| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903101500 | Doc | 37.5% | CN | US | 2025-05-12 |

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 6302992000 | Doc | 38.4% | CN | US | 2025-05-12 |

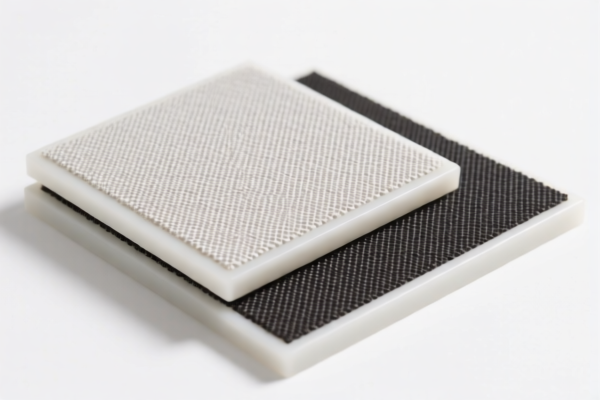

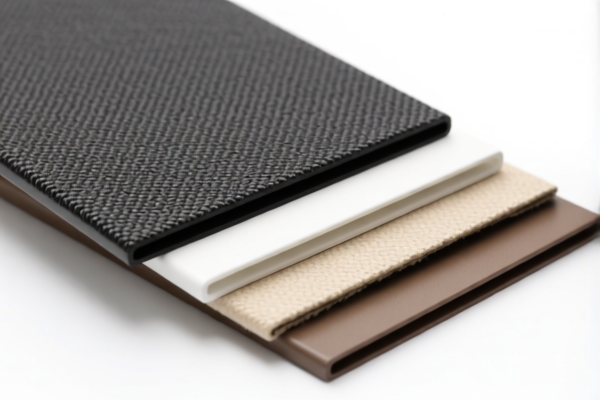

Product Name: PVC-coated polyester tablecloth

Classification HS Code Analysis and Tax Overview:

- HS CODE: 3921121950

- Description: PVC-coated polyester tablecloth

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most applicable code for PVC-coated polyester tablecloths.

-

HS CODE: 3921121100

- Description: PVC-coated polyester table napkin

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff than 3921121950, but still subject to the same additional and special tariffs.

-

HS CODE: 5903103000

- Description: PVC-coated polyester fabric

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general PVC-coated polyester fabric, not specifically for tablecloths.

-

HS CODE: 5903102010

- Description: PVC-coated polyester fabric

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Zero base tariff, but still subject to the same additional and special tariffs.

-

HS CODE: 5903101500

- Description: PVC-coated polyester wall fabric

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower overall tax rate, but only applicable for wall fabric, not tablecloths.

-

HS CODE: 3921121500

- Description: PVC-coated polyester wall fabric

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff than 5903101500, but still applicable for wall fabric.

-

HS CODE: 6302992000

- Description: Polyester tablecloth

- Total Tax Rate: 38.4%

- Breakdown:

- Base Tariff: 8.4%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for non-PVC-coated polyester tablecloths, with no additional tariff but still subject to the special tariff after April 11, 2025.

✅ Proactive Advice:

- Verify the product's exact use: Ensure the product is classified as a "tablecloth" and not a "wall fabric" or "napkin," as this will affect the HS code.

- Check the material composition: Confirm whether the product is PVC-coated or not, as this is a key factor in classification.

- Review the unit price and quantity: This may affect whether the product is subject to anti-dumping or other specific duties.

- Confirm required certifications: Some products may require specific documentation or certifications for customs clearance.

-

Be aware of the April 11, 2025, special tariff: This will increase the total tax rate by 30.0% for all listed codes, so plan accordingly for import costs. Product Name: PVC-coated polyester tablecloth

Classification HS Code Analysis and Tax Overview: -

HS CODE: 3921121950

- Description: PVC-coated polyester tablecloth

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most applicable code for PVC-coated polyester tablecloths.

-

HS CODE: 3921121100

- Description: PVC-coated polyester table napkin

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff than 3921121950, but still subject to the same additional and special tariffs.

-

HS CODE: 5903103000

- Description: PVC-coated polyester fabric

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general PVC-coated polyester fabric, not specifically for tablecloths.

-

HS CODE: 5903102010

- Description: PVC-coated polyester fabric

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Zero base tariff, but still subject to the same additional and special tariffs.

-

HS CODE: 5903101500

- Description: PVC-coated polyester wall fabric

- Total Tax Rate: 37.5%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower overall tax rate, but only applicable for wall fabric, not tablecloths.

-

HS CODE: 3921121500

- Description: PVC-coated polyester wall fabric

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff than 5903101500, but still applicable for wall fabric.

-

HS CODE: 6302992000

- Description: Polyester tablecloth

- Total Tax Rate: 38.4%

- Breakdown:

- Base Tariff: 8.4%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for non-PVC-coated polyester tablecloths, with no additional tariff but still subject to the special tariff after April 11, 2025.

✅ Proactive Advice:

- Verify the product's exact use: Ensure the product is classified as a "tablecloth" and not a "wall fabric" or "napkin," as this will affect the HS code.

- Check the material composition: Confirm whether the product is PVC-coated or not, as this is a key factor in classification.

- Review the unit price and quantity: This may affect whether the product is subject to anti-dumping or other specific duties.

- Confirm required certifications: Some products may require specific documentation or certifications for customs clearance.

- Be aware of the April 11, 2025, special tariff: This will increase the total tax rate by 30.0% for all listed codes, so plan accordingly for import costs.

Customer Reviews

No reviews yet.