| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5903101000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903103000 | Doc | 57.7% | CN | US | 2025-05-12 |

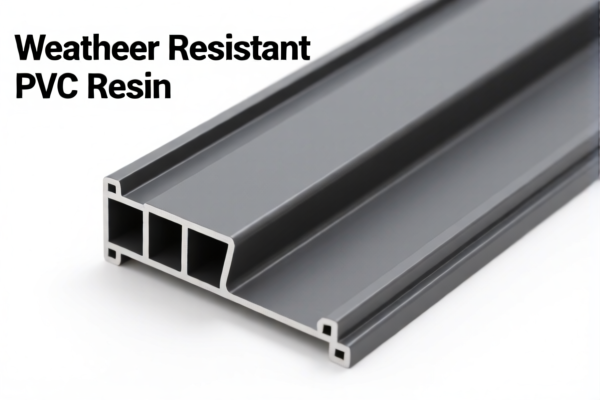

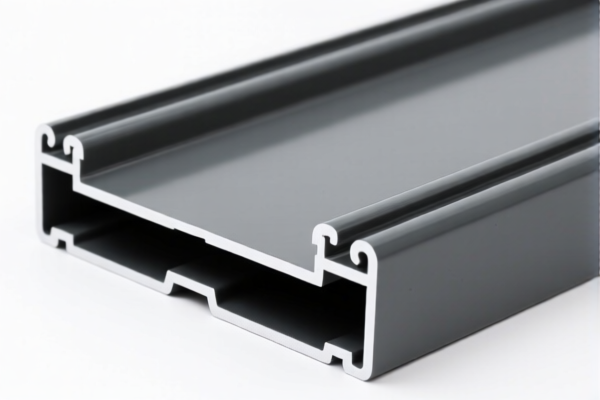

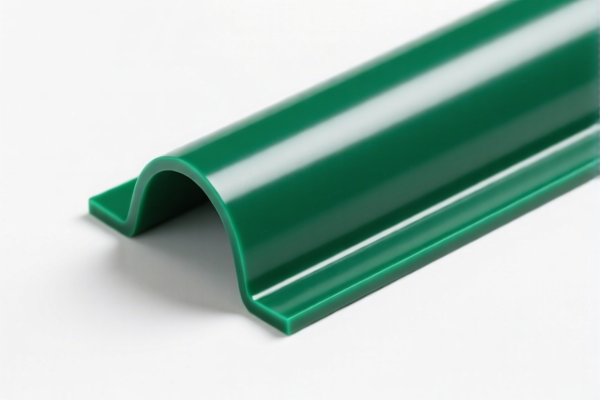

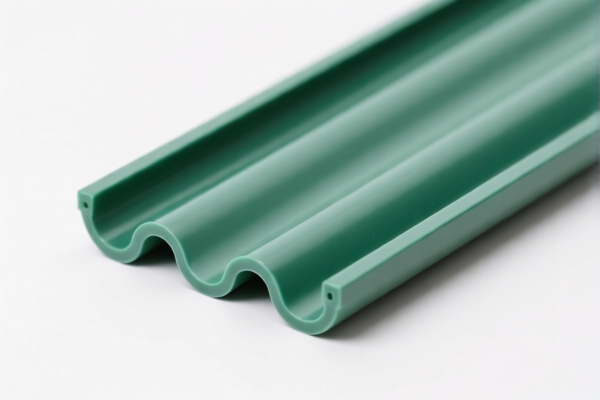

Product Name: PVC涂层遮雨布 (PVC-coated rain cover)

Classification Analysis and Tax Information:

✅ HS CODE: 5903102010

Description:

- Applies to textile products that are impregnated, coated, wrapped, or laminated with plastic, especially those coated with polyvinyl chloride (PVC).

- This code is most suitable for PVC-coated textile products, such as PVC-coated rain covers, which are typically made of fabric coated with PVC for waterproofing.

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently listed for this product category.

📌 Proactive Advice:

-

Verify Material Composition:

Ensure the product is indeed PVC-coated textile fabric and not a plastic sheet or film with textile components (which may fall under a different HS code, e.g., 3921121500). -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import. -

Consider Alternative Codes:

If the product is more PVC film-based with textile components, consider 3921121500 or 3921121100. However, 5903102010 is the most accurate for textile-based PVC-coated products.

📌 Comparison with Other Codes:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 5903102010 | PVC-coated textile products | 55.0% | ✅ Most suitable |

| 5903101000 | PVC-coated cotton fabric | 57.7% | Similar, but cotton-specific |

| 3921121500 | Plastic with textile, synthetic fiber > other | 61.5% | Higher tax, for plastic + textile |

| 3921121100 | Plastic sheets/films with textile | 59.2% | May apply if textile is secondary |

| 5903103000 | Other PVC-coated textile products | 57.7% | Similar to 5903101000, but broader |

📌 Conclusion:

For PVC-coated rain covers made of textile fabric, HS CODE 5903102010 is the most accurate and appropriate classification. The total tax rate is 55.0%, with a 30.0% additional tariff after April 11, 2025. Ensure proper product description and documentation to avoid misclassification.

Product Name: PVC涂层遮雨布 (PVC-coated rain cover)

Classification Analysis and Tax Information:

✅ HS CODE: 5903102010

Description:

- Applies to textile products that are impregnated, coated, wrapped, or laminated with plastic, especially those coated with polyvinyl chloride (PVC).

- This code is most suitable for PVC-coated textile products, such as PVC-coated rain covers, which are typically made of fabric coated with PVC for waterproofing.

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently listed for this product category.

📌 Proactive Advice:

-

Verify Material Composition:

Ensure the product is indeed PVC-coated textile fabric and not a plastic sheet or film with textile components (which may fall under a different HS code, e.g., 3921121500). -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import. -

Consider Alternative Codes:

If the product is more PVC film-based with textile components, consider 3921121500 or 3921121100. However, 5903102010 is the most accurate for textile-based PVC-coated products.

📌 Comparison with Other Codes:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 5903102010 | PVC-coated textile products | 55.0% | ✅ Most suitable |

| 5903101000 | PVC-coated cotton fabric | 57.7% | Similar, but cotton-specific |

| 3921121500 | Plastic with textile, synthetic fiber > other | 61.5% | Higher tax, for plastic + textile |

| 3921121100 | Plastic sheets/films with textile | 59.2% | May apply if textile is secondary |

| 5903103000 | Other PVC-coated textile products | 57.7% | Similar to 5903101000, but broader |

📌 Conclusion:

For PVC-coated rain covers made of textile fabric, HS CODE 5903102010 is the most accurate and appropriate classification. The total tax rate is 55.0%, with a 30.0% additional tariff after April 11, 2025. Ensure proper product description and documentation to avoid misclassification.

Customer Reviews

No reviews yet.