

✅ HS CODE: 3918103150

Product Description: PVC Wall Decals (Textile Fiber Backing, Synthetic Fiber, >70% Plastic)

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC wall coverings with mixed fiber backing (textile + synthetic), and plastic content >70%.

✅ HS CODE: 3918103110

Product Description: Man-Made Fiber Backed PVC Wall Fabric

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for general use wall coverings with man-made fiber backing.

📌 Key Observations and Recommendations:

- All codes are subject to a 30.0% additional tariff after April 11, 2025.

-

This is a time-sensitive policy. Ensure your import timeline aligns with this date to avoid unexpected costs.

-

Base Tariff Varies by Product Type:

-

Medical-grade products (e.g., 3918104010) may have higher base tariffs due to specialized use.

-

Material Composition Matters:

-

Ensure the percentage of plastic and type of backing (textile vs. synthetic) are clearly documented to avoid misclassification.

-

Certifications Required:

-

For medical use, check if medical certification or safety compliance (e.g., FDA, CE) is required for customs clearance.

-

Unit Price and Material Verification:

- Confirm the material composition and unit price to ensure correct HS code selection and tax calculation.

🛑 Proactive Advice:

- Verify the exact product description (e.g., medical use, decorative, wall decal, etc.) to match the correct HS code.

- Check for any additional duties (e.g., anti-dumping duties) if the product is from a country under such measures.

- Consult a customs broker or HS code expert if the product is borderline between categories (e.g., wall decal vs. wall fabric).

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.