| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

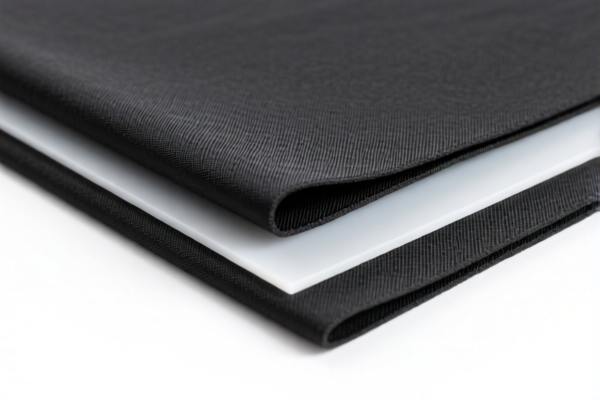

Product Classification: Textile Reinforced Plastic Sheets for Packaging

HS CODEs and Tax Information Overview:

- HS CODE 3921902550

- Description: Reinforced textile plastic sheets for packaging.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to reinforced textile plastic sheets used for packaging.

-

HS CODE 3921902510

- Description: Textile-reinforced plastic sheets.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is for textile-reinforced plastic sheets, likely with similar specifications to 3921902550.

-

HS CODE 3921902900

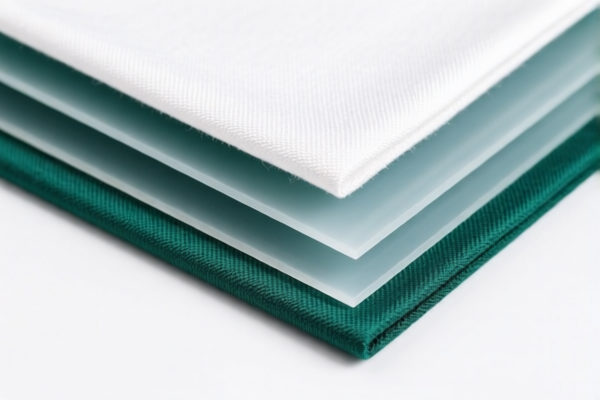

- Description: Fiber-reinforced textile plastic sheets or reinforced textile plastic sheets.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code covers a broader category, including both fiber-reinforced and reinforced textile plastic sheets.

📌 Key Tax Rate Changes (April 2, 2025 onwards):

- All three HS codes will see an increase in the total tax rate by 5% (from 56.5% to 61.5% for 3921902550/3921902510, and from 54.4% to 59.4% for 3921902900).

- This is due to the special tariff of 30.0% being added after April 2, 2025.

⚠️ Important Notes:

- Anti-dumping duties: Not explicitly mentioned in the data, but if the product contains iron or aluminum components, additional anti-dumping duties may apply. Confirm with customs or a trade compliance expert.

- April 11 Special Tariff: Not applicable in this case, but be aware of any new regulations after that date.

- Certifications: Ensure the product meets all required certifications (e.g., material safety, environmental compliance) for import.

✅ Proactive Advice:

- Verify the exact material composition of the textile-reinforced plastic sheets (e.g., type of fiber, plastic base).

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Confirm the HS code with customs or a classification expert, as small differences in product description can lead to different classifications.

-

Review any applicable trade agreements (e.g., RCEP, China-EU) that may offer reduced tariffs. Product Classification: Textile Reinforced Plastic Sheets for Packaging

HS CODEs and Tax Information Overview: -

HS CODE 3921902550

- Description: Reinforced textile plastic sheets for packaging.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code applies to reinforced textile plastic sheets used for packaging.

-

HS CODE 3921902510

- Description: Textile-reinforced plastic sheets.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is for textile-reinforced plastic sheets, likely with similar specifications to 3921902550.

-

HS CODE 3921902900

- Description: Fiber-reinforced textile plastic sheets or reinforced textile plastic sheets.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code covers a broader category, including both fiber-reinforced and reinforced textile plastic sheets.

📌 Key Tax Rate Changes (April 2, 2025 onwards):

- All three HS codes will see an increase in the total tax rate by 5% (from 56.5% to 61.5% for 3921902550/3921902510, and from 54.4% to 59.4% for 3921902900).

- This is due to the special tariff of 30.0% being added after April 2, 2025.

⚠️ Important Notes:

- Anti-dumping duties: Not explicitly mentioned in the data, but if the product contains iron or aluminum components, additional anti-dumping duties may apply. Confirm with customs or a trade compliance expert.

- April 11 Special Tariff: Not applicable in this case, but be aware of any new regulations after that date.

- Certifications: Ensure the product meets all required certifications (e.g., material safety, environmental compliance) for import.

✅ Proactive Advice:

- Verify the exact material composition of the textile-reinforced plastic sheets (e.g., type of fiber, plastic base).

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Confirm the HS code with customs or a classification expert, as small differences in product description can lead to different classifications.

- Review any applicable trade agreements (e.g., RCEP, China-EU) that may offer reduced tariffs.

Customer Reviews

No reviews yet.