| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

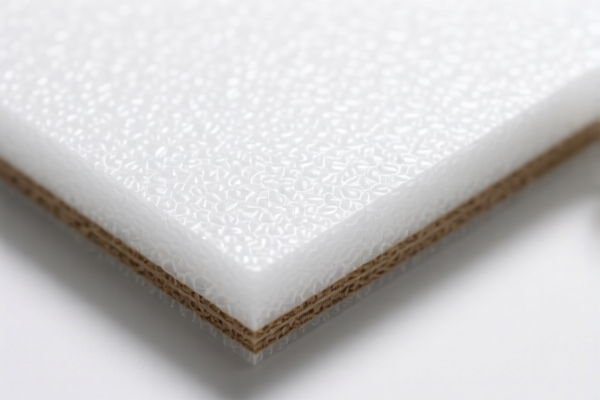

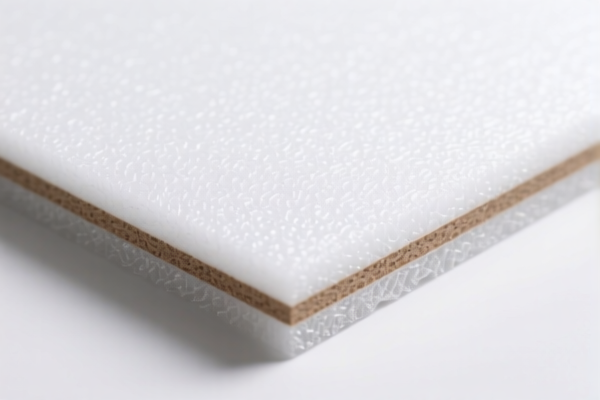

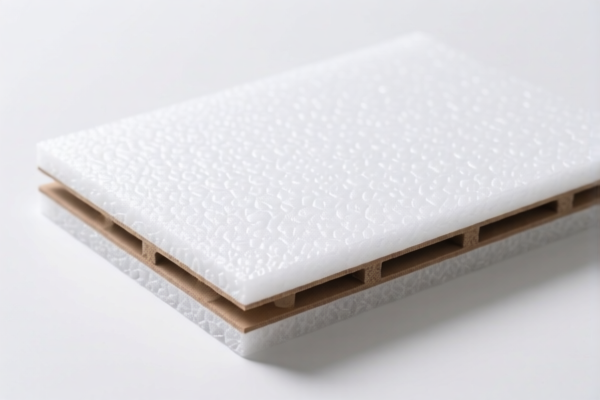

Product Name: PVC泡沫板 (PVC Foam Board)

Classification: Plastic foam boards, specifically PVC foam boards

✅ HS CODE Classification and Tax Details

- HS CODE: 3921125000

- Description: PVC泡沫板、PVC泡沫塑料板、PVC泡沫塑料板材 (PVC foam board, PVC foam plastic sheet, PVC foam plastic board)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121950

- Description: PVC泡沫塑料纺织复合板、PVC纺织复合泡沫塑料板、PVC泡沫塑料纺织复合材料板 (PVC foam plastic textile composite board, PVC textile composite foam plastic board, PVC foam plastic textile composite material board)

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921110000

- Description: 泡沫板 (Foam board)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all three HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PVC foam boards in this context. However, it is advisable to check for any ongoing anti-dumping investigations or duties applicable to PVC products in the destination market.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed PVC foam board and not a composite or textile-based product, which may fall under a different HS code (e.g., 3921121950).

- Check Unit Price and Classification: The tax rate can vary significantly based on the HS code, so accurate classification is crucial.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Policy Updates: Stay updated on any changes in customs policies, especially regarding the April 11, 2025, tariff increase.

If you have more details about the product (e.g., thickness, use, or whether it's a composite), I can help further refine the classification and tax calculation.

Product Name: PVC泡沫板 (PVC Foam Board)

Classification: Plastic foam boards, specifically PVC foam boards

✅ HS CODE Classification and Tax Details

- HS CODE: 3921125000

- Description: PVC泡沫板、PVC泡沫塑料板、PVC泡沫塑料板材 (PVC foam board, PVC foam plastic sheet, PVC foam plastic board)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921121950

- Description: PVC泡沫塑料纺织复合板、PVC纺织复合泡沫塑料板、PVC泡沫塑料纺织复合材料板 (PVC foam plastic textile composite board, PVC textile composite foam plastic board, PVC foam plastic textile composite material board)

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921110000

- Description: 泡沫板 (Foam board)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all three HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs clearance. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for PVC foam boards in this context. However, it is advisable to check for any ongoing anti-dumping investigations or duties applicable to PVC products in the destination market.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed PVC foam board and not a composite or textile-based product, which may fall under a different HS code (e.g., 3921121950).

- Check Unit Price and Classification: The tax rate can vary significantly based on the HS code, so accurate classification is crucial.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Policy Updates: Stay updated on any changes in customs policies, especially regarding the April 11, 2025, tariff increase.

If you have more details about the product (e.g., thickness, use, or whether it's a composite), I can help further refine the classification and tax calculation.

Customer Reviews

No reviews yet.