| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

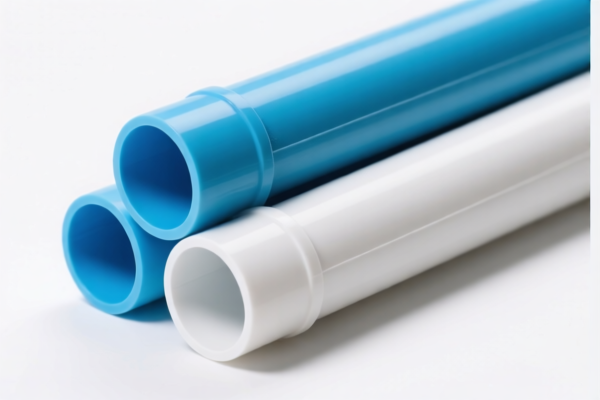

Here is the structured classification and tariff information for PVC plastic tubes based on the provided HS codes and tax details:

✅ HS CODE: 3916200091

Product Description: PVC plastic tubes (PVC is a polymer covered under this code; plastic tubes fall under the category of monofilaments, rods, and profiles).

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is suitable for general PVC tubes, not specialized or modified products.

✅ HS CODE: 3917230000

Product Description: PVC water pipes (PVC is a vinyl polymer; hard plastic pipes fall under this code).

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Notes: This code is for rigid PVC water pipes, commonly used in plumbing.

✅ HS CODE: 3904400000

Product Description: PVC water pipes (PVC is a halogenated ethylene polymer; pipes are considered primary plastic products).

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to PVC pipes in their primary form, not finished or modified products.

✅ HS CODE: 3904220000

Product Description: PVC water pipes (PVC is polyvinyl chloride; pipes are plastic products under Chapter 39).

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for PVC pipes in their primary form, specifically polyvinyl chloride.

✅ HS CODE: 3917400060

Product Description: PVC plastic pipe fittings (pipe connectors or joints made of PVC).

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for PVC fittings used in pipe systems.

📌 Proactive Advice for Users:

- Verify Material: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a blend or composite material.

- Check Unit Price: Tariff rates may vary based on the declared value and whether the product is considered "finished" or "primary."

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for customs clearance.

- April 11, 2025 Deadline: Be aware of the additional 30% tariff that will apply after this date. Plan your import schedule accordingly.

- Consult a Customs Broker: For complex or high-value shipments, consider professional assistance to avoid classification errors.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured classification and tariff information for PVC plastic tubes based on the provided HS codes and tax details:

✅ HS CODE: 3916200091

Product Description: PVC plastic tubes (PVC is a polymer covered under this code; plastic tubes fall under the category of monofilaments, rods, and profiles).

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is suitable for general PVC tubes, not specialized or modified products.

✅ HS CODE: 3917230000

Product Description: PVC water pipes (PVC is a vinyl polymer; hard plastic pipes fall under this code).

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Notes: This code is for rigid PVC water pipes, commonly used in plumbing.

✅ HS CODE: 3904400000

Product Description: PVC water pipes (PVC is a halogenated ethylene polymer; pipes are considered primary plastic products).

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to PVC pipes in their primary form, not finished or modified products.

✅ HS CODE: 3904220000

Product Description: PVC water pipes (PVC is polyvinyl chloride; pipes are plastic products under Chapter 39).

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for PVC pipes in their primary form, specifically polyvinyl chloride.

✅ HS CODE: 3917400060

Product Description: PVC plastic pipe fittings (pipe connectors or joints made of PVC).

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for PVC fittings used in pipe systems.

📌 Proactive Advice for Users:

- Verify Material: Ensure the product is indeed made of PVC (polyvinyl chloride) and not a blend or composite material.

- Check Unit Price: Tariff rates may vary based on the declared value and whether the product is considered "finished" or "primary."

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for customs clearance.

- April 11, 2025 Deadline: Be aware of the additional 30% tariff that will apply after this date. Plan your import schedule accordingly.

- Consult a Customs Broker: For complex or high-value shipments, consider professional assistance to avoid classification errors.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.