Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3824829000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

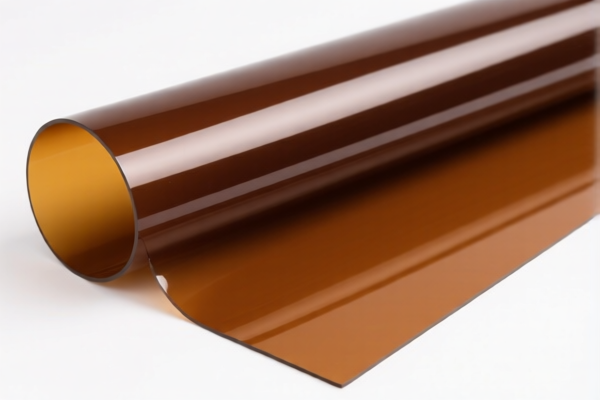

Product Name: Phenolic Resin Foils

Classification HS Code Analysis:

- HS CODE: 3920940000

- Description: Phenolic resin plastic foils, phenolic resin plastic general foils, unsupported phenolic plastic foils, non-supported phenolic plastic foils, phenolic resin films, etc.

-

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3824829000

- Description: Phenolic resins used as binders for casting molds or cores.

-

Total Tax Rate: 58.7%

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3909400000

- Description: Phenolic resin films.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied to all three HS codes. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specifically mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification: Confirm the material composition and unit price to ensure correct classification. Some products may require technical documentation or certifications for customs clearance.

✅ Proactive Advice:

- Verify the exact product description and intended use (e.g., for casting or general use) to ensure the correct HS code is applied.

- Check for any additional trade agreements or preferential tariff programs that may apply to your shipment.

-

Consult with customs brokers or legal advisors if the product is used in specialized industries (e.g., aerospace, electronics) where documentation is more complex. Product Name: Phenolic Resin Foils

Classification HS Code Analysis: -

HS CODE: 3920940000

- Description: Phenolic resin plastic foils, phenolic resin plastic general foils, unsupported phenolic plastic foils, non-supported phenolic plastic foils, phenolic resin films, etc.

-

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3824829000

- Description: Phenolic resins used as binders for casting molds or cores.

-

Total Tax Rate: 58.7%

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3909400000

- Description: Phenolic resin films.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied to all three HS codes. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specifically mentioned for this product category, but always verify if applicable based on the country of origin.

- Material and Certification: Confirm the material composition and unit price to ensure correct classification. Some products may require technical documentation or certifications for customs clearance.

✅ Proactive Advice:

- Verify the exact product description and intended use (e.g., for casting or general use) to ensure the correct HS code is applied.

- Check for any additional trade agreements or preferential tariff programs that may apply to your shipment.

- Consult with customs brokers or legal advisors if the product is used in specialized industries (e.g., aerospace, electronics) where documentation is more complex.

Customer Reviews

No reviews yet.