| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911901500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911903500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

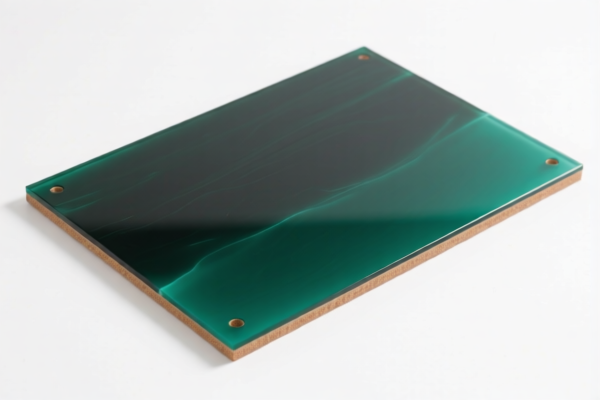

Product Classification: Petroleum Resin Board (HS CODE: 3911909110)

- HS CODE: 3911909110

- Description: 热塑性石油树脂板材 (Thermoplastic petroleum resin board)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. -

No Anti-dumping duties:

No specific anti-dumping duties are currently listed for this product category (e.g., on iron or aluminum).

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed a "thermoplastic petroleum resin board" and not misclassified as a different type of resin or composite material. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consider Alternative HS Codes:

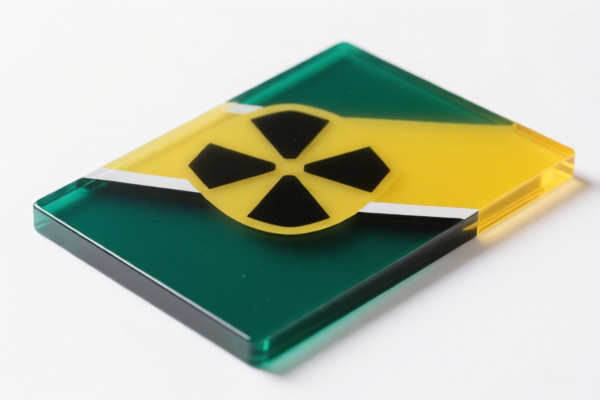

If the product is a composite or has different properties, double-check if a different HS code (e.g., 3911909150 for petroleum resin composites) might be more appropriate.

📊 Comparison with Similar Products:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3911909110 | 热塑性石油树脂板材 | 61.5% | Main product |

| 3911901500 | 石油树脂 | 55.0% | No base tariff |

| 3911902500 | 石油树脂颗粒 | 61.1% | Slightly lower than board |

| 3911903500 | 石油树脂 | 55.0% | Same as 3911901500 |

| 3911909150 | 石油树脂复合材料 | 61.5% | Similar to board |

If you have more details about the product (e.g., technical specifications, end-use), I can help further refine the classification and tax implications. Product Classification: Petroleum Resin Board (HS CODE: 3911909110)

- HS CODE: 3911909110

- Description: 热塑性石油树脂板材 (Thermoplastic petroleum resin board)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden. -

No Anti-dumping duties:

No specific anti-dumping duties are currently listed for this product category (e.g., on iron or aluminum).

📌 Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product is indeed a "thermoplastic petroleum resin board" and not misclassified as a different type of resin or composite material. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consider Alternative HS Codes:

If the product is a composite or has different properties, double-check if a different HS code (e.g., 3911909150 for petroleum resin composites) might be more appropriate.

📊 Comparison with Similar Products:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3911909110 | 热塑性石油树脂板材 | 61.5% | Main product |

| 3911901500 | 石油树脂 | 55.0% | No base tariff |

| 3911902500 | 石油树脂颗粒 | 61.1% | Slightly lower than board |

| 3911903500 | 石油树脂 | 55.0% | Same as 3911901500 |

| 3911909150 | 石油树脂复合材料 | 61.5% | Similar to board |

If you have more details about the product (e.g., technical specifications, end-use), I can help further refine the classification and tax implications.

Customer Reviews

No reviews yet.