| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3923210011 | Doc | 58.0% | CN | US | 2025-05-12 |

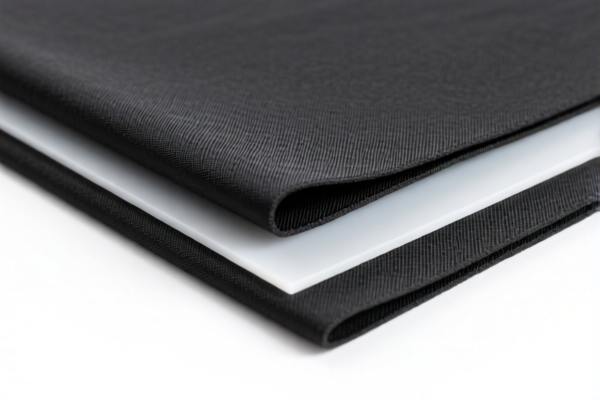

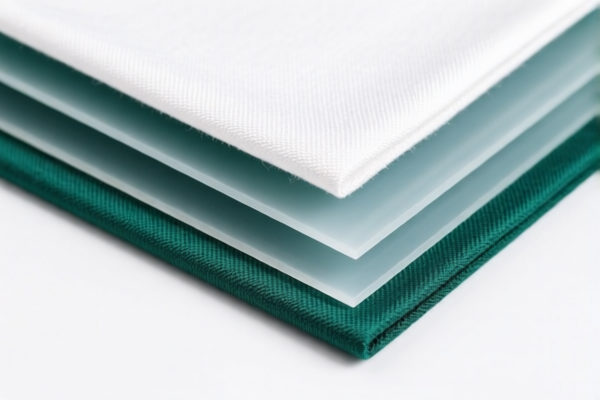

Product Classification: Packaging Textile Plastic Sheets

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3921902900

- Description: Plastic sheets combined with textile materials

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification applies to general plastic-textile composite sheets without specific weight or composition thresholds.

-

HS CODE: 3921902550

- Description: Plastic sheets combined with textile materials, possibly meeting the criteria of weight > 1.492 kg/m² and plastic weight > 70%

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to heavier composite sheets with a higher plastic content.

-

HS CODE: 3921901950

- Description: Plastic sheets combined with textile materials, with weight ≤ 1.492 kg/m²

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to lighter composite sheets with lower plastic content.

-

HS CODE: 3921901100

- Description: Plastic sheets combined with textile materials, with weight ≤ 1.492 kg/m², and synthetic fiber content exceeding any other single fiber type, and plastic weight > 70%

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to lighter composite sheets with high synthetic fiber content and high plastic content.

-

HS CODE: 3923210011

- Description: Resealable plastic packaging bags made of ethylene polymers, with single side length ≤ 75 mm

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to small resealable plastic bags, typically used for packaging.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an additional 30.0% tariff applied, increasing the total tax rate significantly.

- This is a time-sensitive policy, so importers must plan accordingly and consider alternative classifications or product redesigns if applicable.

Proactive Advice:

- Verify the material composition (e.g., plastic weight percentage, textile fiber type) to ensure correct classification.

- Check the unit price and weight per square meter to determine if the product falls under the 1.492 kg/m² threshold.

- Confirm if any certifications (e.g., environmental, safety, or textile-related) are required for import.

- Review the product’s end-use to determine if it qualifies for any preferential tariff treatment or exemptions.

Let me know if you need help determining the most suitable HS code for your specific product.

Product Classification: Packaging Textile Plastic Sheets

HS CODEs and Tax Details (as of current regulations):

- HS CODE: 3921902900

- Description: Plastic sheets combined with textile materials

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification applies to general plastic-textile composite sheets without specific weight or composition thresholds.

-

HS CODE: 3921902550

- Description: Plastic sheets combined with textile materials, possibly meeting the criteria of weight > 1.492 kg/m² and plastic weight > 70%

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to heavier composite sheets with a higher plastic content.

-

HS CODE: 3921901950

- Description: Plastic sheets combined with textile materials, with weight ≤ 1.492 kg/m²

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to lighter composite sheets with lower plastic content.

-

HS CODE: 3921901100

- Description: Plastic sheets combined with textile materials, with weight ≤ 1.492 kg/m², and synthetic fiber content exceeding any other single fiber type, and plastic weight > 70%

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to lighter composite sheets with high synthetic fiber content and high plastic content.

-

HS CODE: 3923210011

- Description: Resealable plastic packaging bags made of ethylene polymers, with single side length ≤ 75 mm

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to small resealable plastic bags, typically used for packaging.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an additional 30.0% tariff applied, increasing the total tax rate significantly.

- This is a time-sensitive policy, so importers must plan accordingly and consider alternative classifications or product redesigns if applicable.

Proactive Advice:

- Verify the material composition (e.g., plastic weight percentage, textile fiber type) to ensure correct classification.

- Check the unit price and weight per square meter to determine if the product falls under the 1.492 kg/m² threshold.

- Confirm if any certifications (e.g., environmental, safety, or textile-related) are required for import.

- Review the product’s end-use to determine if it qualifies for any preferential tariff treatment or exemptions.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.