| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911901500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911903500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

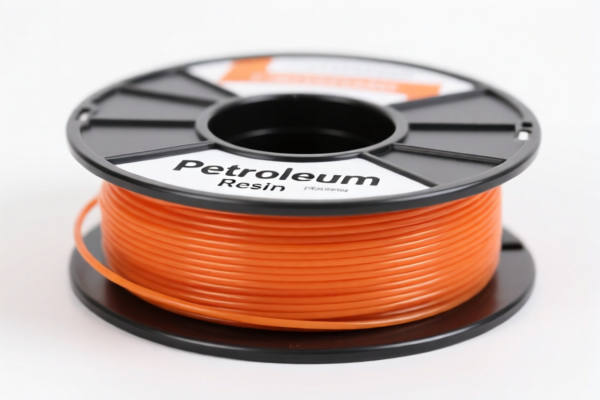

Product Name: Petroleum Resin Filament

Classification: HS CODEs related to petroleum resin filament are listed below. Please verify the specific HS CODE based on the product's physical form and technical specifications.

🔍 HS CODE Classification Overview

- HS CODE 3911901500

- Description: Petroleum resin classified under this code is typically in a primary form and may be thermoplastic.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

-

HS CODE 3911902500

- Description: Petroleum resin in a primary form, possibly thermoplastic.

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff compared to 3911901500.

-

HS CODE 3911903500

- Description: Petroleum resin in a primary form, likely thermoplastic.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Same as 3911901500 in terms of base and special tariffs.

-

HS CODE 3911909110

- Description: Petroleum resin in a primary form, thermoplastic type.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff than 3911901500 and 3911903500.

-

HS CODE 3911909150

- Description: Petroleum resin in a thermosetting type, meeting the criteria for this code.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as 3911909110 in terms of tax structure.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS CODEs after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties on iron or aluminum are mentioned for petroleum resin. However, always verify with the latest customs notices or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the physical form (thermoplastic vs. thermosetting) and technical specifications of the product to ensure correct HS CODE classification.

- Verify if certifications (e.g., RoHS, REACH, or other import compliance documents) are required for the destination market.

- Ensure accurate unit pricing and product description for customs declarations to avoid delays or penalties.

✅ Proactive Actions for Importers

- Double-check the product’s physical and chemical properties to determine the correct HS CODE.

- Confirm the tariff rates with the customs authority or a qualified customs broker, especially for the April 11, 2025 special tariff.

- Maintain updated documentation and certifications to ensure compliance with import regulations.

Let me know if you need help determining the correct HS CODE for your specific petroleum resin filament.

Product Name: Petroleum Resin Filament

Classification: HS CODEs related to petroleum resin filament are listed below. Please verify the specific HS CODE based on the product's physical form and technical specifications.

🔍 HS CODE Classification Overview

- HS CODE 3911901500

- Description: Petroleum resin classified under this code is typically in a primary form and may be thermoplastic.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs on iron/aluminum apply here.

-

HS CODE 3911902500

- Description: Petroleum resin in a primary form, possibly thermoplastic.

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff compared to 3911901500.

-

HS CODE 3911903500

- Description: Petroleum resin in a primary form, likely thermoplastic.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Same as 3911901500 in terms of base and special tariffs.

-

HS CODE 3911909110

- Description: Petroleum resin in a primary form, thermoplastic type.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff than 3911901500 and 3911903500.

-

HS CODE 3911909150

- Description: Petroleum resin in a thermosetting type, meeting the criteria for this code.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same as 3911909110 in terms of tax structure.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS CODEs after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties on iron or aluminum are mentioned for petroleum resin. However, always verify with the latest customs notices or consult a customs broker for confirmation. -

Certifications and Documentation:

- Confirm the physical form (thermoplastic vs. thermosetting) and technical specifications of the product to ensure correct HS CODE classification.

- Verify if certifications (e.g., RoHS, REACH, or other import compliance documents) are required for the destination market.

- Ensure accurate unit pricing and product description for customs declarations to avoid delays or penalties.

✅ Proactive Actions for Importers

- Double-check the product’s physical and chemical properties to determine the correct HS CODE.

- Confirm the tariff rates with the customs authority or a qualified customs broker, especially for the April 11, 2025 special tariff.

- Maintain updated documentation and certifications to ensure compliance with import regulations.

Let me know if you need help determining the correct HS CODE for your specific petroleum resin filament.

Customer Reviews

No reviews yet.