Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

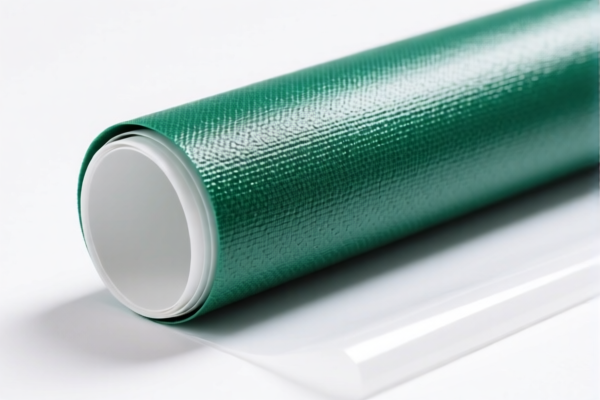

Product Classification: PVC Composite Label Material

HS CODE: 3920995000 (Primary Classification)

🔍 Classification Summary:

- Product: PVC composite label material

- HS Code: 3920995000

- Description: Laminated, supported, or otherwise combined with other materials, classified under "Other plastics."

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties: No specific anti-dumping duties on iron or aluminum are applicable for this product.

- Material Verification Required: Confirm the exact composition and structure of the PVC composite material to ensure correct classification. If it contains other materials (e.g., paper, fabric, or adhesive layers), it may fall under a different HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed a composite of PVC with other materials and not a standalone PVC film or sheet.

- Check Unit Price: The total tax rate is high, so consider the unit price and volume to assess the overall cost impact.

- Consult Customs Authority: For complex or high-value shipments, consult with customs or a professional customs broker to confirm classification and tax implications.

📌 Alternative HS Codes (for reference):

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3904220000 | Chlorinated polyethylene polymers | 61.5% |

| 3920435000 | PVC sheets with plasticizers | 59.2% |

| 3904400000 | Other polyvinyl chloride copolymers | 60.3% |

| 3920490000 | PVC-based plastic sheets, films, etc. | 60.8% |

If you have more details about the product (e.g., thickness, composition, intended use), I can help refine the classification further.

Product Classification: PVC Composite Label Material

HS CODE: 3920995000 (Primary Classification)

🔍 Classification Summary:

- Product: PVC composite label material

- HS Code: 3920995000

- Description: Laminated, supported, or otherwise combined with other materials, classified under "Other plastics."

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties: No specific anti-dumping duties on iron or aluminum are applicable for this product.

- Material Verification Required: Confirm the exact composition and structure of the PVC composite material to ensure correct classification. If it contains other materials (e.g., paper, fabric, or adhesive layers), it may fall under a different HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed a composite of PVC with other materials and not a standalone PVC film or sheet.

- Check Unit Price: The total tax rate is high, so consider the unit price and volume to assess the overall cost impact.

- Consult Customs Authority: For complex or high-value shipments, consult with customs or a professional customs broker to confirm classification and tax implications.

📌 Alternative HS Codes (for reference):

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3904220000 | Chlorinated polyethylene polymers | 61.5% |

| 3920435000 | PVC sheets with plasticizers | 59.2% |

| 3904400000 | Other polyvinyl chloride copolymers | 60.3% |

| 3920490000 | PVC-based plastic sheets, films, etc. | 60.8% |

If you have more details about the product (e.g., thickness, composition, intended use), I can help refine the classification further.

Customer Reviews

No reviews yet.