| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3916200010 | Doc | 60.8% | CN | US | 2025-05-12 |

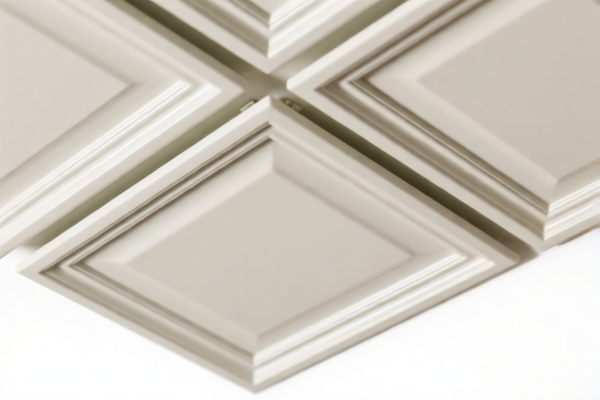

Product Name: PVC Wall Decorative Panel

Classification: Plastic wall coverings (HS Chapter 3918)

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC wall decorative panels:

- HS CODE 3918104050

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

-

Description: Plastic wall coverings, including PVC decorative panels.

-

HS CODE 3918105000

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 59.2%

-

Description: Specifically for PVC polymer-based wall coverings.

-

HS CODE 3918103210

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

-

Description: Plastic wall coverings, including PVC decorative panels.

-

HS CODE 3918102000

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

-

Description: Plastic wall, floor, or ceiling coverings.

-

HS CODE 3916200010

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.8%

- Description: PVC exterior wall panels for buildings.

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for PVC wall panels unless the product is specifically identified as being subject to anti-dumping measures (e.g., if imported from certain countries with known dumping practices).

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a composite or mixed material, which may change the HS classification.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Consult Customs Broker: For accurate classification and to avoid delays, it is recommended to work with a customs broker or a classification expert.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline.

Let me know if you need help with HS code verification or customs documentation.

Product Name: PVC Wall Decorative Panel

Classification: Plastic wall coverings (HS Chapter 3918)

✅ HS CODE Classification Overview

Below are the HS codes and corresponding tax details for PVC wall decorative panels:

- HS CODE 3918104050

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

-

Description: Plastic wall coverings, including PVC decorative panels.

-

HS CODE 3918105000

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 59.2%

-

Description: Specifically for PVC polymer-based wall coverings.

-

HS CODE 3918103210

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 61.5%

-

Description: Plastic wall coverings, including PVC decorative panels.

-

HS CODE 3918102000

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.3%

-

Description: Plastic wall, floor, or ceiling coverings.

-

HS CODE 3916200010

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax: 60.8%

- Description: PVC exterior wall panels for buildings.

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for PVC wall panels unless the product is specifically identified as being subject to anti-dumping measures (e.g., if imported from certain countries with known dumping practices).

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a composite or mixed material, which may change the HS classification.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country.

- Consult Customs Broker: For accurate classification and to avoid delays, it is recommended to work with a customs broker or a classification expert.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.