Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911901500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

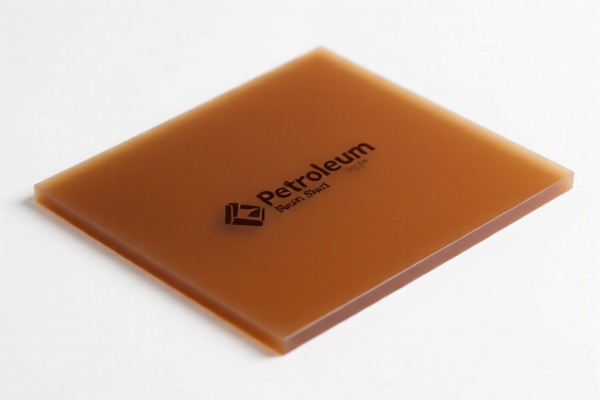

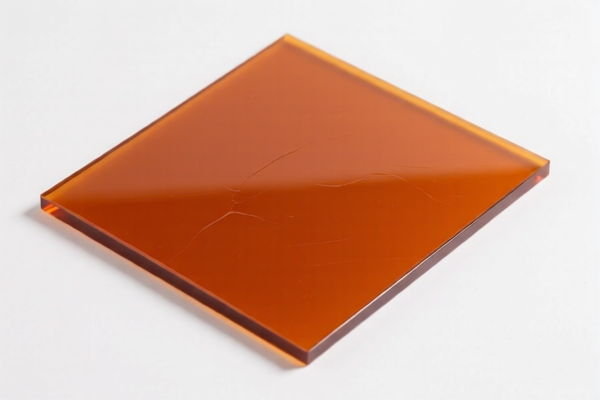

Product Classification: Petroleum Resin Sheet

HS CODE: 3911909110

🔍 Classification Summary

- Product Name: 热塑性石油树脂板材 (Thermoplastic Petroleum Resin Sheet)

- HS CODE: 3911909110

- Tariff Summary: 61.5%

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff: 61.5%

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- No Anti-Dumping Duties: No specific anti-dumping duties are listed for this product.

- No Specific Tariff on Iron/Aluminum: This product is not classified under categories that typically involve anti-dumping duties on metals.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a thermoplastic petroleum resin sheet and not a composite or modified version, which may fall under a different HS code (e.g., 3911909150 for composite materials).

- Check Unit Price and Packaging: Tariff calculations may depend on the unit of measurement (e.g., per kg, per square meter).

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or customs documentation) are needed for import compliance.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025.

📋 Comparison with Similar Products

| HS CODE | Product Description | Total Tariff | Base Tariff | Additional Tariff | April 11 Tariff |

|---|---|---|---|---|---|

| 3911909110 | Thermoplastic Petroleum Resin Sheet | 61.5% | 6.5% | 25.0% | 30.0% |

| 3911901500 | Petroleum Resin | 55.0% | 0.0% | 25.0% | 30.0% |

| 3911902500 | Petroleum Resin Granules | 61.1% | 6.1% | 25.0% | 30.0% |

| 3911901000 | Petroleum Resin Elastomer | 55.0% | 0.0% | 25.0% | 30.0% |

| 3911909150 | Petroleum Resin Composite | 61.5% | 6.5% | 25.0% | 30.0% |

✅ Conclusion

The 3911909110 HS code is the correct classification for thermoplastic petroleum resin sheets. The total tariff is 61.5%, with a 30.0% additional tariff applicable after April 11, 2025. Importers should verify product details and prepare for potential tariff increases.

Product Classification: Petroleum Resin Sheet

HS CODE: 3911909110

🔍 Classification Summary

- Product Name: 热塑性石油树脂板材 (Thermoplastic Petroleum Resin Sheet)

- HS CODE: 3911909110

- Tariff Summary: 61.5%

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff: 61.5%

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- No Anti-Dumping Duties: No specific anti-dumping duties are listed for this product.

- No Specific Tariff on Iron/Aluminum: This product is not classified under categories that typically involve anti-dumping duties on metals.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a thermoplastic petroleum resin sheet and not a composite or modified version, which may fall under a different HS code (e.g., 3911909150 for composite materials).

- Check Unit Price and Packaging: Tariff calculations may depend on the unit of measurement (e.g., per kg, per square meter).

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or customs documentation) are needed for import compliance.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025.

📋 Comparison with Similar Products

| HS CODE | Product Description | Total Tariff | Base Tariff | Additional Tariff | April 11 Tariff |

|---|---|---|---|---|---|

| 3911909110 | Thermoplastic Petroleum Resin Sheet | 61.5% | 6.5% | 25.0% | 30.0% |

| 3911901500 | Petroleum Resin | 55.0% | 0.0% | 25.0% | 30.0% |

| 3911902500 | Petroleum Resin Granules | 61.1% | 6.1% | 25.0% | 30.0% |

| 3911901000 | Petroleum Resin Elastomer | 55.0% | 0.0% | 25.0% | 30.0% |

| 3911909150 | Petroleum Resin Composite | 61.5% | 6.5% | 25.0% | 30.0% |

✅ Conclusion

The 3911909110 HS code is the correct classification for thermoplastic petroleum resin sheets. The total tariff is 61.5%, with a 30.0% additional tariff applicable after April 11, 2025. Importers should verify product details and prepare for potential tariff increases.

Customer Reviews

No reviews yet.