| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

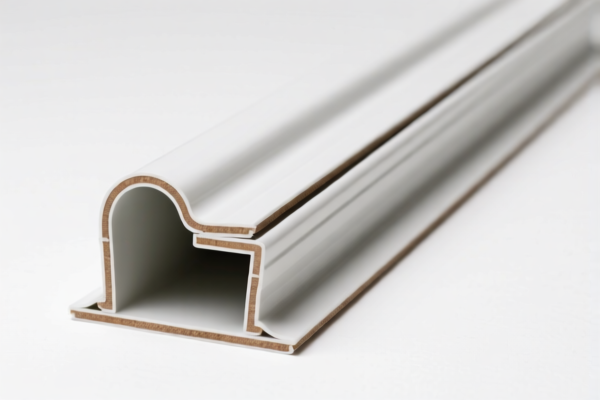

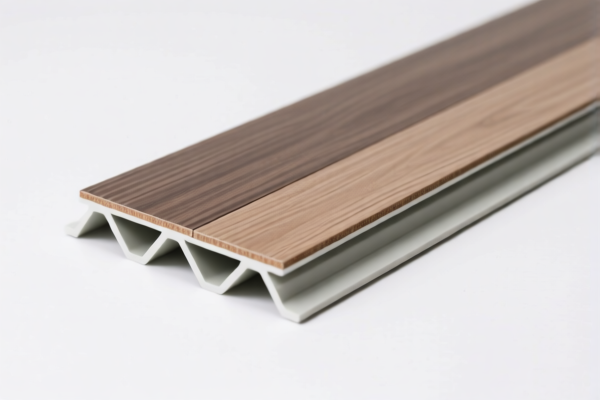

Product Classification: PVC条材 (PVC Strips)

HS CODEs and Tax Information Summary:

- HS CODE: 3921125000

- Description: PVC条材符合HSCODE 3921的描述,属于聚氯乙烯聚合物,条材符合塑料板、片、薄膜、箔和条的定义。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for PVC strips that are finished products made of PVC polymer.

-

HS CODE: 3920490000

- Description: PVC塑料条材符合HSCODE 3920490000的描述,该HS编码专门针对以聚氯乙烯聚合物为基础的塑料板、片、薄膜、箔和条。

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC strips made from PVC polymer, but may be more specific than 3921125000.

-

HS CODE: 3904220000

- Description: PVC条带符合HS编码3904章的描述,属于聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to PVC strips in their primary form (e.g., raw or unprocessed).

-

HS CODE: 3916200020

- Description: PVC塑料条符合HS编码3916.20.00.91的描述,涵盖了其他聚氯乙烯聚合物制成的单丝纤维、棒材、棍棒和型材。

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC strips that are shaped or formed products (e.g., rods, profiles).

-

HS CODE: 3904220000 (Duplicate Entry)

- Description: PVC板条符合HS编码3904的解释,属于聚氯乙烯的初级形态,且对应的是增塑的聚氯乙烯。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a duplicate entry for the same HS code, likely due to data duplication.

✅ Key Notes and Recommendations:

- Tariff Changes After April 11, 2025:

- All listed HS codes will be subject to an additional 30.0% tariff after this date.

-

This is a time-sensitive policy, so ensure your import timeline aligns with this change.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for PVC products in this context. However, always verify if your product is subject to any ongoing anti-dumping or countervailing duties.

-

Certifications and Documentation:

- Confirm the material composition (e.g., whether it is PVC, modified PVC, or other additives).

-

Check if certifications (e.g., RoHS, REACH, or specific customs documentation) are required for your product type and destination country.

-

Unit Price and Classification:

-

Ensure the unit price and product form (e.g., raw, processed, shaped) match the HS code description to avoid misclassification and potential penalties.

-

Recommendation:

- If your product is finished or shaped, consider HS CODE 3916200020 or 3921125000.

- If it is raw or unprocessed, HS CODE 3904220000 may be more appropriate.

Let me know if you need help selecting the most accurate HS code for your specific product.

Product Classification: PVC条材 (PVC Strips)

HS CODEs and Tax Information Summary:

- HS CODE: 3921125000

- Description: PVC条材符合HSCODE 3921的描述,属于聚氯乙烯聚合物,条材符合塑料板、片、薄膜、箔和条的定义。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for PVC strips that are finished products made of PVC polymer.

-

HS CODE: 3920490000

- Description: PVC塑料条材符合HSCODE 3920490000的描述,该HS编码专门针对以聚氯乙烯聚合物为基础的塑料板、片、薄膜、箔和条。

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC strips made from PVC polymer, but may be more specific than 3921125000.

-

HS CODE: 3904220000

- Description: PVC条带符合HS编码3904章的描述,属于聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to PVC strips in their primary form (e.g., raw or unprocessed).

-

HS CODE: 3916200020

- Description: PVC塑料条符合HS编码3916.20.00.91的描述,涵盖了其他聚氯乙烯聚合物制成的单丝纤维、棒材、棍棒和型材。

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC strips that are shaped or formed products (e.g., rods, profiles).

-

HS CODE: 3904220000 (Duplicate Entry)

- Description: PVC板条符合HS编码3904的解释,属于聚氯乙烯的初级形态,且对应的是增塑的聚氯乙烯。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a duplicate entry for the same HS code, likely due to data duplication.

✅ Key Notes and Recommendations:

- Tariff Changes After April 11, 2025:

- All listed HS codes will be subject to an additional 30.0% tariff after this date.

-

This is a time-sensitive policy, so ensure your import timeline aligns with this change.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for PVC products in this context. However, always verify if your product is subject to any ongoing anti-dumping or countervailing duties.

-

Certifications and Documentation:

- Confirm the material composition (e.g., whether it is PVC, modified PVC, or other additives).

-

Check if certifications (e.g., RoHS, REACH, or specific customs documentation) are required for your product type and destination country.

-

Unit Price and Classification:

-

Ensure the unit price and product form (e.g., raw, processed, shaped) match the HS code description to avoid misclassification and potential penalties.

-

Recommendation:

- If your product is finished or shaped, consider HS CODE 3916200020 or 3921125000.

- If it is raw or unprocessed, HS CODE 3904220000 may be more appropriate.

Let me know if you need help selecting the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.