| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4707200020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4802626120 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4805934010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

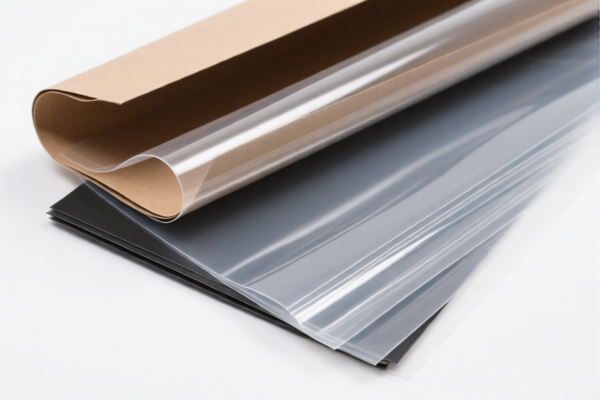

Product Classification and Customs Tariff Analysis for "Paper Reinforced Flexible Plastic Sheets (Printing Grade)"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 4707200020

Product Description: High-quality recycled paper (printing grade)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This classification is for high-quality recycled paper intended for printing.

- The high total tax rate is due to the additional tariffs applied.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 4802626120

Product Description: Printing paper (high quality)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is for high-quality printing paper, likely used in commercial printing.

- Same tariff structure as the previous code.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 4805934010

Product Description: Printing-grade folded paper

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This classification is for folded paper used in printing applications.

- The tax structure is consistent with the other paper-related codes.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3920991000

Product Description: Printing-grade polypropylene film

Total Tax Rate: 61.0%

Tariff Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is a plastic product (polypropylene film) used for printing.

- The base tariff is higher than the paper products, but the additional tariffs are the same.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (e.g., paper vs. plastic).

- Check Unit Price and Certification: Confirm if any certifications (e.g., environmental, safety, or printing suitability) are required for import.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is a composite or hybrid material.

Let me know if you need help with a specific import scenario or documentation. Product Classification and Customs Tariff Analysis for "Paper Reinforced Flexible Plastic Sheets (Printing Grade)"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 4707200020

Product Description: High-quality recycled paper (printing grade)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This classification is for high-quality recycled paper intended for printing.

- The high total tax rate is due to the additional tariffs applied.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 4802626120

Product Description: Printing paper (high quality)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is for high-quality printing paper, likely used in commercial printing.

- Same tariff structure as the previous code.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 4805934010

Product Description: Printing-grade folded paper

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This classification is for folded paper used in printing applications.

- The tax structure is consistent with the other paper-related codes.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3920991000

Product Description: Printing-grade polypropylene film

Total Tax Rate: 61.0%

Tariff Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This is a plastic product (polypropylene film) used for printing.

- The base tariff is higher than the paper products, but the additional tariffs are the same.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its primary material (e.g., paper vs. plastic).

- Check Unit Price and Certification: Confirm if any certifications (e.g., environmental, safety, or printing suitability) are required for import.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff increase.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is a composite or hybrid material.

Let me know if you need help with a specific import scenario or documentation.

Customer Reviews

No reviews yet.