| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

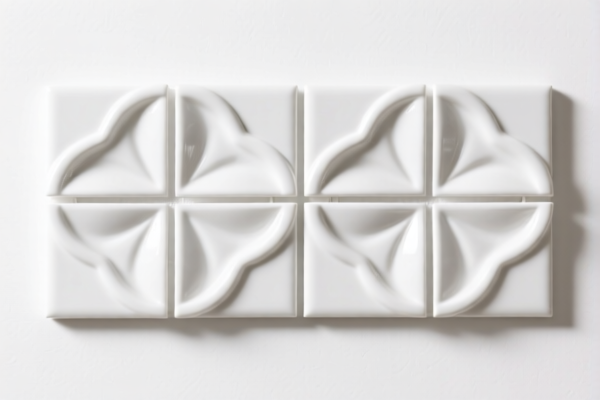

Product Name: PVC Wall Decoration Tile

Classification: Plastic Wall Covering (HS Chapter 3918)

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC wall decoration tiles:

- HS CODE 3918104050

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 60.3%

-

HS CODE 3918105000

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 59.2%

-

HS CODE 3918103210

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 61.5%

-

HS CODE 3918102000

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 60.3%

-

HS CODE 3918103250

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not applicable for this product category (plastic wall coverings), but always verify with the latest customs updates.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a composite or mixed material, which may affect classification.

- Check Unit Price and Packaging: Tariff rates may vary based on the declared value and packaging method.

- Certifications Required: Confirm if any certifications (e.g., CE, RoHS) are needed for import into the target market.

- Consult Customs Broker: For accurate HS code selection and compliance, especially if the product has special features or uses.

📊 Summary of Tax Rates

| HS CODE | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax |

|---|---|---|---|---|

| 3918104050 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918105000 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918103210 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3918102000 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918103250 | 6.5% | 25.0% | 30.0% | 61.5% |

If you need help determining the most suitable HS code for your specific product, feel free to provide more details.

Product Name: PVC Wall Decoration Tile

Classification: Plastic Wall Covering (HS Chapter 3918)

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC wall decoration tiles:

- HS CODE 3918104050

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 60.3%

-

HS CODE 3918105000

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 59.2%

-

HS CODE 3918103210

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 61.5%

-

HS CODE 3918102000

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax: 60.3%

-

HS CODE 3918103250

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not applicable for this product category (plastic wall coverings), but always verify with the latest customs updates.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a composite or mixed material, which may affect classification.

- Check Unit Price and Packaging: Tariff rates may vary based on the declared value and packaging method.

- Certifications Required: Confirm if any certifications (e.g., CE, RoHS) are needed for import into the target market.

- Consult Customs Broker: For accurate HS code selection and compliance, especially if the product has special features or uses.

📊 Summary of Tax Rates

| HS CODE | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax |

|---|---|---|---|---|

| 3918104050 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918105000 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918103210 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3918102000 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918103250 | 6.5% | 25.0% | 30.0% | 61.5% |

If you need help determining the most suitable HS code for your specific product, feel free to provide more details.

Customer Reviews

No reviews yet.