| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903101800 | Doc | 69.1% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

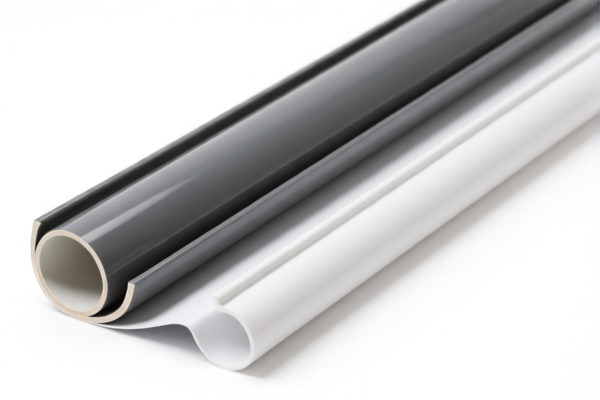

Product Name: PVC Coated Embossed Wall Fabric

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

Description:

- This code applies to PVC-coated wall fabrics made from plastic sheets, films, or foils containing polyvinyl chloride (PVC), combined with textile materials.

- The 8–10 digit description includes "chlor乙烯 polymer," which matches the material composition of the product.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is used for multiple product types, including PVC-coated textile wall fabrics and knitted wall fabrics.

- Ensure the product is not classified under textile-based codes (e.g., 5903) if it is primarily a plastic composite.

✅ HS CODE: 5903101800

Description:

- This code applies to PVC-coated polyester fiber embossed fabric.

- The term "PVC coating" corresponds to "impregnated, coated, covered, or laminated with plastics."

- "Polyester fiber" corresponds to "based on man-made fibers."

Tariff Summary:

- Base Tariff Rate: 14.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

Key Notes:

- This code is more specific and applies to products with a textile base (e.g., polyester fiber) coated with PVC.

- Higher tax rate compared to plastic-based codes.

✅ HS CODE: 5903103000

Description:

- This code applies to PVC-coated printed fabric.

- The product is a textile fabric that is impregnated, coated, covered, or laminated with plastic (PVC).

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes:

- Lower base tariff rate compared to other codes, but still subject to the same additional tariffs.

- Applicable if the fabric is primarily textile with PVC coating.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is primarily a plastic composite (e.g., PVC film with textile backing) or a textile fabric with PVC coating. This will determine the correct HS CODE.

- Check Unit Price and Certification: Some HS CODEs may require specific certifications (e.g., textile or plastic industry certifications) for accurate classification.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost calculations.

- Consult Customs Broker: For complex classifications, especially when multiple HS CODEs seem applicable, seek professional customs advice to avoid delays or penalties.

📅 Important Date Reminder:

- April 11, 2025: Additional tariffs of 30.0% will be applied to all the above HS CODEs. Ensure your import planning accounts for this.

Product Name: PVC Coated Embossed Wall Fabric

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

Description:

- This code applies to PVC-coated wall fabrics made from plastic sheets, films, or foils containing polyvinyl chloride (PVC), combined with textile materials.

- The 8–10 digit description includes "chlor乙烯 polymer," which matches the material composition of the product.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is used for multiple product types, including PVC-coated textile wall fabrics and knitted wall fabrics.

- Ensure the product is not classified under textile-based codes (e.g., 5903) if it is primarily a plastic composite.

✅ HS CODE: 5903101800

Description:

- This code applies to PVC-coated polyester fiber embossed fabric.

- The term "PVC coating" corresponds to "impregnated, coated, covered, or laminated with plastics."

- "Polyester fiber" corresponds to "based on man-made fibers."

Tariff Summary:

- Base Tariff Rate: 14.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.1%

Key Notes:

- This code is more specific and applies to products with a textile base (e.g., polyester fiber) coated with PVC.

- Higher tax rate compared to plastic-based codes.

✅ HS CODE: 5903103000

Description:

- This code applies to PVC-coated printed fabric.

- The product is a textile fabric that is impregnated, coated, covered, or laminated with plastic (PVC).

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes:

- Lower base tariff rate compared to other codes, but still subject to the same additional tariffs.

- Applicable if the fabric is primarily textile with PVC coating.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is primarily a plastic composite (e.g., PVC film with textile backing) or a textile fabric with PVC coating. This will determine the correct HS CODE.

- Check Unit Price and Certification: Some HS CODEs may require specific certifications (e.g., textile or plastic industry certifications) for accurate classification.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, are significant and should be factored into cost calculations.

- Consult Customs Broker: For complex classifications, especially when multiple HS CODEs seem applicable, seek professional customs advice to avoid delays or penalties.

📅 Important Date Reminder:

- April 11, 2025: Additional tariffs of 30.0% will be applied to all the above HS CODEs. Ensure your import planning accounts for this.

Customer Reviews

No reviews yet.