Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

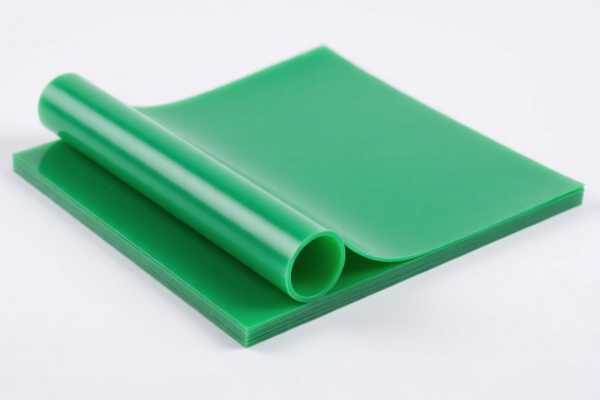

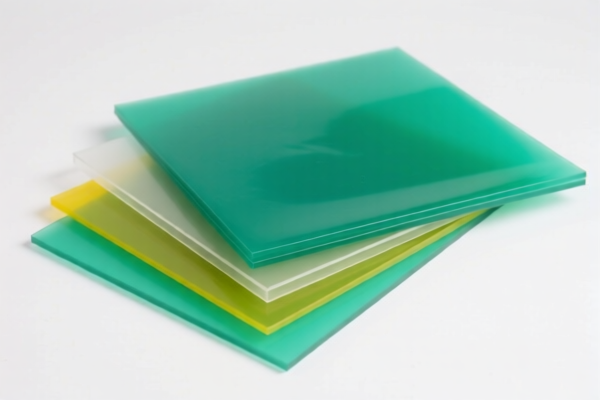

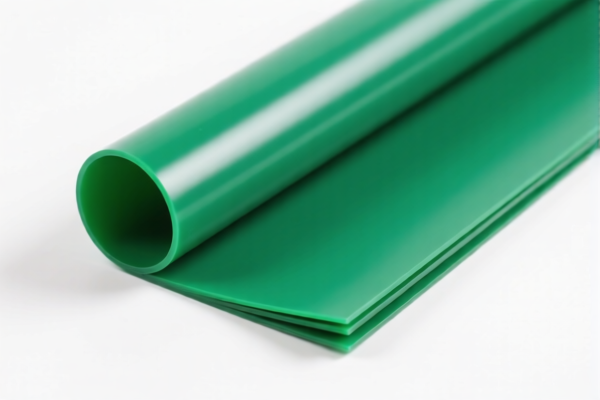

Product Name: PVC食品接触板 (PVC Food Contact Sheet)

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921125000

- Description: PVC (Polyvinyl Chloride) food contact sheet falls under HS CODE 3921, which covers "Other plastic plates, sheets, films, foils and strips." PVC is a polyvinyl chloride polymer, and the product is not explicitly excluded from food contact use.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the options.

✅ HS CODE: 3920431000

- Description: PVC plastic sheet fits under HS CODE 3920, which includes plastic sheets made from chlor乙烯 polymer with plasticizers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff compared to 3921125000, but still subject to the same additional tariffs.

✅ HS CODE: 3920995000

- Description: PVC plastic sheet fits under HS CODE 3920995000, which includes various plastic sheets, non-cellular, non-reinforced, and not laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower than 3921125000 but still high.

✅ HS CODE: 3916200020

- Description: PVC plastic sheet fits under HS CODE 3916.20.00.91, which includes other polyvinyl chloride polymer products such as rods, bars, and profiles.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is more suitable for rod or profile shapes, not flat sheets.

✅ HS CODE: 3921905050

- Description: PVC plastic sheet fits under HS CODE 3921905050, which includes other plastic sheets not elsewhere specified.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lowest base tariff among all options. However, the special tariff after April 11, 2025 still applies.

📌 Key Observations and Recommendations:

- Tariff Impact: All options are subject to the special tariff of 30.0% after April 11, 2025, which is a critical date to be aware of.

- Material and Certification: Ensure the product is certified for food contact (e.g., FDA, GB 4806.7-2016), as this may affect customs clearance and compliance.

- Unit Price and Classification: Verify the material composition and physical form (sheet, rod, profile) to ensure correct HS CODE classification.

- Cost Consideration: If cost is a priority, HS CODE 3921905050 offers the lowest base tariff, but the special tariff will still apply after April 11, 2025.

🛑 Action Required:

- Confirm the exact product form (sheet, rod, profile) and material composition.

- Check if food contact certification is required for import.

- Review the tariff schedule and customs regulations for the destination country.

Product Name: PVC食品接触板 (PVC Food Contact Sheet)

Classification HS CODEs and Tax Details:

✅ HS CODE: 3921125000

- Description: PVC (Polyvinyl Chloride) food contact sheet falls under HS CODE 3921, which covers "Other plastic plates, sheets, films, foils and strips." PVC is a polyvinyl chloride polymer, and the product is not explicitly excluded from food contact use.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the options.

✅ HS CODE: 3920431000

- Description: PVC plastic sheet fits under HS CODE 3920, which includes plastic sheets made from chlor乙烯 polymer with plasticizers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff compared to 3921125000, but still subject to the same additional tariffs.

✅ HS CODE: 3920995000

- Description: PVC plastic sheet fits under HS CODE 3920995000, which includes various plastic sheets, non-cellular, non-reinforced, and not laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower than 3921125000 but still high.

✅ HS CODE: 3916200020

- Description: PVC plastic sheet fits under HS CODE 3916.20.00.91, which includes other polyvinyl chloride polymer products such as rods, bars, and profiles.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is more suitable for rod or profile shapes, not flat sheets.

✅ HS CODE: 3921905050

- Description: PVC plastic sheet fits under HS CODE 3921905050, which includes other plastic sheets not elsewhere specified.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lowest base tariff among all options. However, the special tariff after April 11, 2025 still applies.

📌 Key Observations and Recommendations:

- Tariff Impact: All options are subject to the special tariff of 30.0% after April 11, 2025, which is a critical date to be aware of.

- Material and Certification: Ensure the product is certified for food contact (e.g., FDA, GB 4806.7-2016), as this may affect customs clearance and compliance.

- Unit Price and Classification: Verify the material composition and physical form (sheet, rod, profile) to ensure correct HS CODE classification.

- Cost Consideration: If cost is a priority, HS CODE 3921905050 offers the lowest base tariff, but the special tariff will still apply after April 11, 2025.

🛑 Action Required:

- Confirm the exact product form (sheet, rod, profile) and material composition.

- Check if food contact certification is required for import.

- Review the tariff schedule and customs regulations for the destination country.

Customer Reviews

No reviews yet.