Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

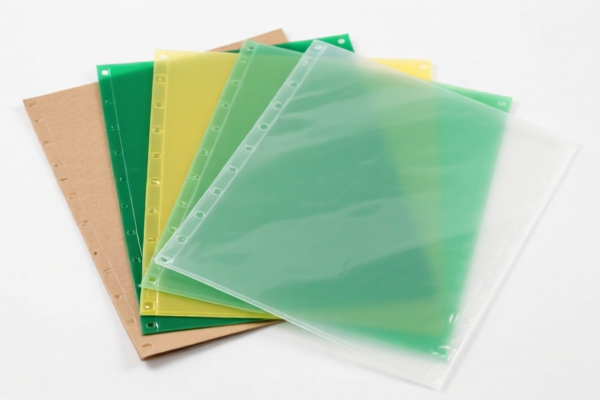

Product Classification: Paper Reinforced Flexible Plastic Sheets for Household Use

HS CODE: 3921904010 (Primary Classification)

🔍 Classification Summary:

- The product is classified under HS CODE 3921904010, which covers paper-reinforced flexible plastic sheets, films, foils, and strips.

- This classification is consistent with the description of "paper-reinforced flexible plastic sheets" used for household purposes.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (Currently): 0.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties on iron or aluminum are applicable for this product, as it is a plastic composite with paper reinforcement.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed paper-reinforced flexible plastic and not a different composite (e.g., metal or fully synthetic).

- Check Unit Price and Packaging: Tariff rates may vary based on unit price and packaging type (e.g., bulk vs. retail).

- Certifications Required: Confirm if any import certifications (e.g., safety, environmental compliance) are needed for household use.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly impact import costs.

🔄 Alternative HS Code Consideration:

- HS CODE 3920631000 (Flexible Polyester Plastic Sheets) was also suggested, but it is not the most accurate for paper-reinforced products.

- Tariff for 3920631000: 59.2% (higher than 3921904010), so 3921904010 is the preferred classification.

✅ Conclusion:

- Recommended HS CODE: 3921904010

- Total Tax Rate: 34.2% (with a 30% increase after April 11, 2025)

- Action Required: Confirm product composition and prepare for potential tariff increases.

Product Classification: Paper Reinforced Flexible Plastic Sheets for Household Use

HS CODE: 3921904010 (Primary Classification)

🔍 Classification Summary:

- The product is classified under HS CODE 3921904010, which covers paper-reinforced flexible plastic sheets, films, foils, and strips.

- This classification is consistent with the description of "paper-reinforced flexible plastic sheets" used for household purposes.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (Currently): 0.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties on iron or aluminum are applicable for this product, as it is a plastic composite with paper reinforcement.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed paper-reinforced flexible plastic and not a different composite (e.g., metal or fully synthetic).

- Check Unit Price and Packaging: Tariff rates may vary based on unit price and packaging type (e.g., bulk vs. retail).

- Certifications Required: Confirm if any import certifications (e.g., safety, environmental compliance) are needed for household use.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly impact import costs.

🔄 Alternative HS Code Consideration:

- HS CODE 3920631000 (Flexible Polyester Plastic Sheets) was also suggested, but it is not the most accurate for paper-reinforced products.

- Tariff for 3920631000: 59.2% (higher than 3921904010), so 3921904010 is the preferred classification.

✅ Conclusion:

- Recommended HS CODE: 3921904010

- Total Tax Rate: 34.2% (with a 30% increase after April 11, 2025)

- Action Required: Confirm product composition and prepare for potential tariff increases.

Customer Reviews

No reviews yet.