| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

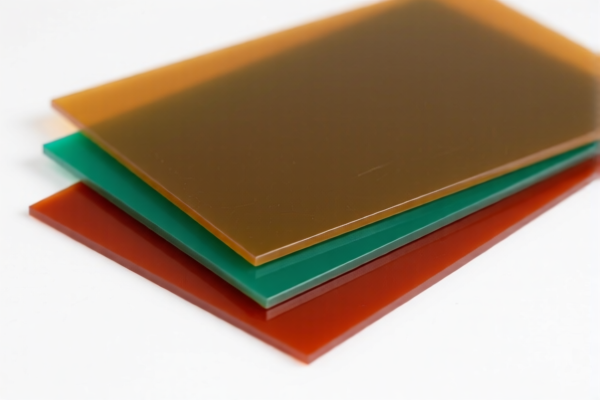

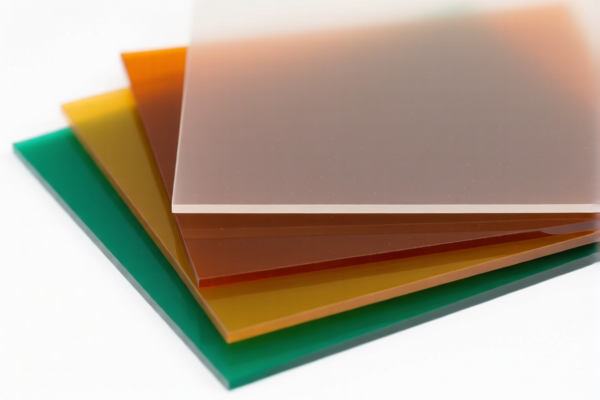

Product Name: Phenolic Resin Sheets

Classification HS Code: 3920940000 or 3909390000 (depending on product form)

🔍 HS Code Classification Overview

- 3920940000

- Applicable Products: Phenolic resin sheets, building boards, furniture boards, packaging boards, chemical boards, etc., made from phenolic resin plastic sheets.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 60.8%

-

3909390000

- Applicable Products: Phenolic resin adhesive sheets, which are in the primary form of phenolic resin.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on both HS codes starting April 11, 2025.

-

This is a time-sensitive policy and may affect customs clearance costs significantly.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for phenolic resin sheets in the current data. However, it is advisable to check for any ongoing investigations or duties related to iron or aluminum (if applicable in composite products).

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Confirm whether the product is a finished sheet (e.g., building board, furniture board) or a primary form (e.g., adhesive sheet). This will determine the correct HS code.

-

Check Unit Price and Certification:

-

Ensure the product's unit price and specifications meet the customs requirements. Some products may require specific certifications (e.g., fire resistance, environmental standards).

-

Monitor Tariff Updates:

-

Stay informed about any changes in tariff policies, especially the April 11, 2025 special tariff, which could significantly increase import costs.

-

Consult a Customs Broker:

- For complex classifications or large-volume imports, it is recommended to consult a professional customs broker or compliance expert.

Let me know if you need help determining which HS code applies to your specific product.

Product Name: Phenolic Resin Sheets

Classification HS Code: 3920940000 or 3909390000 (depending on product form)

🔍 HS Code Classification Overview

- 3920940000

- Applicable Products: Phenolic resin sheets, building boards, furniture boards, packaging boards, chemical boards, etc., made from phenolic resin plastic sheets.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 60.8%

-

3909390000

- Applicable Products: Phenolic resin adhesive sheets, which are in the primary form of phenolic resin.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on both HS codes starting April 11, 2025.

-

This is a time-sensitive policy and may affect customs clearance costs significantly.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for phenolic resin sheets in the current data. However, it is advisable to check for any ongoing investigations or duties related to iron or aluminum (if applicable in composite products).

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Confirm whether the product is a finished sheet (e.g., building board, furniture board) or a primary form (e.g., adhesive sheet). This will determine the correct HS code.

-

Check Unit Price and Certification:

-

Ensure the product's unit price and specifications meet the customs requirements. Some products may require specific certifications (e.g., fire resistance, environmental standards).

-

Monitor Tariff Updates:

-

Stay informed about any changes in tariff policies, especially the April 11, 2025 special tariff, which could significantly increase import costs.

-

Consult a Customs Broker:

- For complex classifications or large-volume imports, it is recommended to consult a professional customs broker or compliance expert.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.