| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903101000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

| 5903102500 | Doc | 62.5% | CN | US | 2025-05-12 |

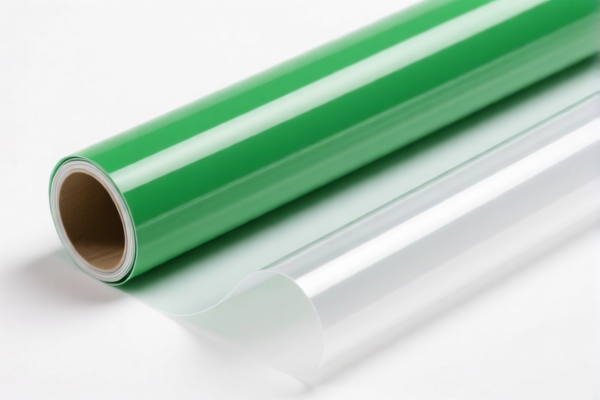

Product Name: PVC Coated Canvas

Classification Notes: Based on the provided HS codes and descriptions, PVC-coated canvas can be classified under several HS codes depending on the base material (e.g., cotton, polyester, man-made fibers) and specific product characteristics.

🔍 HS Code Classification Overview

- HS CODE 3921121500

- Description: Plastic sheets, of chlorinated polyethylene or polyvinyl chloride (PVC), etc.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is more suitable for products that are primarily plastic sheets, not textile-based.

-

HS CODE 5903103000

- Description: Textile fabrics coated, impregnated, or laminated with plastics (other than those in 5903101000 or 5903101500).

- Total Tax Rate: 57.7%

- Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for general PVC-coated canvas not specifically made from cotton or polyester.

-

HS CODE 5903101000

- Description: Cotton textile fabrics coated, impregnated, or laminated with polyvinyl chloride (PVC).

- Total Tax Rate: 57.7%

- Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Specifically for cotton-based PVC-coated canvas.

-

HS CODE 5903101500

- Description: Polyester textile fabrics coated, impregnated, or laminated with polyvinyl chloride (PVC).

- Total Tax Rate: 37.5%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower tax rate due to zero base tariff, but still subject to the 2025.4.2 special tariff.

-

HS CODE 5903102500

- Description: Textile fabrics made of man-made fibers, coated, impregnated, or laminated with polyvinyl chloride (PVC).

- Total Tax Rate: 62.5%

- Tax Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher tax rate due to higher base tariff.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Material Verification:

- Confirm the base fabric (cotton, polyester, man-made fibers) to determine the correct HS code.

-

If the product is primarily plastic (e.g., not textile-based), HS CODE 3921121500 may be more appropriate.

-

Certifications and Documentation:

- Ensure compliance with customs documentation and product certifications (e.g., material composition, origin, etc.).

-

Be prepared to provide technical specifications or product samples if requested by customs.

-

Tariff Optimization:

- If the product is polyester-based, HS CODE 5903101500 offers the lowest total tax rate (37.5%) before the April 11, 2025 special tariff.

- However, after April 11, 2025, the total tax rate will increase to 67.5% (0.0% + 7.5% + 30.0%).

✅ Proactive Advice

- Verify the fabric composition (cotton, polyester, man-made fibers) and PVC coating thickness to ensure correct classification.

- Check the unit price and total tax impact based on the selected HS code.

- Consult with customs brokers or legal advisors if the product is close to the boundary between textile and plastic classification.

- Monitor the April 11, 2025 deadline and plan accordingly for tariff adjustments.

Product Name: PVC Coated Canvas

Classification Notes: Based on the provided HS codes and descriptions, PVC-coated canvas can be classified under several HS codes depending on the base material (e.g., cotton, polyester, man-made fibers) and specific product characteristics.

🔍 HS Code Classification Overview

- HS CODE 3921121500

- Description: Plastic sheets, of chlorinated polyethylene or polyvinyl chloride (PVC), etc.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is more suitable for products that are primarily plastic sheets, not textile-based.

-

HS CODE 5903103000

- Description: Textile fabrics coated, impregnated, or laminated with plastics (other than those in 5903101000 or 5903101500).

- Total Tax Rate: 57.7%

- Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for general PVC-coated canvas not specifically made from cotton or polyester.

-

HS CODE 5903101000

- Description: Cotton textile fabrics coated, impregnated, or laminated with polyvinyl chloride (PVC).

- Total Tax Rate: 57.7%

- Tax Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Specifically for cotton-based PVC-coated canvas.

-

HS CODE 5903101500

- Description: Polyester textile fabrics coated, impregnated, or laminated with polyvinyl chloride (PVC).

- Total Tax Rate: 37.5%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower tax rate due to zero base tariff, but still subject to the 2025.4.2 special tariff.

-

HS CODE 5903102500

- Description: Textile fabrics made of man-made fibers, coated, impregnated, or laminated with polyvinyl chloride (PVC).

- Total Tax Rate: 62.5%

- Tax Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher tax rate due to higher base tariff.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Material Verification:

- Confirm the base fabric (cotton, polyester, man-made fibers) to determine the correct HS code.

-

If the product is primarily plastic (e.g., not textile-based), HS CODE 3921121500 may be more appropriate.

-

Certifications and Documentation:

- Ensure compliance with customs documentation and product certifications (e.g., material composition, origin, etc.).

-

Be prepared to provide technical specifications or product samples if requested by customs.

-

Tariff Optimization:

- If the product is polyester-based, HS CODE 5903101500 offers the lowest total tax rate (37.5%) before the April 11, 2025 special tariff.

- However, after April 11, 2025, the total tax rate will increase to 67.5% (0.0% + 7.5% + 30.0%).

✅ Proactive Advice

- Verify the fabric composition (cotton, polyester, man-made fibers) and PVC coating thickness to ensure correct classification.

- Check the unit price and total tax impact based on the selected HS code.

- Consult with customs brokers or legal advisors if the product is close to the boundary between textile and plastic classification.

- Monitor the April 11, 2025 deadline and plan accordingly for tariff adjustments.

Customer Reviews

No reviews yet.