| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

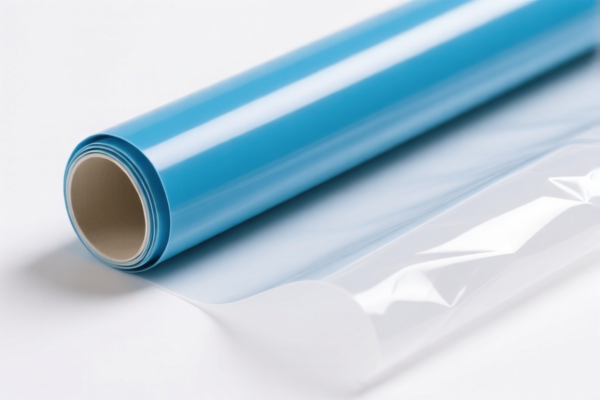

Product Classification: PVC Wallcloth (Synthetic Fiber Backing, Other)

HS CODE: 3918.10.31.50 and 3918.10.32.50

🔍 Classification Overview

- Product Type: PVC wallcloth with synthetic fiber backing (e.g., wall stickers, wall membranes, wall protection films).

- Material Composition: PVC (plastic content >70%) with synthetic fiber backing (e.g., polyester, polypropylene).

- HS Code Options:

- 3918.10.31.50: For products with textile fiber backing (e.g., woven or non-woven fabric).

- 3918.10.32.50: For products with synthetic fiber backing (e.g., non-woven or synthetic fabric).

📊 Tariff Breakdown (as of now)

- Base Tariff Rate:

- 3918.10.31.50: 4.2%

-

3918.10.32.50: 6.5%

-

Additional Tariff (General): 25.0% (applies to all imports from certain countries/regions)

-

Special Tariff (April 11, 2025 onwards): 30.0% (applies to all products under these HS codes)

-

Total Tax Rate:

- 3918.10.31.50: 59.2%

- 3918.10.32.50: 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all products under these HS codes after April 11, 2025. This is a time-sensitive policy and may significantly increase import costs. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for PVC wallcloth with synthetic fiber backing. However, it is advisable to check for any ongoing investigations or duties specific to your product's origin.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product contains >70% plastic and has a synthetic fiber backing (e.g., polyester, polypropylene) to qualify for these HS codes.

- Check Unit Price and Classification: Confirm the HS code with customs or a classification expert, as misclassification can lead to penalties.

- Certifications Required: Some countries may require product safety certifications (e.g., flame resistance, VOC compliance) for wallcoverings.

- Monitor Tariff Changes: Stay updated on April 11, 2025 policy changes and consider adjusting your import strategy accordingly.

✅ Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3918.10.31.50 | PVC wall membrane with textile fiber backing | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918.10.32.50 | PVC wallcloth with synthetic fiber backing | 6.5% | 25.0% | 30.0% | 61.5% |

If you need help determining the correct HS code for your specific product or want to calculate the total import cost, feel free to provide more details.

Product Classification: PVC Wallcloth (Synthetic Fiber Backing, Other)

HS CODE: 3918.10.31.50 and 3918.10.32.50

🔍 Classification Overview

- Product Type: PVC wallcloth with synthetic fiber backing (e.g., wall stickers, wall membranes, wall protection films).

- Material Composition: PVC (plastic content >70%) with synthetic fiber backing (e.g., polyester, polypropylene).

- HS Code Options:

- 3918.10.31.50: For products with textile fiber backing (e.g., woven or non-woven fabric).

- 3918.10.32.50: For products with synthetic fiber backing (e.g., non-woven or synthetic fabric).

📊 Tariff Breakdown (as of now)

- Base Tariff Rate:

- 3918.10.31.50: 4.2%

-

3918.10.32.50: 6.5%

-

Additional Tariff (General): 25.0% (applies to all imports from certain countries/regions)

-

Special Tariff (April 11, 2025 onwards): 30.0% (applies to all products under these HS codes)

-

Total Tax Rate:

- 3918.10.31.50: 59.2%

- 3918.10.32.50: 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all products under these HS codes after April 11, 2025. This is a time-sensitive policy and may significantly increase import costs. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for PVC wallcloth with synthetic fiber backing. However, it is advisable to check for any ongoing investigations or duties specific to your product's origin.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product contains >70% plastic and has a synthetic fiber backing (e.g., polyester, polypropylene) to qualify for these HS codes.

- Check Unit Price and Classification: Confirm the HS code with customs or a classification expert, as misclassification can lead to penalties.

- Certifications Required: Some countries may require product safety certifications (e.g., flame resistance, VOC compliance) for wallcoverings.

- Monitor Tariff Changes: Stay updated on April 11, 2025 policy changes and consider adjusting your import strategy accordingly.

✅ Summary Table

| HS Code | Product Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3918.10.31.50 | PVC wall membrane with textile fiber backing | 4.2% | 25.0% | 30.0% | 59.2% |

| 3918.10.32.50 | PVC wallcloth with synthetic fiber backing | 6.5% | 25.0% | 30.0% | 61.5% |

If you need help determining the correct HS code for your specific product or want to calculate the total import cost, feel free to provide more details.

Customer Reviews

No reviews yet.