| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

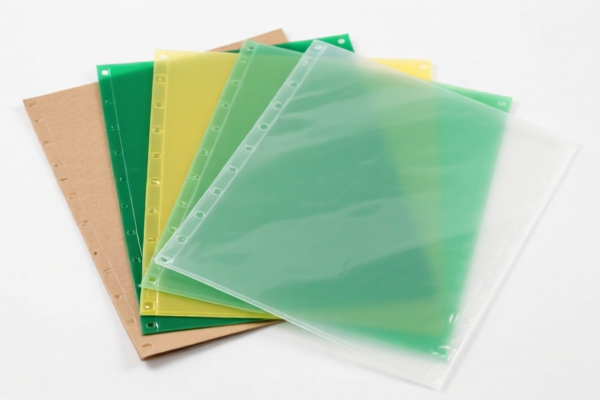

Here is the structured classification and tariff information for Paper Reinforced Flexible Plastic Sheets for Construction, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description:

- Paper-reinforced flexible plastic sheets, films, foils, and strips used in construction

- Paper-plastic composite structural panels

- Paper-plastic composite decorative panels

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

✅ HS CODE: 3921904090

Product Description:

- Other flexible plastic sheets, films, foils, and strips reinforced with paper

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

✅ HS CODE: 4807009400

Product Description:

- Composite paper or paperboard made by bonding multiple layers with adhesive, uncoated or unimpregnated

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

📌 Key Notes and Recommendations:

- April 11, 2025 Special Tariff:

- A 30% additional tariff will be applied to products under HS CODE 3921904010 and 3921904090 after April 11, 2025.

-

This is a time-sensitive policy—ensure your import timeline aligns with this date.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are listed for this product category in the provided data. However, always verify with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations.

-

Certifications and Documentation:

- Confirm the material composition and unit price to ensure correct classification.

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for construction use in your target market.

-

Alternative Classification:

- If the product is primarily a paper composite (e.g., layered paper with adhesive), HS CODE 4807009400 may be more appropriate. However, if it is a plastic sheet reinforced with paper, HS CODE 3921904010 is likely the correct classification.

🛑 Proactive Advice:

- Verify the exact product composition (e.g., plastic type, paper reinforcement, adhesive used) to ensure accurate HS code selection.

- Consult with customs or a classification expert if the product is used in specific applications (e.g., fire-rated, structural, or decorative).

- Monitor the April 11, 2025 deadline to avoid unexpected tax increases.

Let me know if you need help with a specific product description or customs documentation. Here is the structured classification and tariff information for Paper Reinforced Flexible Plastic Sheets for Construction, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description:

- Paper-reinforced flexible plastic sheets, films, foils, and strips used in construction

- Paper-plastic composite structural panels

- Paper-plastic composite decorative panels

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

✅ HS CODE: 3921904090

Product Description:

- Other flexible plastic sheets, films, foils, and strips reinforced with paper

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

✅ HS CODE: 4807009400

Product Description:

- Composite paper or paperboard made by bonding multiple layers with adhesive, uncoated or unimpregnated

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

📌 Key Notes and Recommendations:

- April 11, 2025 Special Tariff:

- A 30% additional tariff will be applied to products under HS CODE 3921904010 and 3921904090 after April 11, 2025.

-

This is a time-sensitive policy—ensure your import timeline aligns with this date.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are listed for this product category in the provided data. However, always verify with customs or a compliance expert if the product is subject to any ongoing anti-dumping investigations.

-

Certifications and Documentation:

- Confirm the material composition and unit price to ensure correct classification.

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for construction use in your target market.

-

Alternative Classification:

- If the product is primarily a paper composite (e.g., layered paper with adhesive), HS CODE 4807009400 may be more appropriate. However, if it is a plastic sheet reinforced with paper, HS CODE 3921904010 is likely the correct classification.

🛑 Proactive Advice:

- Verify the exact product composition (e.g., plastic type, paper reinforcement, adhesive used) to ensure accurate HS code selection.

- Consult with customs or a classification expert if the product is used in specific applications (e.g., fire-rated, structural, or decorative).

- Monitor the April 11, 2025 deadline to avoid unexpected tax increases.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.