| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 7019739090 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

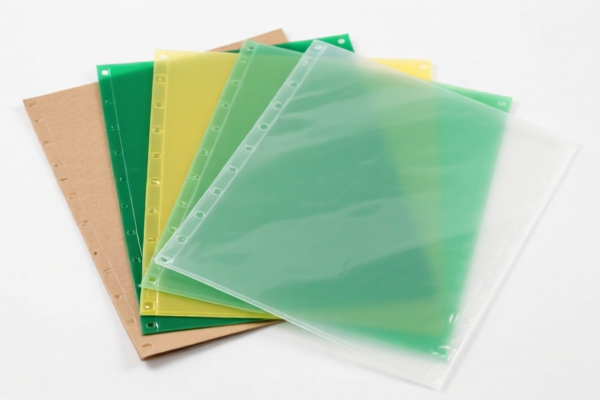

Product Name: Paper Reinforced Flexible Plastic Sheets

Classification Notes: Based on the material composition and reinforcement type, the product may fall under several HS codes. Below is a structured breakdown of the classification and associated tariffs:

✅ HS CODE: 3921904010

Description: Plastic sheets, films, foils, and strips made of plastic, including paper-reinforced flexible plastic sheets.

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- This code is suitable for general plastic sheets with paper reinforcement.

- Proactive Advice: Confirm the exact composition and whether it is primarily plastic with paper reinforcement.

✅ HS CODE: 3921902100

Description: Plastic sheets, films, foils, and strips combined with other textile materials (e.g., cotton-reinforced plastic films).

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Notes:

- This code applies if the product is reinforced with cotton or similar textile materials.

- Proactive Advice: Verify if the reinforcement material is cotton or another textile.

✅ HS CODE: 3921902550

Description: Plastic sheets, films, foils, and strips combined with textile materials (e.g., textile-reinforced plastic films).

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Notes:

- This code is for textile-reinforced plastic films, which may include paper.

- Proactive Advice: Confirm the type of textile used for reinforcement.

✅ HS CODE: 7019739090

Description: Glass fiber-reinforced plastic films.

Total Tax Rate: 61.0%

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Notes:

- This code applies to glass fiber-reinforced plastic films, not paper-reinforced.

- Proactive Advice: Ensure the product is not glass fiber-reinforced if this code is not intended.

📌 Key Considerations:

- Material Composition: The classification depends heavily on the reinforcement material (e.g., paper, cotton, textile, or glass fiber).

- Tariff Changes After April 11, 2025: All listed codes will have an additional 30% tariff applied.

- Certifications: Check if any certifications (e.g., material safety, origin) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or duty calculation.

🛑 Critical Action Reminder:

- Confirm the reinforcement material used in the product (e.g., paper, cotton, textile, or glass fiber).

- Check the product’s exact composition to ensure correct HS code selection.

- Review the April 11, 2025 tariff changes and plan accordingly for import costs.

Product Name: Paper Reinforced Flexible Plastic Sheets

Classification Notes: Based on the material composition and reinforcement type, the product may fall under several HS codes. Below is a structured breakdown of the classification and associated tariffs:

✅ HS CODE: 3921904010

Description: Plastic sheets, films, foils, and strips made of plastic, including paper-reinforced flexible plastic sheets.

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

Notes:

- This code is suitable for general plastic sheets with paper reinforcement.

- Proactive Advice: Confirm the exact composition and whether it is primarily plastic with paper reinforcement.

✅ HS CODE: 3921902100

Description: Plastic sheets, films, foils, and strips combined with other textile materials (e.g., cotton-reinforced plastic films).

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Notes:

- This code applies if the product is reinforced with cotton or similar textile materials.

- Proactive Advice: Verify if the reinforcement material is cotton or another textile.

✅ HS CODE: 3921902550

Description: Plastic sheets, films, foils, and strips combined with textile materials (e.g., textile-reinforced plastic films).

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Notes:

- This code is for textile-reinforced plastic films, which may include paper.

- Proactive Advice: Confirm the type of textile used for reinforcement.

✅ HS CODE: 7019739090

Description: Glass fiber-reinforced plastic films.

Total Tax Rate: 61.0%

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

Notes:

- This code applies to glass fiber-reinforced plastic films, not paper-reinforced.

- Proactive Advice: Ensure the product is not glass fiber-reinforced if this code is not intended.

📌 Key Considerations:

- Material Composition: The classification depends heavily on the reinforcement material (e.g., paper, cotton, textile, or glass fiber).

- Tariff Changes After April 11, 2025: All listed codes will have an additional 30% tariff applied.

- Certifications: Check if any certifications (e.g., material safety, origin) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or duty calculation.

🛑 Critical Action Reminder:

- Confirm the reinforcement material used in the product (e.g., paper, cotton, textile, or glass fiber).

- Check the product’s exact composition to ensure correct HS code selection.

- Review the April 11, 2025 tariff changes and plan accordingly for import costs.

Customer Reviews

No reviews yet.