| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3703906000 | Doc | 57.8% | CN | US | 2025-05-12 |

| 3703903060 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3707906000 | Doc | 55.0% | CN | US | 2025-05-12 |

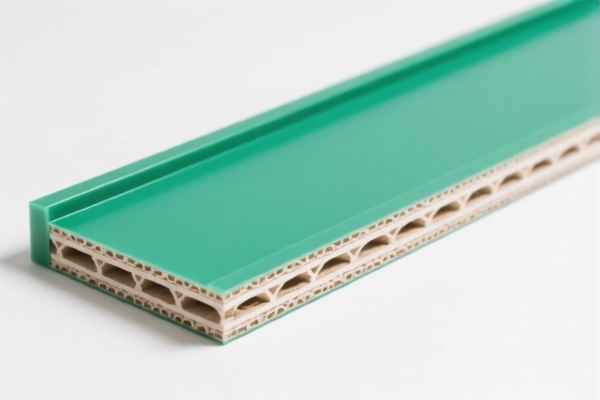

PVC Skirting Board HS Code Classification & Tariff Information

Based on the provided reference data and the product description "PVCSKIRTINGBOARD", here's a breakdown of potential HS code classifications and associated tariff information. Given the description, the most likely classification falls under plastics, specifically focusing on profile shapes.

Here's a detailed analysis:

- 3916.20.00.91 - Plastics in primary forms, of polymers of vinyl chloride, other: This is the most probable HS code.

- 39: Chapter 39 covers plastics and articles thereof.

- 16: Refers to polymers of vinyl chloride (PVC).

- 20: Specifically covers monofilament, rods, sticks and profile shapes.

- 00: Further specifies other forms.

- 91: Indicates a specific sub-category within other forms.

- Tariff Details:

- Basic Duty: 5.8%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30%

- Total Tariff: 60.8%

Important Considerations & Recommendations:

- Material Confirmation: Ensure the skirting board is exclusively made of PVC. If any other materials are present (e.g., wood composite, additives exceeding a certain percentage), the HS code may change.

- Profile Shape Definition: The description "skirting board" implies a specific profile shape. This falls under the scope of

3916.20.00.91. - Surface Treatment: The reference data specifies "whether or not surface-worked but not otherwise worked". If the skirting board has undergone significant processing beyond surface treatment (e.g., complex machining, assembly with other parts), a different HS code might be more appropriate.

- Declaration Accuracy: Provide a detailed product specification to customs to ensure accurate classification.

- Post-April 2, 2025 Tariffs: Be aware of the increased additional duty of 30% effective April 2, 2025.

- Certification: Depending on the final application of the skirting board (e.g., construction, interior design), specific certifications or standards may be required. Check with the importing country's regulations.

- Single Invoice: Ensure the invoice clearly states the material composition and intended use of the product.

Disclaimer: This information is based solely on the provided reference data and the user's input. Final HS code determination rests with customs authorities in the importing country. It is recommended to consult with a licensed customs broker for definitive classification.

Customer Reviews

I really appreciated the section on material confirmation and surface treatment. It helped me avoid potential issues with classification and tariffs. Highly recommend this page for anyone dealing with PVC products.

It's a good start, but I wish there were more examples of how to apply the HS codes in real scenarios. The info is accurate, but I had to look up some of the terms to fully understand the context.

The page gave a clear explanation of the tariff rates for different HS codes. I was a bit confused about which one to choose, but the detailed analysis helped me pick the right code for my product.

The breakdown of HS code 3916200091 was super helpful. I needed this info for exporting PVC skirting boards to the US, and the details on the tariff rate and classification made it much easier.