Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

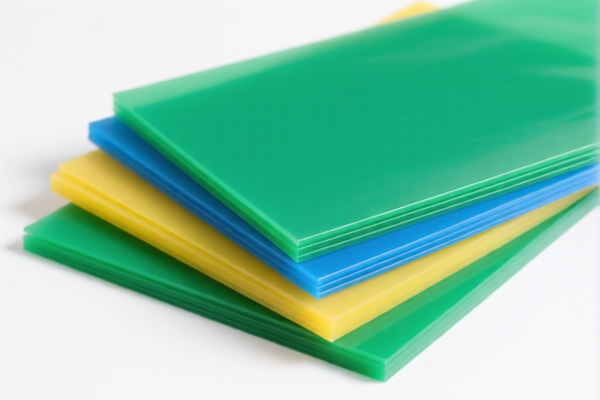

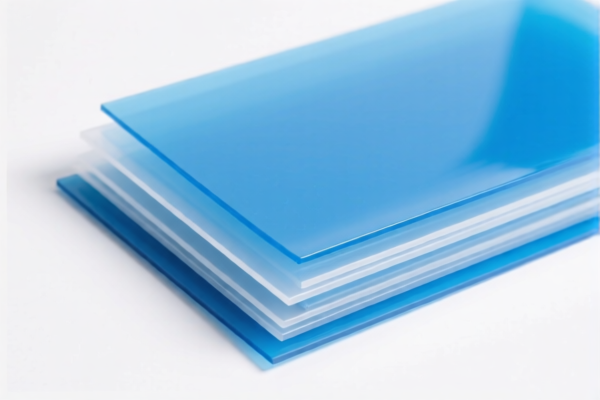

Here is the structured classification and tariff information for PVC plastic sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3916200020

- Description: Other polyvinyl chloride (PVC) polymer made plastic monofilament, rods, sticks, and profiles.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC in specific forms (e.g., rods, profiles), not flat sheets.

✅ HS CODE: 3920431000

- Description: Plastic sheets made from polyvinyl chloride (PVC) with plasticizers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific code for PVC sheets with added plasticizers.

✅ HS CODE: 3920995000

- Description: Plastic sheets made from various plastics, non-cellular, not reinforced, and not laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for non-reinforced, non-laminated plastic sheets.

✅ HS CODE: 3921905050

- Description: Plastic sheets, including PVC, in specific categories.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower base tariff but still applies the 30% special tariff after April 11, 2025.

✅ HS CODE: 3921125000

- Description: Other plastic sheets, including those made from polyvinyl chloride (PVC).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for various types of plastic sheets, including PVC.

📌 Key Observations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30% tariff after this date.

- Base Tariff Variations: The base tariff ranges from 3.1% to 6.5%, depending on the specific HS code.

- Additional Tariff: A 25% additional tariff is applied to most codes, except for 3921905050, which has 0% additional tariff.

🛑 Proactive Advice:

- Verify Material Composition: Confirm whether the PVC sheets contain plasticizers or are reinforced/laminated, as this will affect the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for plasticizers or additives).

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025 is time-sensitive and may significantly impact your import costs.

- Consult Customs Authority: For final confirmation, always cross-check with local customs or a qualified customs broker.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for PVC plastic sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3916200020

- Description: Other polyvinyl chloride (PVC) polymer made plastic monofilament, rods, sticks, and profiles.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for PVC in specific forms (e.g., rods, profiles), not flat sheets.

✅ HS CODE: 3920431000

- Description: Plastic sheets made from polyvinyl chloride (PVC) with plasticizers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a specific code for PVC sheets with added plasticizers.

✅ HS CODE: 3920995000

- Description: Plastic sheets made from various plastics, non-cellular, not reinforced, and not laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for non-reinforced, non-laminated plastic sheets.

✅ HS CODE: 3921905050

- Description: Plastic sheets, including PVC, in specific categories.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower base tariff but still applies the 30% special tariff after April 11, 2025.

✅ HS CODE: 3921125000

- Description: Other plastic sheets, including those made from polyvinyl chloride (PVC).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for various types of plastic sheets, including PVC.

📌 Key Observations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30% tariff after this date.

- Base Tariff Variations: The base tariff ranges from 3.1% to 6.5%, depending on the specific HS code.

- Additional Tariff: A 25% additional tariff is applied to most codes, except for 3921905050, which has 0% additional tariff.

🛑 Proactive Advice:

- Verify Material Composition: Confirm whether the PVC sheets contain plasticizers or are reinforced/laminated, as this will affect the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for plasticizers or additives).

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025 is time-sensitive and may significantly impact your import costs.

- Consult Customs Authority: For final confirmation, always cross-check with local customs or a qualified customs broker.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.