| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3923290000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

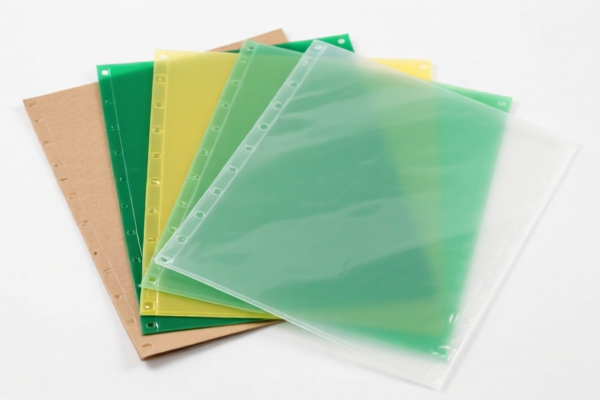

Here is the structured classification and tariff information for "Paper Reinforced Flexible Plastic Sheets for Agriculture" based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Description: Flexible plastic sheets, plates, films, foils, and strips reinforced with paper

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code is specifically for paper-reinforced flexible plastic sheets, which matches your product description.

- The 30% additional tariff applies after April 11, 2025, so be mindful of the timing for customs clearance.

✅ HS CODE: 3921904090

Description: Other flexible plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for non-paper-reinforced flexible plastics.

- If your product is not reinforced with paper, this may be the correct code.

- Again, the 30% additional tariff applies after April 11, 2025.

✅ HS CODE: 3923290000

Description: Plastic-made transport or packaging items

Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for packaging or transport items made of plastic.

- If your product is used for agricultural packaging, this may be a possible match.

- The total tax rate is higher due to the 25% additional tariff.

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for other types of plastic sheets, not reinforced with paper.

- The 30% additional tariff applies after April 11, 2025.

✅ HS CODE: 3920991000

Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for non-reinforced, non-cellular plastic sheets combined with other materials.

- The total tax rate is the highest due to the 25% additional tariff.

- Likely not the best fit for your product unless it is not reinforced with paper.

📌 Proactive Advice for You:

- Verify the material composition of your product (e.g., is it paper-reinforced? Is it used for packaging or agricultural purposes?).

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., food-grade, agricultural use, etc.) for customs clearance.

- Plan for the April 11, 2025, tariff increase to avoid unexpected costs.

- If in doubt, consult a customs broker or classification expert for confirmation.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for "Paper Reinforced Flexible Plastic Sheets for Agriculture" based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Description: Flexible plastic sheets, plates, films, foils, and strips reinforced with paper

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category

Key Notes:

- This code is specifically for paper-reinforced flexible plastic sheets, which matches your product description.

- The 30% additional tariff applies after April 11, 2025, so be mindful of the timing for customs clearance.

✅ HS CODE: 3921904090

Description: Other flexible plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for non-paper-reinforced flexible plastics.

- If your product is not reinforced with paper, this may be the correct code.

- Again, the 30% additional tariff applies after April 11, 2025.

✅ HS CODE: 3923290000

Description: Plastic-made transport or packaging items

Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for packaging or transport items made of plastic.

- If your product is used for agricultural packaging, this may be a possible match.

- The total tax rate is higher due to the 25% additional tariff.

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for other types of plastic sheets, not reinforced with paper.

- The 30% additional tariff applies after April 11, 2025.

✅ HS CODE: 3920991000

Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials

Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

Key Notes:

- This code is for non-reinforced, non-cellular plastic sheets combined with other materials.

- The total tax rate is the highest due to the 25% additional tariff.

- Likely not the best fit for your product unless it is not reinforced with paper.

📌 Proactive Advice for You:

- Verify the material composition of your product (e.g., is it paper-reinforced? Is it used for packaging or agricultural purposes?).

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., food-grade, agricultural use, etc.) for customs clearance.

- Plan for the April 11, 2025, tariff increase to avoid unexpected costs.

- If in doubt, consult a customs broker or classification expert for confirmation.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.