| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918105000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

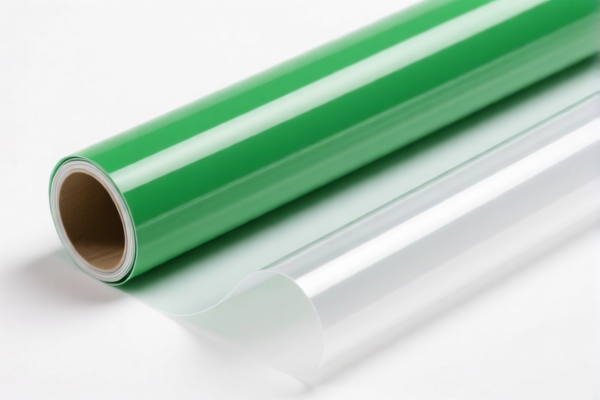

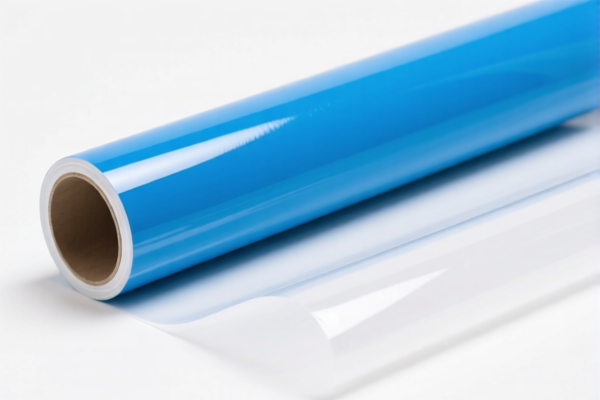

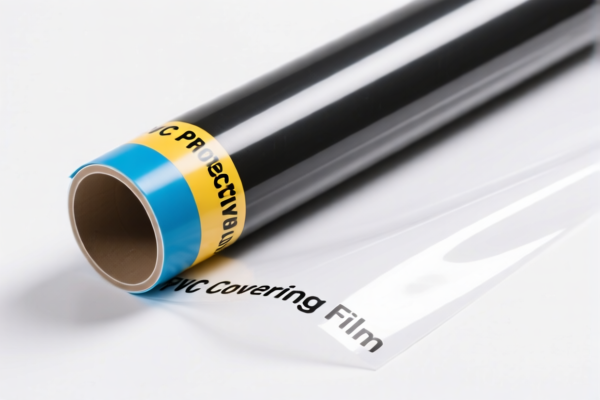

Product Name: PVC Wall Film

Classification: Plastic wall coverings (PVC-based)

HS Code Analysis and Tax Overview:

- HS CODE: 3918105000

- Description: PVC decorative wall film, made of polyvinyl chloride (PVC), classified under HS code 3918105000 due to its material and product form.

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104050

- Description: PVC wall film, classified under HS code 3918.10.40.50, which covers PVC polymer-based wall or ceiling materials.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918103210

- Description: PVC wall film, classified under HS code 3918.10.32.10, which includes plastic wall coverings.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918103250

- Description: PVC wall protection film, classified under HS code 3918.10.32.50, which includes plastic wall coverings.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104050 (Duplicate)

- Description: PVC wall decorative film, classified under HS code 3918.10.40.50. Note: If the product has a textile backing, further clarification is needed to determine whether it falls under 3918.10.40.10 or 3918.10.40.50.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Material and Certification Check:

- Confirm the exact composition of the PVC wall film (e.g., whether it contains additives, textile backing, or other materials). This may affect the correct HS code classification.

-

Verify if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification:

-

Ensure the unit price and product description match the HS code. Misclassification can lead to delays and penalties.

-

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for PVC wall films in this context, but always check the latest customs notices for any updates.

✅ Proactive Action Steps:

- Confirm the material composition and backing structure (if any) of the product.

- Check the destination country’s import regulations for any additional requirements.

-

Consider customs broker assistance for accurate classification and tariff calculation. Product Name: PVC Wall Film

Classification: Plastic wall coverings (PVC-based)

HS Code Analysis and Tax Overview: -

HS CODE: 3918105000

- Description: PVC decorative wall film, made of polyvinyl chloride (PVC), classified under HS code 3918105000 due to its material and product form.

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104050

- Description: PVC wall film, classified under HS code 3918.10.40.50, which covers PVC polymer-based wall or ceiling materials.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918103210

- Description: PVC wall film, classified under HS code 3918.10.32.10, which includes plastic wall coverings.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918103250

- Description: PVC wall protection film, classified under HS code 3918.10.32.50, which includes plastic wall coverings.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918104050 (Duplicate)

- Description: PVC wall decorative film, classified under HS code 3918.10.40.50. Note: If the product has a textile backing, further clarification is needed to determine whether it falls under 3918.10.40.10 or 3918.10.40.50.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

-

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Material and Certification Check:

- Confirm the exact composition of the PVC wall film (e.g., whether it contains additives, textile backing, or other materials). This may affect the correct HS code classification.

-

Verify if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification:

-

Ensure the unit price and product description match the HS code. Misclassification can lead to delays and penalties.

-

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for PVC wall films in this context, but always check the latest customs notices for any updates.

✅ Proactive Action Steps:

- Confirm the material composition and backing structure (if any) of the product.

- Check the destination country’s import regulations for any additional requirements.

- Consider customs broker assistance for accurate classification and tariff calculation.

Customer Reviews

No reviews yet.