Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921121500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

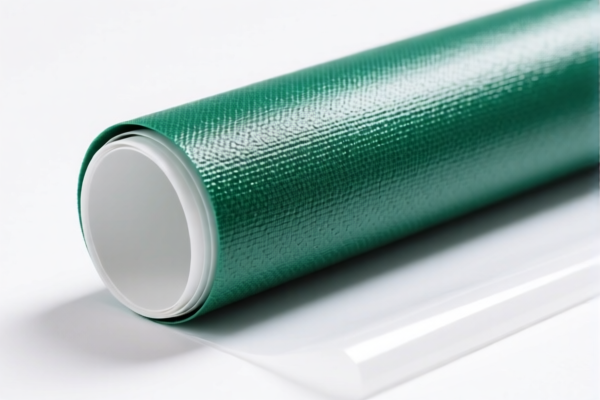

Product Name: PVC纺织品包装材料

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

- Description: PVC纺织品包装材料,归类于3921项下,涵盖其他塑料板、片、薄膜、箔和条,且描述中包含与纺织材料结合的塑料产品。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for products that are a combination of PVC and textile materials.

✅ HS CODE: 3904210000

- Description: PVC包装材料,归类于3904项下,涵盖聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to raw or primary form PVC materials, not combined with textiles.

✅ HS CODE: 3921121950

- Description: PVC纺织品礼品包装布,归类于3921.12.19.50,涵盖其他塑料板、片、薄膜、箔和条,且描述中包含与纺织材料结合的塑料产品。

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more specific for gift packaging materials made of PVC and textiles.

✅ HS CODE: 3904400000

- Description: PVC包装膜,归类于3904项下,涵盖聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC films in primary form, not combined with textiles.

✅ HS CODE: 5903903090

- Description: PVC涂层纺织品,归类于5903903090,涵盖浸渍、涂层、覆盖或层压有塑料的纺织织物。

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for textile products coated with PVC, not raw plastic.

📌 Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: All the above HS codes will be subject to an additional 30.0% tariff. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a combination of PVC and textile, or just PVC in primary form).

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for the product.

- Unit Price: Be aware that the total tax rate is applied to the declared value, so accurate pricing is crucial for cost estimation.

If you are unsure about the exact product composition, it is recommended to consult a customs broker or a classification expert for confirmation.

Product Name: PVC纺织品包装材料

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921121500

- Description: PVC纺织品包装材料,归类于3921项下,涵盖其他塑料板、片、薄膜、箔和条,且描述中包含与纺织材料结合的塑料产品。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for products that are a combination of PVC and textile materials.

✅ HS CODE: 3904210000

- Description: PVC包装材料,归类于3904项下,涵盖聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to raw or primary form PVC materials, not combined with textiles.

✅ HS CODE: 3921121950

- Description: PVC纺织品礼品包装布,归类于3921.12.19.50,涵盖其他塑料板、片、薄膜、箔和条,且描述中包含与纺织材料结合的塑料产品。

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is more specific for gift packaging materials made of PVC and textiles.

✅ HS CODE: 3904400000

- Description: PVC包装膜,归类于3904项下,涵盖聚氯乙烯或其他卤代烯烃的聚合物,初级形态。

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC films in primary form, not combined with textiles.

✅ HS CODE: 5903903090

- Description: PVC涂层纺织品,归类于5903903090,涵盖浸渍、涂层、覆盖或层压有塑料的纺织织物。

- Total Tax Rate: 57.7%

- Breakdown:

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for textile products coated with PVC, not raw plastic.

📌 Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: All the above HS codes will be subject to an additional 30.0% tariff. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a combination of PVC and textile, or just PVC in primary form).

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for the product.

- Unit Price: Be aware that the total tax rate is applied to the declared value, so accurate pricing is crucial for cost estimation.

If you are unsure about the exact product composition, it is recommended to consult a customs broker or a classification expert for confirmation.

Customer Reviews

No reviews yet.