| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4805934010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810321020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811908050 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810311020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4805934010 | Doc | 55.0% | CN | US | 2025-05-12 |

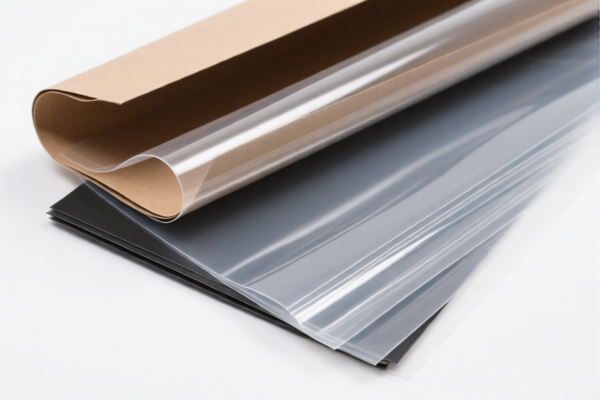

Product Name: Paper Reinforced Flexible Plastic Sheets (Medical Grade)

Classification HS Codes and Tax Details:

✅ HS CODE: 4805934010

Description: Other uncoated paper and paperboard, in rolls or sheets, not further processed, with a weight of 225 g/m² or more, specifically corrugated paperboard.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4810321020

Description: Paper and paperboard coated with kaolin or other inorganic substances, not for writing or printing purposes, meeting weight, fiber content, and size requirements.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4811908050

Description: Paper coated, impregnated, covered, surface-colored, surface-decorated, or printed.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4810311020

Description: Paperboard coated with kaolin or other inorganic substances, not for writing, printing, or other graphic purposes, uniformly bleached, with total fiber content over 95% of chemical wood fibers, weight ≤ 150 g/m², in specific dimensions as strips, rolls, or rectangular sheets.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

-

No Anti-Dumping Duties Listed: No specific anti-dumping duties for iron or aluminum are mentioned in the provided data.

-

Material and Certification Verification: Since the product is medical-grade, ensure that the material composition and certifications (e.g., ISO, FDA, CE) are clearly documented and match the HS code description.

-

Unit Price and Classification: Confirm the material composition and weight of the product to ensure correct HS code classification. Misclassification may lead to delays or penalties.

📌 Proactive Advice:

- Verify the exact composition of the paper and plastic reinforcement to ensure it aligns with the HS code description.

- Check the weight and dimensions of the product to confirm it falls under the correct category.

- Consult with a customs broker or regulatory authority if the product involves medical certification or special import permits.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Product Name: Paper Reinforced Flexible Plastic Sheets (Medical Grade)

Classification HS Codes and Tax Details:

✅ HS CODE: 4805934010

Description: Other uncoated paper and paperboard, in rolls or sheets, not further processed, with a weight of 225 g/m² or more, specifically corrugated paperboard.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4810321020

Description: Paper and paperboard coated with kaolin or other inorganic substances, not for writing or printing purposes, meeting weight, fiber content, and size requirements.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4811908050

Description: Paper coated, impregnated, covered, surface-colored, surface-decorated, or printed.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

✅ HS CODE: 4810311020

Description: Paperboard coated with kaolin or other inorganic substances, not for writing, printing, or other graphic purposes, uniformly bleached, with total fiber content over 95% of chemical wood fibers, weight ≤ 150 g/m², in specific dimensions as strips, rolls, or rectangular sheets.

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

-

No Anti-Dumping Duties Listed: No specific anti-dumping duties for iron or aluminum are mentioned in the provided data.

-

Material and Certification Verification: Since the product is medical-grade, ensure that the material composition and certifications (e.g., ISO, FDA, CE) are clearly documented and match the HS code description.

-

Unit Price and Classification: Confirm the material composition and weight of the product to ensure correct HS code classification. Misclassification may lead to delays or penalties.

📌 Proactive Advice:

- Verify the exact composition of the paper and plastic reinforcement to ensure it aligns with the HS code description.

- Check the weight and dimensions of the product to confirm it falls under the correct category.

- Consult with a customs broker or regulatory authority if the product involves medical certification or special import permits.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Customer Reviews

No reviews yet.