| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921121910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903102010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921121100 | Doc | 59.2% | CN | US | 2025-05-12 |

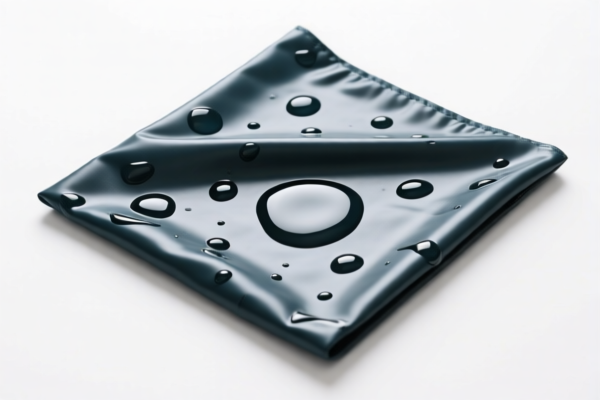

Product Classification and Tax Information for PVC-Coated Tablecloths (Waterproof)

Below is the detailed classification and tariff information for PVC-coated tablecloths (waterproof), based on the provided HS codes and tax details:

✅ HS CODE: 3921121100

Product Description: PVC-coated tablecloths (waterproof), classified under HS code 3921, which covers plastic sheets, plates, films, foils, and strips.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code also applies to PVC-coated polyester tablecloths.

✅ HS CODE: 3921121910

Product Description: PVC-coated textile tablecloths, classified under HS code 3921121910, which falls under "Other plastic sheets, plates, films, foils, and strips."

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121950

Product Description: PVC-coated textile tablecloths, classified under HS code 3921121950, which also falls under "Other plastic sheets, plates, films, foils, and strips."

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 5903102010

Product Description: PVC-coated food-grade waterproof fabric, classified under HS code 5903102010, which covers plastic-coated textile fabrics.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This is the lowest tax rate among the options, but it applies only to food-grade products.

📌 Important Notes and Recommendations:

- Material Verification: Confirm the exact material composition (e.g.,涤纶, polyester, or textile-based) to ensure correct HS code classification.

- Certifications Required: For food-grade products (e.g., under HS 5903102010), ensure compliance with food safety standards and obtain necessary certifications.

- Unit Price and Tax Calculation: Be aware that the total tax rate is cumulative (base + additional + special tariffs). This can significantly impact the final cost.

- April 11, 2025, Deadline: The special tariff of 30% applies after this date. If your shipment is planned after this date, ensure you factor this into your cost estimation.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with customs or a compliance expert for the latest updates.

🛑 Action Required:

- Double-check the product composition and intended use (e.g., food-grade or general use).

- Confirm the most accurate HS code based on the material and coating type.

- If exporting to China, consider the timing of your shipment in relation to the April 11, 2025, tariff change.

Let me know if you need help with customs documentation or further classification details. Product Classification and Tax Information for PVC-Coated Tablecloths (Waterproof)

Below is the detailed classification and tariff information for PVC-coated tablecloths (waterproof), based on the provided HS codes and tax details:

✅ HS CODE: 3921121100

Product Description: PVC-coated tablecloths (waterproof), classified under HS code 3921, which covers plastic sheets, plates, films, foils, and strips.

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code also applies to PVC-coated polyester tablecloths.

✅ HS CODE: 3921121910

Product Description: PVC-coated textile tablecloths, classified under HS code 3921121910, which falls under "Other plastic sheets, plates, films, foils, and strips."

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 3921121950

Product Description: PVC-coated textile tablecloths, classified under HS code 3921121950, which also falls under "Other plastic sheets, plates, films, foils, and strips."

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS CODE: 5903102010

Product Description: PVC-coated food-grade waterproof fabric, classified under HS code 5903102010, which covers plastic-coated textile fabrics.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This is the lowest tax rate among the options, but it applies only to food-grade products.

📌 Important Notes and Recommendations:

- Material Verification: Confirm the exact material composition (e.g.,涤纶, polyester, or textile-based) to ensure correct HS code classification.

- Certifications Required: For food-grade products (e.g., under HS 5903102010), ensure compliance with food safety standards and obtain necessary certifications.

- Unit Price and Tax Calculation: Be aware that the total tax rate is cumulative (base + additional + special tariffs). This can significantly impact the final cost.

- April 11, 2025, Deadline: The special tariff of 30% applies after this date. If your shipment is planned after this date, ensure you factor this into your cost estimation.

- Anti-Dumping Duties: Not applicable for this product category, but always verify with customs or a compliance expert for the latest updates.

🛑 Action Required:

- Double-check the product composition and intended use (e.g., food-grade or general use).

- Confirm the most accurate HS code based on the material and coating type.

- If exporting to China, consider the timing of your shipment in relation to the April 11, 2025, tariff change.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.